Dollar roars back on renewed US-China trade tensions

( 2 min read )

- Go back to blog home

- Latest

After having spent much of the week on the back foot, the US dollar roared back against its major peers during Asian trading on Friday.

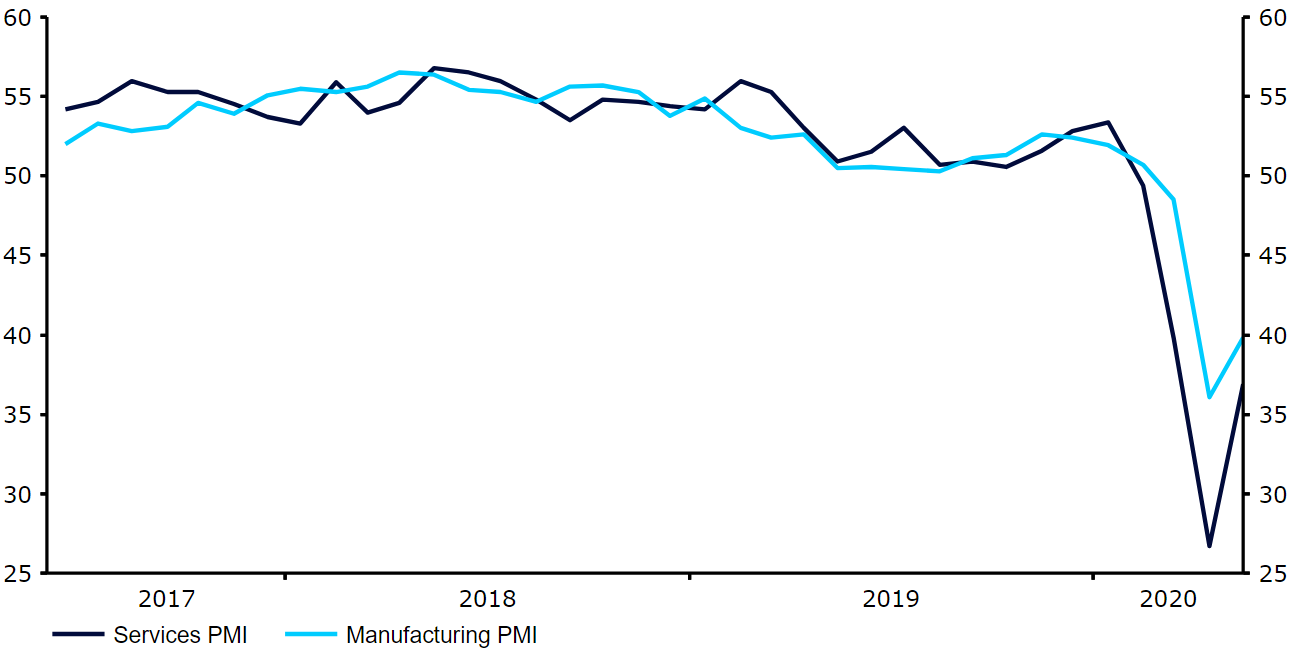

A solid rebound in US services activity also helped lift the dollar higher yesterday. The services PMI for May jumped back up to a better-than-expected 36.9 from April’s 26.7. We are beginning to see a generally encouraging upward trend in these numbers globally that would suggest businesses are becoming tentatively more optimistic about expanding business operations in the month ahead.

Figure 1: US PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 22/05/2020

UK retail sales fall by most on record in April

The pound also eased back against the dollar this morning, falling back below the 1.22 mark. This morning’s retail sales were largely as expected, with sales falling by the most on record in April. On an annual basis sales plummeted by 22.6% last month, following an 18.1% decline on the month previous.

If it wasn’t already abundantly clear, the lockdown is having a significant impact on consumer spending activity – ordinarily the largest single driver of growth in UK GDP. The drop could have actually been an awful lot worse with high street stores shut for business, although a record surge in online sales have supported demand to some extent. With lockdown measures beginning to be eased, we think that we have now seen a bottom in both UK retail sales and PMIs. With no major data out globally today, we expect FX to be driven mostly by broad shifts in sentiment.