UK inflation breaks to fresh four decades highs

( 3 min )

- Go back to blog home

- Latest

Another surprise to the upside in this morning’s UK inflation report, a trend that we have become all too familiar with in the past year or so, elicited a rather muted response in currency markets.

Summary:

- UK inflation exceeds expectations once again, rising to a four decade high 10.1% in July.

- GBP reaction rather muted. On the one hand, higher inflation raises possibility of a 50bp rate hike from BoE in September, on the other, heightens the chances of a UK recession.

- Risk currencies largely rebounded versus the US dollar on Tuesday ahead of today’s FOMC meeting minutes, US retail sales.

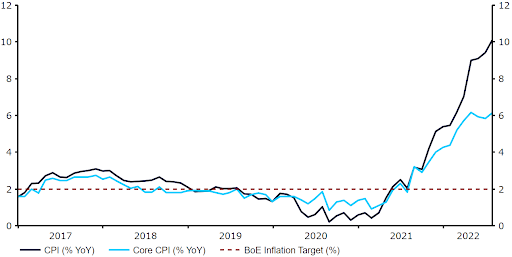

The headline CPI number leapt into double-digits for the first time since the early-1980s in July (10.1%), comfortably above the 9.8% that markets were anticipating. This marks the thirteenth occasion in the past sixteen months that this critical inflation measure has exceeded economists expectations, eight of those by 0.3p.p or more. Core inflation also came in much hotter than consensus (6.2%), providing another worrying confirmation that the surge in prices is not being driven solely by the increase in energy.

Figure 1: UK Inflation Rate (2017 – 2022)

Source: Refinitiv Datastream Date: 17/08/2022

Today’s data leaves the Bank of England stuck in a bit of a quandary, with multi-decade high inflation accompanied by an economy expected to enter into a deep recession in 2023. That said, we think that the MPC made it clear at its last meeting that it is prioritising the former, for now. Following today’s blowout report, we think that another 50 basis point interest rate hike is effectively guaranteed at the bank’s next meeting in September, with a non-negligible possibility of an additional one in November.

While this is unlikely to trigger a swift reversal in price pressures, which have been driven by factors largely out of the bank’s control, it may at least act to anchor inflation expectations and prevent a prolonged period of high inflation once supply-side pressures abate. As mentioned, the pound hasn’t reacted particularly aggressively to this morning’s data, posting modest losses on the US dollar. On the one hand, higher inflation should trigger a more aggressive monetary policy response from the Bank of England – a bullish signal for sterling. On the other hand, however, higher prices present a clear downside risk to economic activity, and raises the possibility of a potentially prolonged UK recession, which is clearly bearish for GBP.

Risk currencies had largely rebounded on Tuesday, including sterling, recovering losses from earlier in the week. Market attention today shifts to this evening’s FOMC meeting minutes, which may shed more light on the Fed’s plans for monetary policy. With US inflation beginning to show signs that it may have already peaked, speculation is turning to both when the hiking cycle may be brought to an end, and the timing of potential interest rate cuts. Markets seem to think that the latter will take place at some point in mid-2023, although we think that the minutes may push back on these expectations, which could be bullish for the dollar. In the meantime, this afternoon’s US retail sales data could also be a market mover, with economists bracing for near flat reading.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk