Bank of England ramps up QE, calms negative rates talk

( 3 min read )

- Go back to blog home

- Latest

Yesterday afternoon’s Bank of England announcement was largely in line with what the market had anticipated.

The bank’s accompanying communications were mildly hawkish. Policymakers noted that downside risks to the global economy remain and that there was a risk of higher and more persistent unemployment in the UK. It did, however, note that the expected contraction in UK GDP in the second quarter of 2020 would likely be less severe than it had anticipated during its communications in May. The bank also stated that there were signs that consumer spending was beginning to pick-up pace amid the recent easing in lockdown measures in Britain.

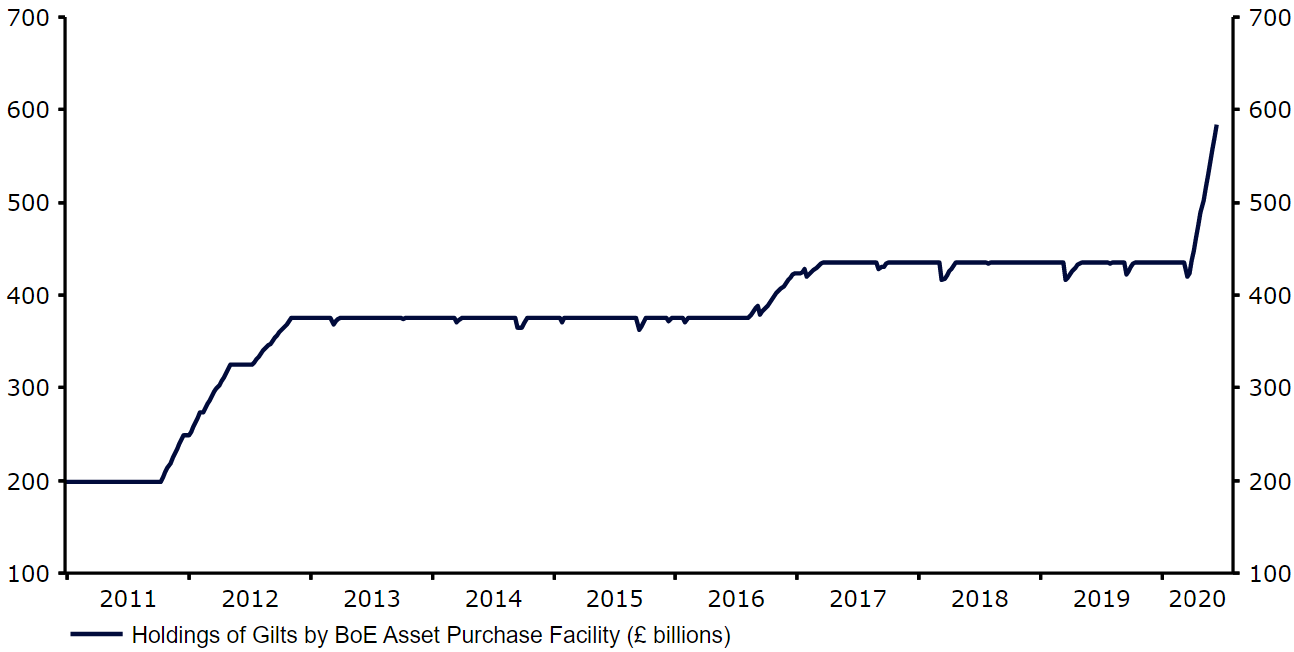

Regarding future policy moves, the bank noted that the additional £100 billion worth of asset purchases will be conducted at a slower pace than we have witnessed since the latest round of easing was announced in March (Figure 1). This, we believe, should ensure that the Bank of England is able to continue buying government bonds at least through to the September or even November MPC meetings. These additional £100 billion worth of purchases will be composed entirely of government bonds, without the addition of corporate bonds.

Figure 1: Bank of England Gilts Holdings (2011 – 2020)

Source: Refinitiv Datastream Date: 18/06/2020

According to its statement, the MPC expects the total stock of asset purchases to reach £745 billion ‘around the turn of the year’. We estimate that this would lower the pace of weekly asset purchases from around £13.5 billion to approximately £5 billion, although they would have scope to readjust this pace should they deem fit. We would expect policymakers to then reassess the state of the UK economy later in the year before they decide whether additional QE is required. Today’s statement left the door open to such an increase, noting that the bank ‘stands ready to take further action as necessary to support the economy’.

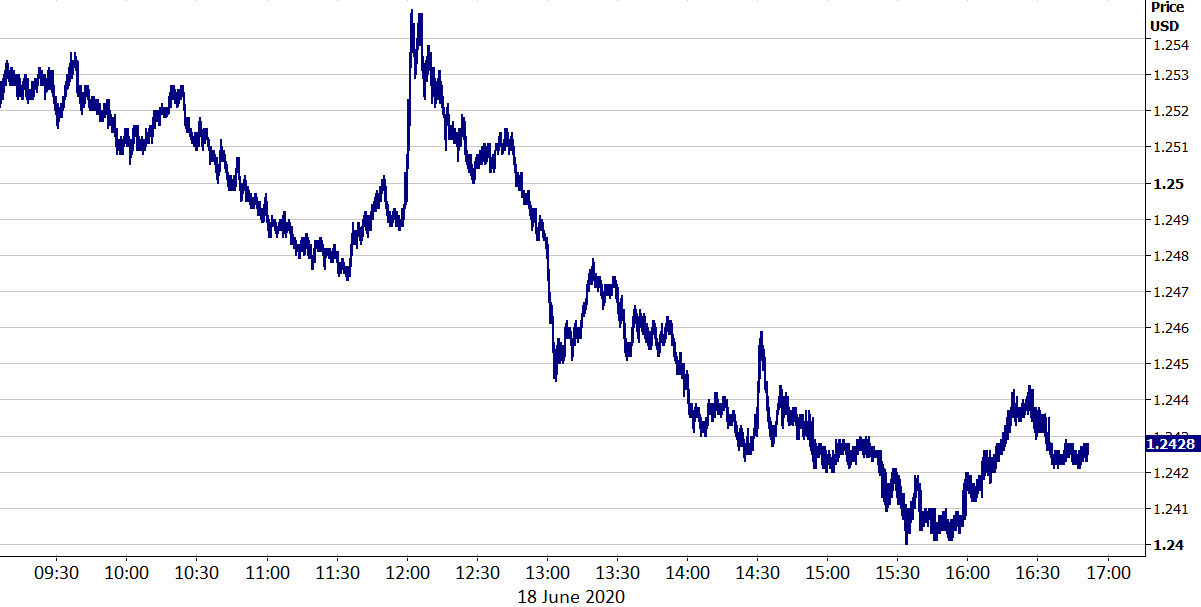

This pledge for a much more gradual pace of purchases is, we think, largely behind today’s move in sterling. After an initial brief rally, the pound reversed its gains and sold-off aggressively versus the US dollar as the afternoon progressed (Figure 2).

Figure 2: GBP/USD (18/06/2020)

Source: Refinitiv Datastream Date: 18/06/2020

It does appear, however, that committee members are wary about the prospect of lowering interest rates into negative territory to combat the crisis. While there was no mention of negative rates during the bank’s statement, Governor Andrew Bailey later noted that sub-zero rates were ‘not in any sense imminent’. The bank instead appears to be carefully gauging the potential implications of negative rates on the UK economy, before deciding whether or not such a policy would be suitable. This reluctance to cut rates further is a positive for sterling, in our view, making the aggressive nature of today’s sell-off in the pound somewhat puzzling.