Biden on course for victory, but election remains on a knife-edge

( 4 min )

- Go back to blog home

- Latest

The big uncertainty among investors going into this year’s US presidential election has come to pass – a knife-edge vote where the result has been delayed and the outcome will almost certainly be contested.

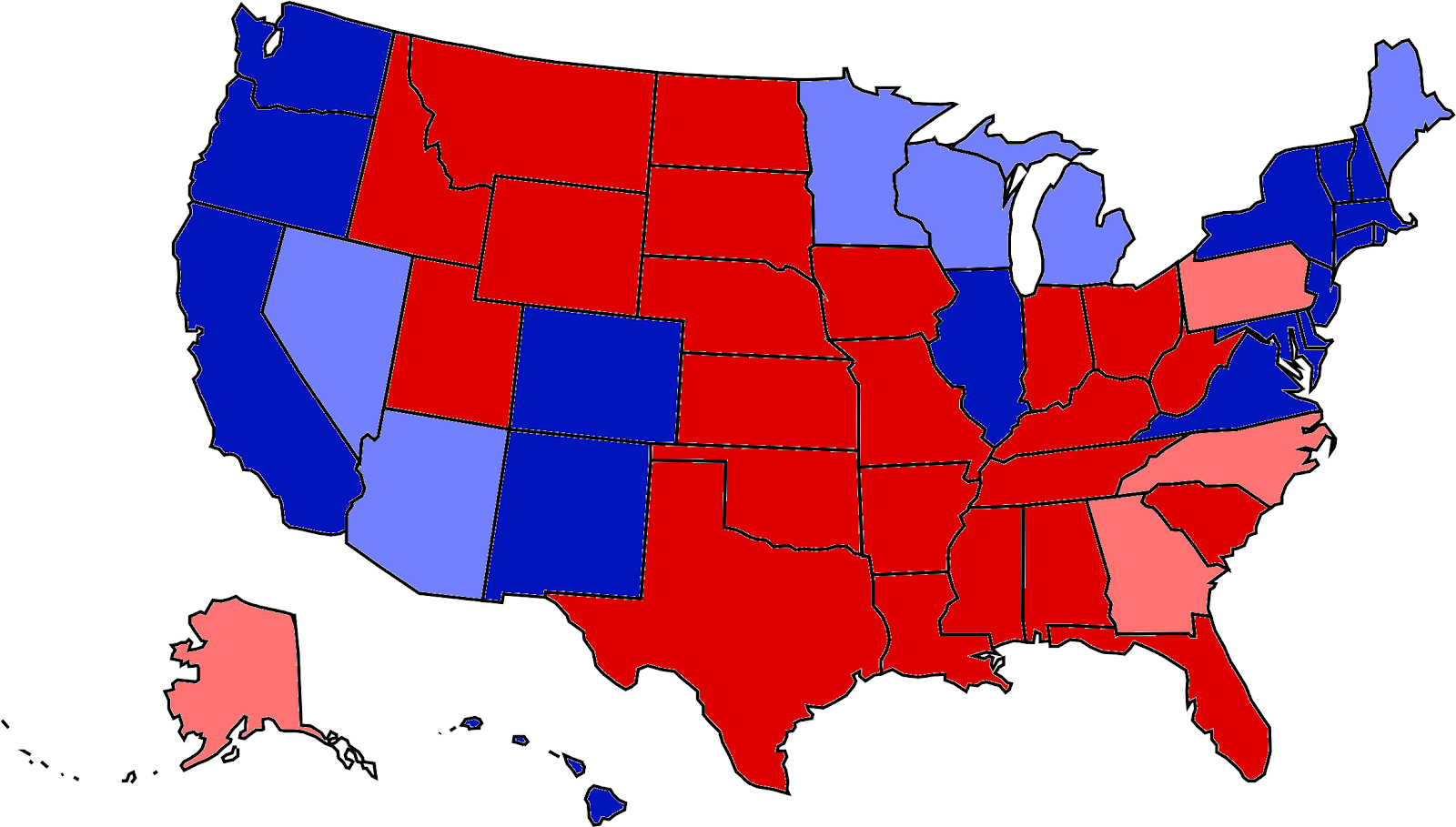

Figure 1: US 2020 Presidential Election Results Map (as of 10:30AM GMT 05/11)

Source: Ebury/BBC Date: 05/11/2020

An added complication relative to previous years has been the high influx of postal voting brought about by the COVID-19 pandemic. Approximately 100 million Americans are said to have voted by mail this year of the record 160 million or so that voted – considerably higher than the 20% that did so four years ago. While many states were able to process these mail-in votes ahead of time others, including some of the key swing states such as Michigan and Pennsylvania, were unable to begin counting these votes until a few days before or on the day of the election.

Which swing states remain in the balance?

Markets entered into a state of deja vu overnight on Wednesday, as early results showed that Trump had once again outperformed the opinion polls – as was the case at the 2016 election. Going into the election, the poll of polls had Biden around 7 points clear in the popular vote. With a high percentage of votes counted in the majority of states, this currently stands at a little over 2 points. This is likely to widen once all the votes are processed in many of the Democratic strongholds, albeit it has still ended up as a much tighter contest than the market had anticipated.

The safe-haven US dollar initially strengthened on the prospect of a close race after President Trump won in a handful of battleground states. The key swing state of Florida once again went to the Republicans at around 00:30 eastern time on Wednesday morning (05:30 GMT), with Trump claiming a big win in Texas not long after. Ohio and Iowa were also won by Trump, although Biden appears on course to win back Arizona for the Democrats.

