Fed indicates November QE taper announcement on the way

( 3 min )

- Go back to blog home

- Latest

The US dollar rallied against its major peers on Wednesday, after the Federal Reserve indicated that it would soon be ready to unwind its massive stimulus measures introduced during the onset of the COVID-19 pandemic.

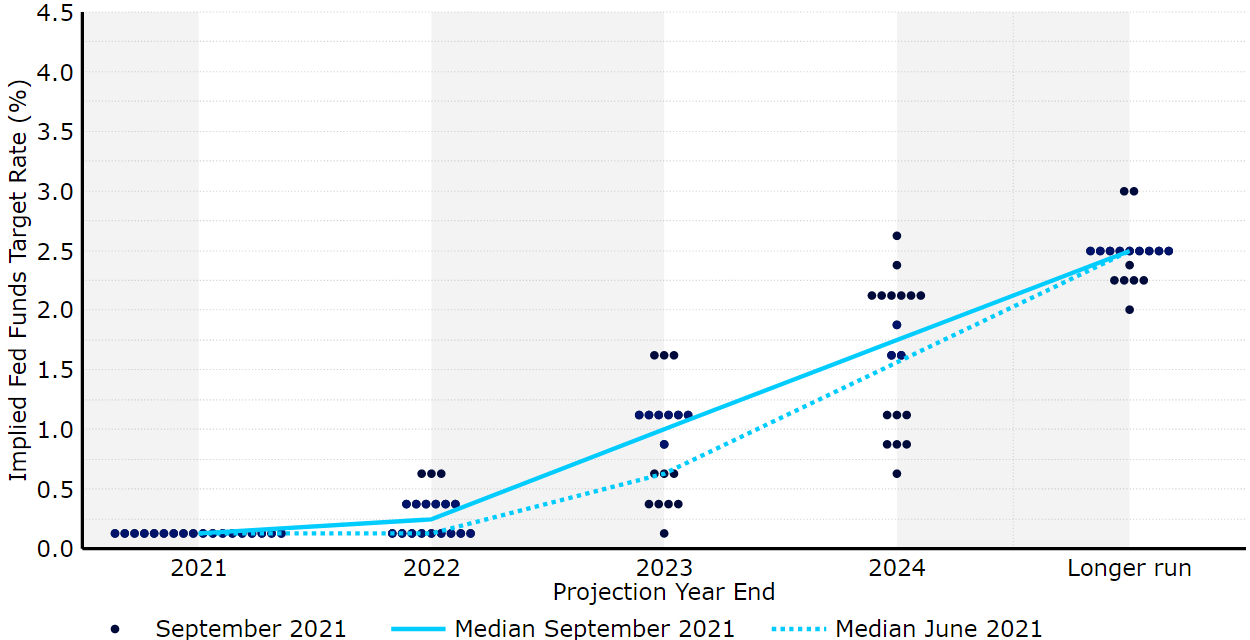

As we had anticipated, the Fed’s interest rate projections (the ‘dot plot’) were revised higher. Nine of the eighteen committee members now see hikes in 2022, up from seven in June, with all but one of the members now envisaging at least one rate increase before the end of 2023 (Figure 1). The median dot suggests that the Fed may be on course to raise rates once before the end of next year and on three occasions in 2023 and 2024, a more aggressive pace than they had previously outlined. Again, this upward revision was more-or-less in line with what the market had priced in prior to the meeting, so no surprises there.

Figure 1: FOMC ‘Dot Plot’ [September 2021]

Source: Refinitiv Datastream Date: 23/09/2021

The growth forecast for this year was downgraded rather sharply, in light of the recent aggressive spread of the delta variant. According to the Fed, the US economy is now expected to expand by 5.9%, down on the 7% that had been pencilled in back in July, although the 2022 and 2023 projections were shifted higher. PCE inflation forecasts were, on the other hand, upgraded, with the central bank now pencilling in price growth of 4.2% in 2021 and 2.2% in 2022. The projection for 2023 was unchanged at 2.2%. We are, however, slightly surprised by the Fed’s apparent lack of concern for rising inflationary pressures. Powell noted that supply-chain bottleneck effects had been ‘larger and longer-lasting than anticipated’, although the committee continues to see higher prices as transitory. This, in our view, is a dovish signal and we continue to think that high inflation is likely to prove more persistent than the Fed is currently anticipating.

The reaction in the FX market to the above was slightly counterintuitive, with the dollar briefly rallying against most of its major peers. EUR/USD ended the presser around half a percent lower, although the pair has since retraced almost all of its losses. We think that the initial move higher in the dollar was largely a reflection of the slightly more explicit indication of tapering. While a detailed timeline for the tapering path won’t be known until the actual announcement, Powell did state that it may end around mid-2022, which suggests hikes could be on the way not too long after. Markets did, however, largely take the announcement in its stride, although we do note the slight dichotomy between the initial reaction in the dollar and risk currencies, with the latter seemingly perceiving the tone as a more dovish one.

Following Wednesday’s meeting, we are increasingly confident in our call for an official taper announcement in November, with the process to begin in December. We think the first hike in late-2022 is now likely, although again this will be highly dependent on the impact of the ongoing pandemic.

Watch our latest Global Webinar: “Federal Reserve meeting & German elections – how will financial markets respond?” ahead of the German elections this weekend.