BoE November Meeting Preview: More stimulus coming as second lockdown looms

( 4 min )

- Go back to blog home

- Latest

With the COVID-19 pandemic worsening and the UK government reintroducing tighter restrictions in an attempt to halt the virus’ spread, this Thursday’s Bank of England meeting takes on additional importance.

QE set to be increased, but by how much?

The growing downside risks facing the UK economy will be in focus when the MPC convenes for its policy meeting this week. We think it’s likely that the BoE will announce an immediate increase in monetary stimulus in the form of more quantitative easing.

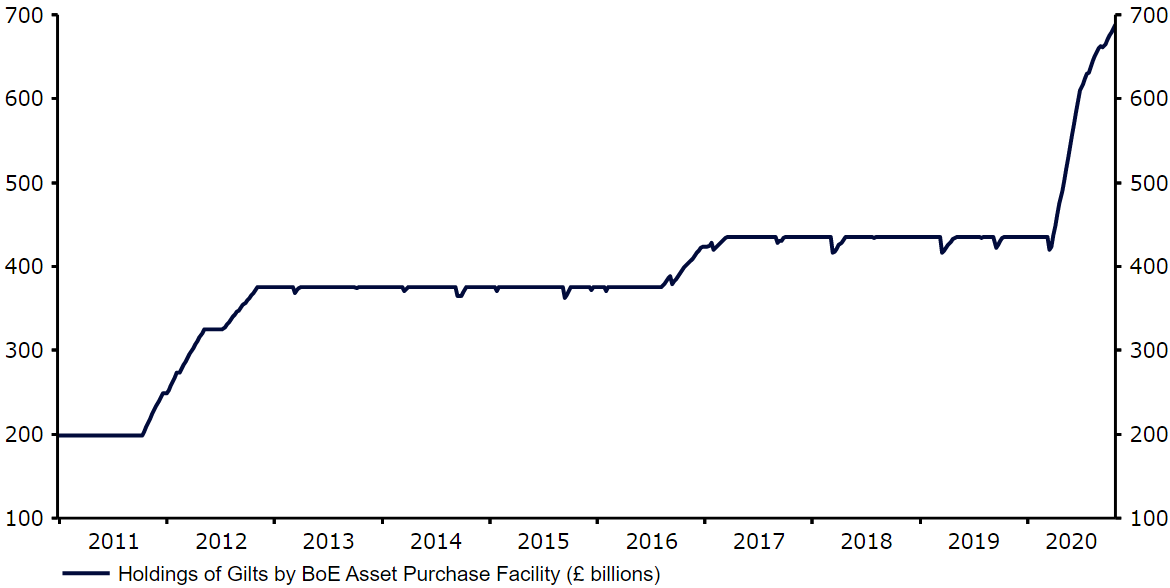

At the current pace of purchases, the existing QE programme is set to run dry in mid-December (Figure 1). More accommodation beyond then is almost certainly coming in order to stave off downside risks to growth. We noted following the September meeting that we thought a £50 billion ramping up in asset purchases was likely this month. Following Johnson’s announcement at the weekend, we are now pencilling in a £100 billion expansion in QE, which would take the programme up to £845 billion – almost double pre-pandemic levels. We are also not ruling out an even larger envelope of purchases that would allow the programme to run deeper and possibly at a faster pace into 2021.

Figure 1: Bank of England Gilts Holdings (2011 – 2020)

Source: Refiniv Datastream Date: 02/11/2020

Are negative UK interest rates on the way?

Aside from the QE announcement, the key unknown this week will be the bank’s latest view on the possible introduction of a negative interest rate possibility (NIRP). MPC members have diverging views over the effectiveness of sub-zero rates. Negative rates have been said to be part of the BoE’s ‘toolbox’ of measures, with the September statement noting that ratesetters had been briefed on how such a policy could be implemented effectively. MPC members Vlieghe and Haskel have both recently talked up the potential benefits of negative rates, although there still appears no clear consensus as to whether they would actually prove effective in the current environment.

For this reason, we think that rates will remain on hold this Thursday, with the vote likely to once again be unanimous for no change. We think that QE will remain the tool of choice for now, particularly given concerns over the impact of negative rates on bank profitability and the lack of evidence in places such as the Eurozone that they actually succeed in lifting inflation. We do, however, expect the language in the BoE’s communications to keep the door open to further cuts down the road.

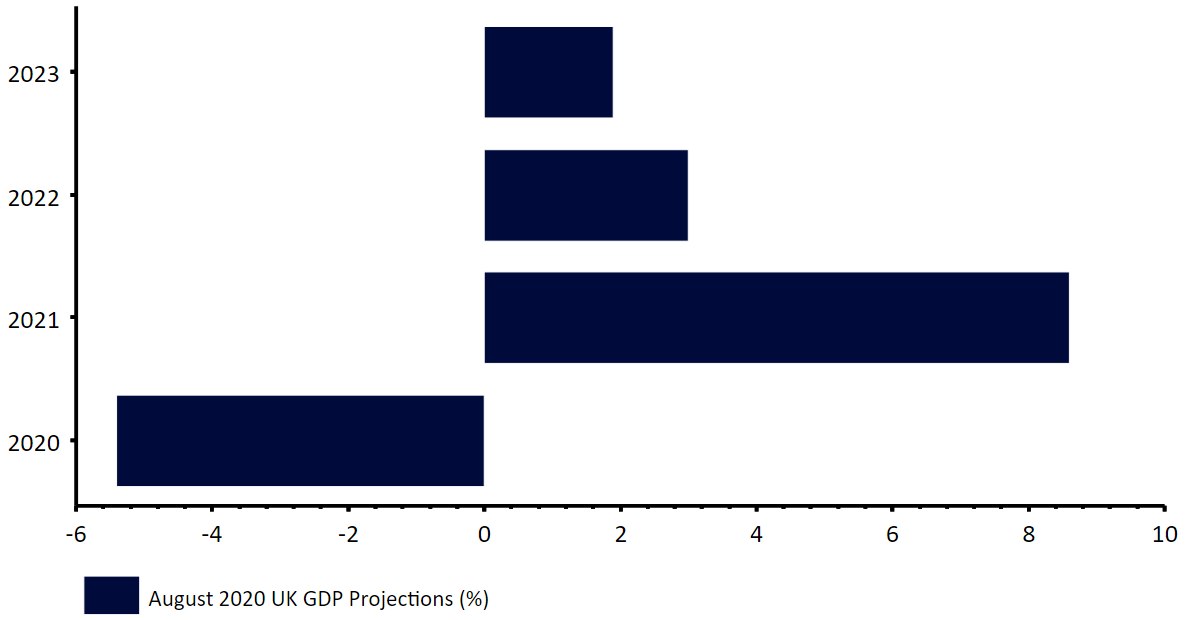

Updated macroeconomic projections to be released

The MPC will also be unveiling its latest macroeconomic projections this week as part of its “Super Thursday” announcement. Even prior to the recent tightening in virus restrictions, the market had been bracing for a downward revision to its GDP estimates for this year – a revision that we think is now a near certainty. The real question will be how severe the BoE thinks the downturn will be, and how long it might last. The UK government has already acknowledged that stay-at-home orders could be extended in England beyond 2nd December should these tighter restrictions fail to materially suppress the rate of infection.

Figure 2: Bank of England UK GDP Projections [August 2020]

Source: Refiniv Datastream Date: 02/11/2020

How could the pound react to Thursday’s announcement?

Investors are expecting a very dovish tone from the Bank of England this Thursday. With an upping in the BoE’s quantitative easing programme largely priced in, in our view, sterling is likely to take its cue from both the size of the QE expansion and the bank’s comments on the possibility of negative UK interest rates.

We think that a modest increase in the QE programme of less than £100 billion would fall short of the markets’ expectation and could support sterling on Thursday. On the other hand, an increase in asset purchases of an amount greater than this would likely weigh on it. Meanwhile, any comments in the statement or Bailey’s press conference that raises the possibility of sub-zero rates, or a shock dissenter or two in favour of an immediate cut, would catch the market wrong-footed. In this event, we think that we would almost certainly see a very sharp sell-off in the pound as investors begin rapidly pricing in the possibility of cuts in early-2021.

The Bank of England’s policy decision, meeting minutes and monetary policy report will all be released at 12pm GMT on Thursday (1pm CET), with Governor Bailey’s press conference to follow 30 minutes later.