BoE March Meeting Preview: Third consecutive rate hike on the cards

( 3 min )

- Go back to blog home

- Latest

The Bank of England is poised to raise interest rates for the third consecutive meeting on Thursday, as it continues its battle to rein in surging UK inflation.

Financial markets continue to see an aggressive pace of policy tightening from the BoE this year (165 basis points of additional hikes by year-end), and are now back pricing in a decent chance (approximately one-in-three) of a 50 basis point move this week. The latter would be very bullish for the pound, although we see it as a low likelihood outcome. In the event of a 25 basis point hike, the reaction in sterling to the announcement would likely be driven by the MPC’s voting pattern and communications on future policy moves.

We see it as likely that some members of the committee will again vote for a larger hike (perhaps hawks Saunders and Ramsden), although this number will probably be lower than in February. Should more than two MPC members vote for a larger move, the pound would rally, in our view.

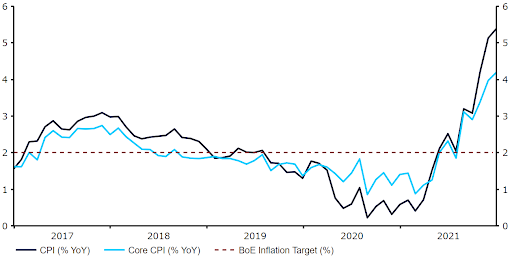

The bank’s comments on inflation will also be closely watched by market participants. The war in Ukraine should ensure that prices remain elevated for longer, which would create a significant headache in an environment of already rapidly rising prices. Headline inflation soared to a thirty-year high of 5.5% in January, with the MPC warning in February that this was set to peak at 7.25% in April, when the government’s energy price cap is lifted. Policymakers will probably continue to reiterate that preemptive tightening is required to anchor inflation expectations. Should they sound increasingly concerned over the inflation overshoot, and warn that a return to target will be delayed further due to the war in Ukraine, then investors would see this as a bullish signal.

Figure 1: UK Inflation Rate (2017 – 2022)

Source: Refinitv Datastream Date: 15/03/2022

On the other hand, however, a number of risks to growth remain, namely geopolitics, ongoing supply-chain issues and rising energy prices out of the bank’s control. Should the MPC indicate that it may need to pause the hiking cycle at some stage, and prioritise supporting growth, then the pound would likely sell-off. Sterling would be particularly susceptible should the bank’s communications explicitly push back against market pricing for hikes in 2022, although we don’t expect this to be the case. We think that the bank will instead wish to operate with a degree of flexibility, and keep its options open to hike at a relatively aggressive pace during the remainder of the year, should macroeconomic conditions warrant.

With inflation surging and risks to near-term growth mounting, we think that the BoE will aim to strike a delicate balance on Thursday. Similarly to its February communications, we think that the MPC will be keen for the market to not get too carried away with pricing in an aggressive pace of hikes. We instead think it will keep its options open by raising rates by 25 basis points on Thursday and indicating that it will take a data-dependent approach to further tightening.

The Bank of England’s policy decision will be announced at 12pm GMT (1pm CET) on Thursday.