Doubts about global recovery as COVID numbers worsen in US

( 2 min read )

- Go back to blog home

- Latest

Last week was a very mixed one for global financial markets.

The focus this week is again on the US labour market and the speed at which it recovers from the worst of the crisis. In addition to the weekly jobless data, the payrolls report for the month of June will be key. Quarter-end re-balancing flows in asset managers will add volatility going into Tuesday evening.

GBP

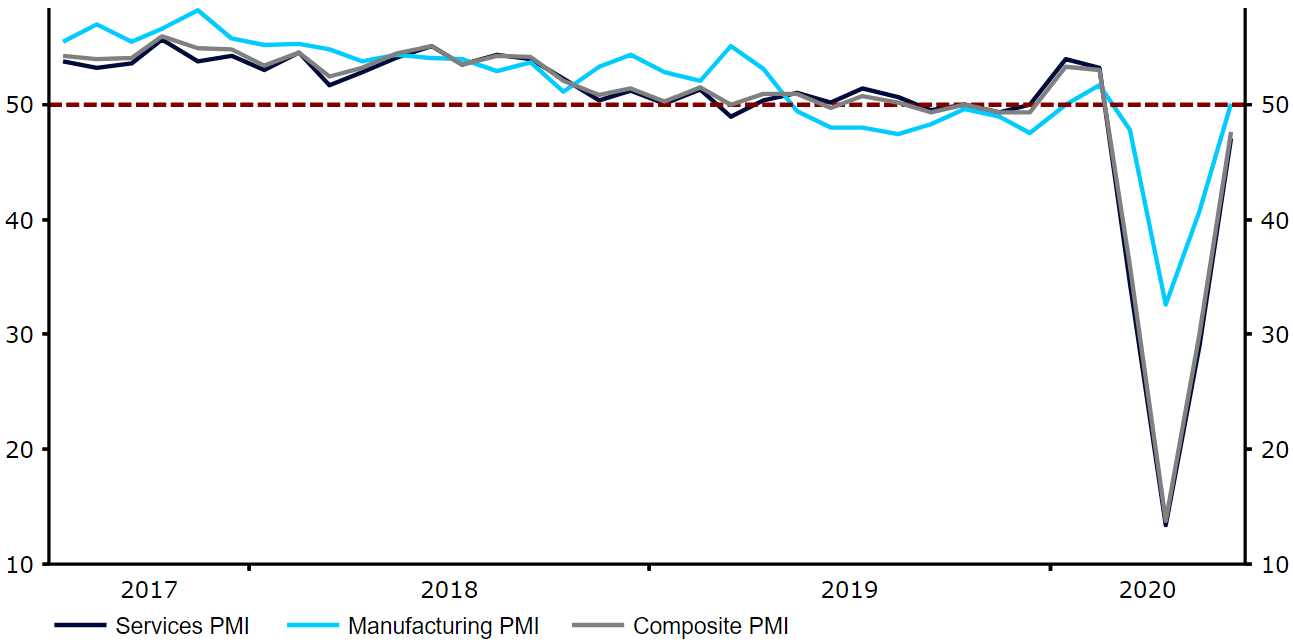

The June PMIs of business activity rebounded more-than-expected last week, as they did in most countries. At 47.6, the composite number indicates that the economy is close to expanding again and that the second quarter of 2020 will probably mark the trough in economic activity.

Figure 1: UK PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 29/06/2020

The deadline for a Brexit extension is on Tuesday, but the British government has already indicated that it will not seek one, and we do not expect much volatility beyond the usual quarter-end rebalancing flows. Both sides have been making cautiously optimistic noises, so we expect sterling to resume its rebound over the coming weeks.

EUR

The Eurozone PMIs bounced to similar levels as those in the UK in June. Other than that, the common currency benefited from the increased focus in the divergence of the pandemic path across the Atlantic, as European cases clearly trend down while US cases increase. Nevertheless, general nervousness and the uncertainty over quarter-end portfolio flows meant that in the end the euro ended the week just about where it started it against the US dollar.

Now that the risk of the euro crisis has been pushed out of trader’s radar screens, we expect the euro to resume a slow grind higher against most world currencies.

USD

One of the largest sources of uncertainty in currency markets going into the second half of 2020 is whether the US dollar will retain its status as a safe-haven as pandemic conditions deteriorate there relative to most other developed countries. Last week, new cases surged to fresh records, although deaths thankfully lagged, a sign that the latter is at least partially due to more testing. Nevertheless, as states pause or roll back their reopening schedules, the damage inflicted on the labour market will take longer to heal. So far, the unusually generous state response (stimulus and expanded unemployment benefits) has succeeded in preventing a collapse in workers incomes, but with the extra weekly $600 benefits set to expire at the end of July, much depends on an agreement between the parties to prolong the special measures.

The June payrolls report on Thursday should reflect continued modest improvements in unemployment and job numbers from the dismal troughs of April. However, given the unusual level of uncertainty it is likely that the more timely weekly jobless claims number will give at least as much useful information as the actual payrolls report.