ECB hints at downside risks, dismal PMIs sink Euro

- Go back to blog home

- Latest

The Euro fell against its major peers yesterday and then again this morning, following a dovish message from the European Central Bank (ECB) and the release of a dismal set of Eurozone business activity PMIs.

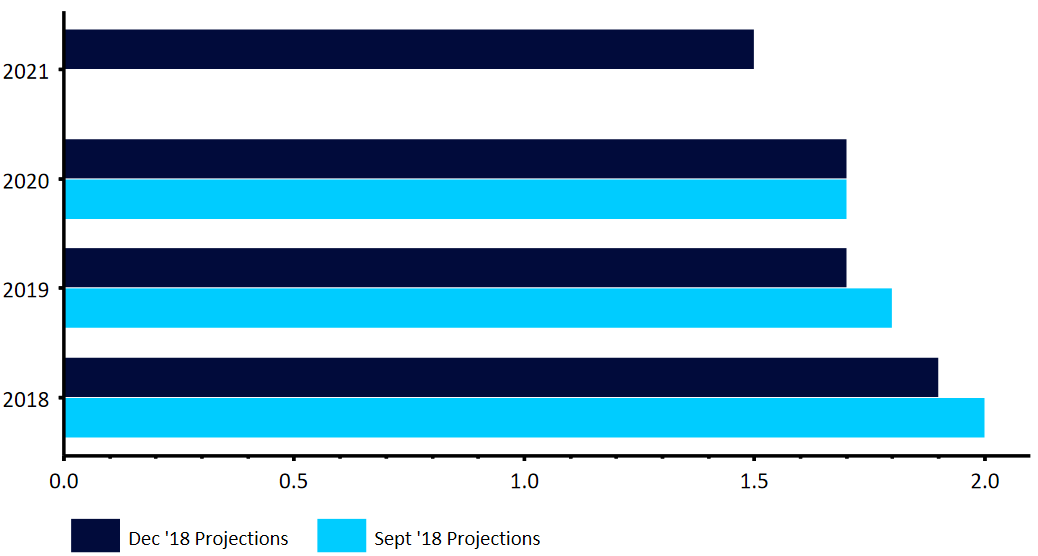

Figure 2: ECB Annual GDP Growth Forecasts (%) [13th December 2018]

Draghi stated that the timing of the first interest rate hike was not discussed during this week’s meeting. With no sign of an uptrend in core inflation in any way, shape or form, we continue to think the next hike is a long way off. We are calling for a hike no earlier than the fourth quarter of 2019 or, more likely, the first quarter of 2020, providing this core inflation measure doesn’t show any meaningful signs of an uptrend any time soon.

Eurozone composite PMI slumps to 49-month low

To compound the misery for the common currency, this morning’s EZ business activity PMIs were a massive disappointment, suggesting that growth in the bloc may be set to slow even further in Q4.

The preliminary numbers for December came in well short of expectations, dragging the Euro over half a percent lower. The crucial composite PMI tanked to 51.3 this month, down sharply from last month’s 52.7 and well short of consensus. This is the lowest level in the crucial indicator in 49 months, dragged lower by an uncertain external environment and protests in France. This is a worrying sign that gives us even more confidence in our call for an ECB rate hike no sooner than late-2019.

EU dismisses chance of Brexit deal renegotiation

For the first time in a number of sessions, the topic of Brexit didn’t dominate the headlines in the foreign exchange market.

Theresa May has been meeting with European leaders in the past 24 hours with the hope of attaining some form of reassurance over the contentious Irish border issue. While legal assurances may still be on the table, the EU has again categorically ruled out any renegotiations on the deal. This is another blow to May, who still looks increasingly unlikely to force her deal through parliament when MPs reconvene in the New Year.