Does the Federal Reserve have room for further stimulus measures?

- Go back to blog home

- Latest

The COVID-19 pandemic is causing devastation to the global economy and forcing central banks and governments to unveil massive and unprecedented stimulus measures.

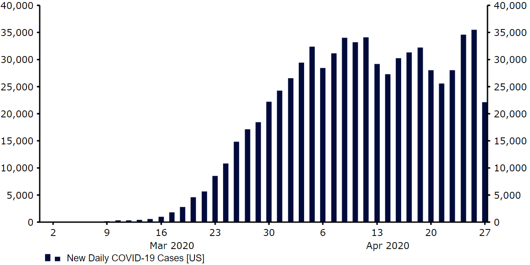

Since the bank announced its most recent policy measures, the virus has continued to spread at a very aggressive rate in the US, which now has the highest number of confirmed cases in the world at just over 1 million – though in per capita terms the situation looks less dire. While lockdown measures appear to be having an impact on slowing the rate of contagion there are, as of yet, also no clear signs of a meaningful slowdown in the number of new daily virus cases that would warrant their immediate unwinding (Figure 1).

Figure 1: US New Confirmed Daily COVID-19 Cases (February ‘20 – April ‘20)

Refinitiv Datastream. Date: 28/04/2020

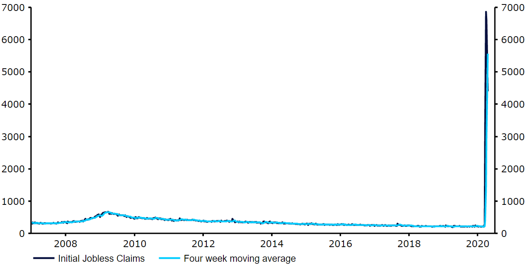

Macroeconomic data out of the US has also begun to show the devastation that the lockdown measures are having on the world’s largest economy. PMI data fell to fresh record lows in April, March industrial production posted its worst monthly decline since the 1940s, while retail sales experienced a record contraction last month. Of particular concern will be the impact the containment measures are having on the US labour market, which continues to shed jobs at a very alarming rate. A total of 26.5 million Americans have now filed for unemployment benefits since the onset of the crisis (Figure 2), with more set to follow in the coming weeks. This brings the unemployment rate to approximately 20% by our calculations, which would be its highest level since the 1930s.

Figure 2: US Initial Jobless Claims (2007 – 2020)

Refinitiv Datastream. Date: 28/04/2020

Given the comprehensive nature of the stimulus measures already announced by the FOMC, we think that the Fed will keep its policy unchanged for the first time since January at its meeting on Wednesday. We think that another very downbeat and dovish set of communications is highly likely. Powell’s press conference, which will take place via video call, will be key for markets. The big question will, in our view, be whether Powell can convince the market that the Fed has additional tools at its disposal should it need to inject further stimulus into the US economy. Should he manage to do so, then we could see a relief rally in stocks and a general increase in appetite for risk in FX.

Conversely, should the market believe that the Fed has run out of ammunition, then we may see renewed support for the safe-haven currencies, the US dollar included. We do not, however, believe that the latter is the case and think that the Fed has room to do more if needed, which may involve expanding its lending to SMEs or including more unorthodox instruments in its asset purchases.

Aside from the above, the Fed may also choose to release its latest economic and interest rate projections at this week’s meeting, having skipped doing so in March. Should they do so, we think that policymakers are likely to indicate unchanged interest rates for the foreseeable future. Growth forecasts will be revised sharply lower and may show the US economy headed for its worst contraction since the Great Depression. Comments from Powell on how quickly the Fed expects the US economy to bounce back once the worst is over could also prove market moving. We think this recovery looks likely to be a gradual U-shaped one, rather than an immediate bounce back to normal capacity.

Yet, with currency traders already bracing for the worst, this is likely already priced in by the market. We actually think that the market reaction to the Fed’s announcement could be relatively contained, as investors await the potentially more eventful ECB meeting on Thursday before committing to sizeable positions in either direction.