BoE December Meeting Reaction: surprise rate hike gives a boost to sterling

( 3 min )

- Go back to blog home

- Latest

Sterling rose sharply against its main peers following a surprise decision of the Bank of England’s Monetary Policy Committee to deliver its first interest rate hike since the pandemic began.

The statement after the decisions acknowledged that ‘consumer price inflation in advanced economies has risen by more than expected’. Although bank staff have revised down short-term UK GDP expectations, the bank’s near-term outlook regarding the labour market appears to remain positive judging by the downward revised unemployment rate forecast for Q4 2021. Inflation is expected to remain around 5% through most of the winter period and to peak at around 6% in April 2022. The statement did mention Omicron risk which is set to negatively affect growth in December and the first quarter of 2022 but said its effect on inflation is ‘unclear’.

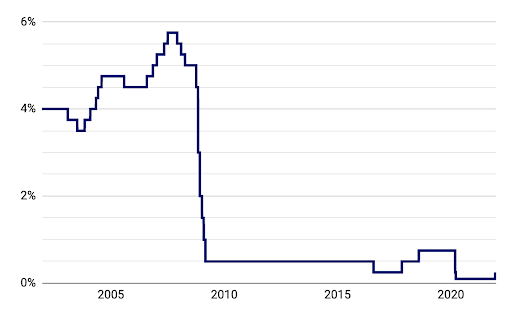

Figure 1: Bank of England Base Rate (2001 – 2021)

Source: Bloomberg Date: 16/12/2021

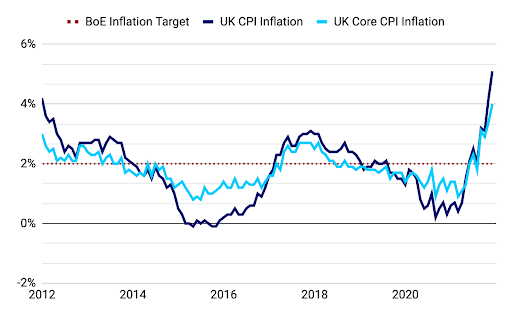

Today’s decision comes after on Tuesday the International Monetary Fund (IMF) urged UK policymakers not to delay monetary policy tightening and followed an increase in domestic inflation. In November, consumer prices rose by 5.1% year-on-year, surprising to the upside. Core inflation was also higher-than-expected, increasing to 4%, its highest level since 1991 and double the central bank inflation target (Figure 2).

Figure 2: UK Inflation Rate (2011 – 2021)

Source: Bloomberg Date: 16/12/2021

Today’s rate increase comes as a surprise to both us as well as the consensus as the MPC members’ rhetoric prior to the meeting was rather dovish, indicating policymakers are worried about the effects of the new variant on the economy, particularly as the UK has been one of the countries that tightened restrictions the most in the past few weeks.

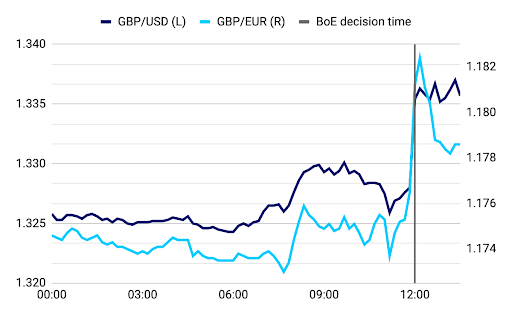

The FX market reaction after the announcement has been rather typical, as sterling soared by more than 0.5% against both the US dollar and the euro in the immediate aftermath (Figure 3).

Figure 3: GBP/USD & GBP/EUR (16/12/2021)

Source: Bloomberg Date: 16/12/2021

We expect monetary policy tightening in the UK to continue in 2022, with rates likely to rise to pre-pandemic levels or above before the end of next year. We believe that rate increases should support sterling going forward as the Bank of England sets up to be one of the most aggressively tightening central banks among the G10 in 2022.