Bank of England June Meeting Preview: More QE on the way?

( 3 min read )

- Go back to blog home

- Latest

The Bank of England appears on course to ramp up its efforts to protect the UK economy from the impact of the COVID-19 pandemic this week.

During the height of the crisis in March, the bank unveiled a host of stimulus measures, including slashing rates to a record low 0.1%. It also pledged to purchase an additional £210 billion worth of bonds as part of its quantitative easing programme, taking the total envelope of the scheme to £645 billion. Since this announcement, the lockdown measures have caused UK economic activity to contract at a record pace, with GDP down 20.4% in April (Figure 1) – by far the largest on record. While the April numbers probably mark the worst of the downturn, we think that the bank will view continued policy accommodation as necessary, since the recovery looks likely to be gradual.

Figure 1: UK GDP [% change month-on-month] (2013 – 2020)

![UK GDP [% change month-on-month] (2013 - 2020)](https://ebury.com/wp-content/uploads/2020/06/image-1-15062020.png)

Source: Refinitv Datastream Date: 15/06/2020

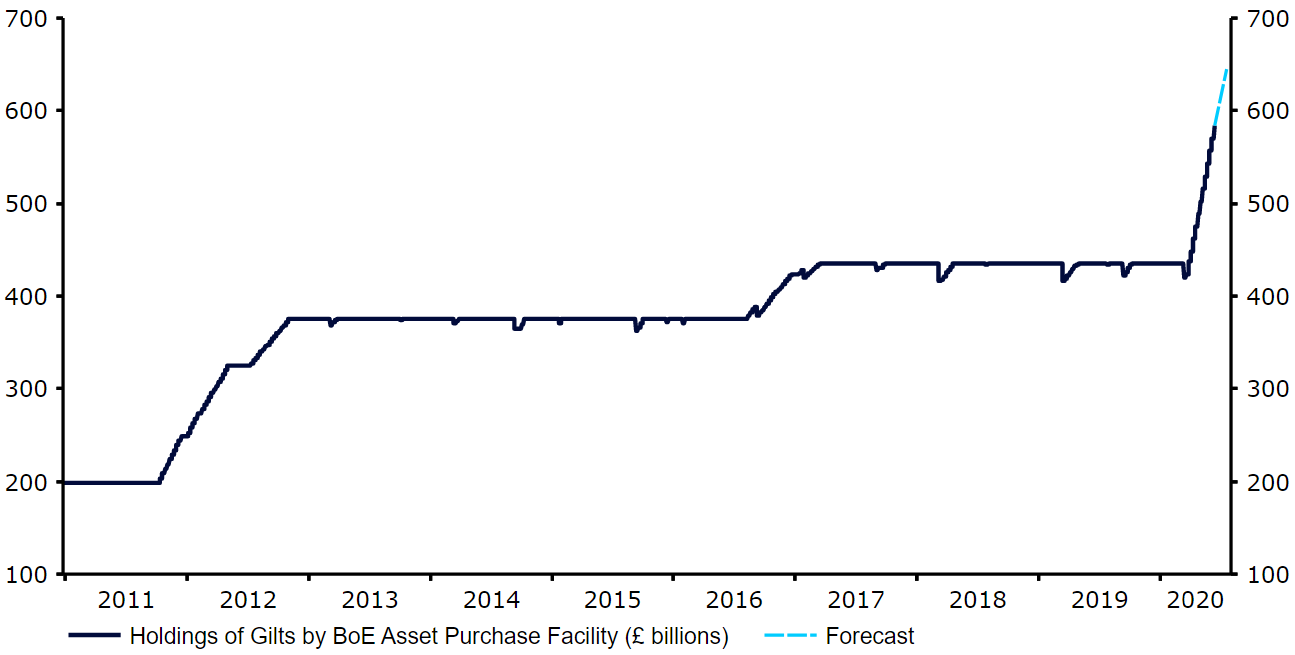

According to the latest data on Bank of England gilts holdings, the QE programme will reach the £645 billion capacity by late-July at the current pace of purchases (Figure 2), i.e. before the following MPC meeting in August. We therefore think that an increase in stimulus will be required now in order to keep yields suppressed and ensure that businesses and households have access to cheap funding. We are therefore pencilling in a £100 billion increase in asset purchases, which would bring the programme to an overall size of £745 billion. These purchases are, in our view, likely to be conducted at a slightly slower pace than was the case between March and June and may therefore run until beyond the September or even November MPC meetings.

Figure 2: Bank of England Gilts Holdings (2011 – 2020)

Source: Refinitv Datastream Date: 15/06/2020

We think that a £100 billion increase in the asset purchase programme is already largely priced in by the market, particularly after Governor Andrew Bailed warned last week that the central bank stands “ready to take action”. An increase in purchases of this magnitude would therefore not materially shift the pound, in our view. As has been customary during the current crisis, we think that a larger package of measures in excess of £100 billion would likely support sterling. By contrast, a smaller increase, or lack of immediate action would, we believe, likely trigger a fairly sharp move lower in the currency. The voting pattern among committee members could also prove key to the FX reaction.

Aside from any immediate policy announcements, the market will be paying close attention to the bank’s accompanying communications, particularly regarding the possibility of negative interest rates in the coming months. At present, there appears mixed views among the committee as to the effectiveness of sub-zero rates. Should the MPC strike a dovish tone and indicate that negative rates may be on the way at an upcoming meeting, then the pound could come under a bit of selling pressure.

The BoE’s policy announcement, statement and minutes will all be released at midday BST this coming Thursday.