At the time of writing (10:30AM GMT on Thursday), results in 43 out of the 50 states have been called (according to the BBC), with Biden ahead 243 electoral college votes to 214. Of those that remain, one is a Republican stronghold and will go to Trump – Alaska [4 votes]. Of the remaining 6, Biden currently holds narrow advantages in 3 of them: Wisconsin [10], Arizona [11] and Nevada [6], with Trump ahead in Pennsylvania [20], North Carolina [15] and Georgia [16]. As things stand, Biden would be on course to obtain just enough electoral college votes in order to be elected (270).

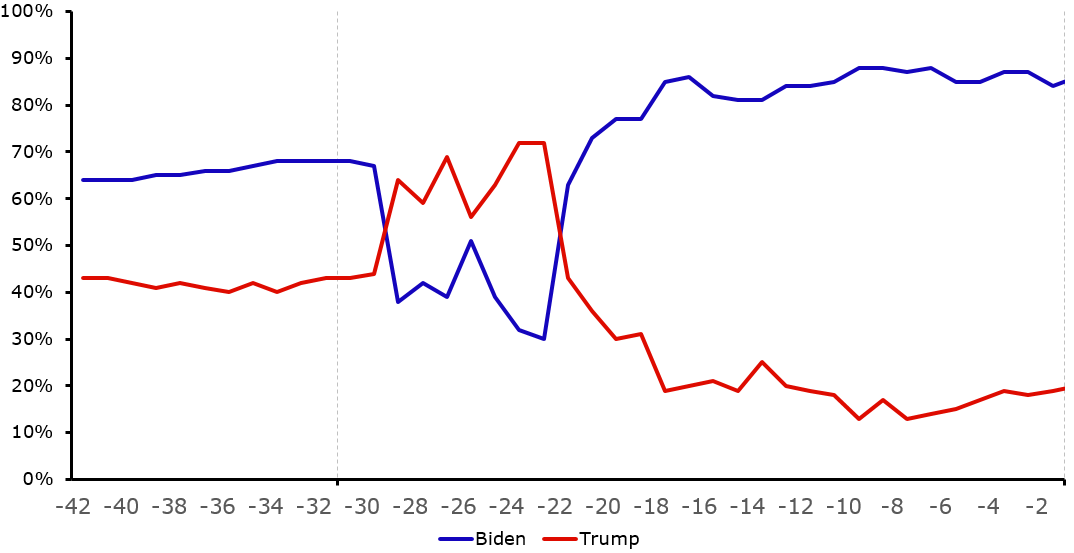

Despite three of the states being very close with more than 10% of votes yet to be counted, markets are highly confident of a Biden win. Implied odds based on PredictIt, which showed around a 70% chance of a Trump win overnight on Wednesday, now places an 86% probability of a Biden victory (Figure 2). This largely has to do with the fact that most of the so far uncounted votes in these states are those that were mailed in ahead of time, a high percentage of which are expected to vote Biden. A feature of this year’s election is that the majority of mail-in voters are said to be Democrats, with Republicans far more likely to have attended the polls in person.

Figure 2: PredictIt Probability of US Election Victory (Hours from 11:00AM GMT 05/11)

Source: PredictIt Date: 05/11/2020

How have financial markets reacted?

So far, the FX market has actually reacted relatively calmly, which is somewhat of a surprise given that the market had positioned itself for a comfortable Biden victory. The dollar sold-off as polls began to close in anticipation of a Biden win. This quickly reversed once it was clear that Trump had outperformed, although risk assets have been back on the front foot in the past 24 hours or so as the path to a Biden victory becomes increasingly clear.

EUR/USD is now trading higher than it was prior to the results from the first few states (Figure 3), buoyed by the growing likelihood of a Biden win, which as we mentioned in our election preview report is positive for risk assets. Emerging market currencies have also rallied, with notably moves higher in the likes of the Mexican peso and Chinese yuan, two of the countries that investors deemed as most likely to suffer from a continuation of Trump’s protectionist policies.

Figure 3: EUR/USD (02/11/20 – 05/11/20)

Source: Refinitiv Date: 05/11/2020

We have seen a sharp move higher in equity markets, with the S&P 500 index rising to its strongest position since mid-October (Figure 4). Government bond yields have also fallen, as investors ditch low risk assets (the US 10-year Treasury yield has fallen around 15 basis points to 0.75%).

Figure 4: S&P 500 Index (02/11/20 – 05/11/20)

Source: Refinitiv Date: 05/11/2020

What could happen next?

We think that this move higher in risk assets may prove short-lived. The results in some of the remaining key states may not be available until Friday, notably Pensylvannia, so it may still be a few days before the final result is known. A much greater risk to the market is that Trump has repeatedly stated his view that voter fraud has taken place and that he would be launching a legal challenge in order to contest the vote. The Trump campaign is challenging vote counts in Wisconsin, Georgia, Pennsylvania and Michigan at the state level, which could then be escalated to the Supreme Court. This is a similar scenario to the Bush vs. Gore election of 2000, where weeks of legal battles delayed the result of the election by more than a month.

We think that this may well be the case this time around, and that the definitive outcome may not be known for a number of days or weeks into the future. The longer this process drags on, the more support we could see for the safe-havens (including the US dollar) at the expense of just about every other currency.