Weak Eurozone data and higher US yields boost Dollar

- Go back to blog home

- Latest

Yet another weak print from the PMI leading indicators of economic activity slammed the Euro and dragged down all the other European currencies last week, which lost anywhere from 0.8% to 1.5% against the US Dollar.

All eyes are now on the Federal Reserve meeting this week. The FOMC is universally expected to hike rates, but the key will be the extent to which its expected path for 2019 hikes is revised lower. Political headlines around Brexit and the trade conflict between the US and China should also add to currency volatility.

Major currencies in detail

GBP

Volatility and uncertainty continue to be high in Sterling as we go into the year-end period.

The cancellation of last Tuesday’s Parliament vote and the refusal of the European Union to enter into any substantial renegotiations understandably hammered the Pound, which ended up underperforming every G10 currency, except the Norwegian Kroner. The seriousness of the situation is underscored by the decision of the European Commission to push ahead with preparations for a no-deal Brexit.

Paradoxically, May’s failure increases the chance of a last minute can-kicking exercise in which Brexit is postponed beyond the 29th March deadline, perhaps opening the door for a new referendum.

EUR

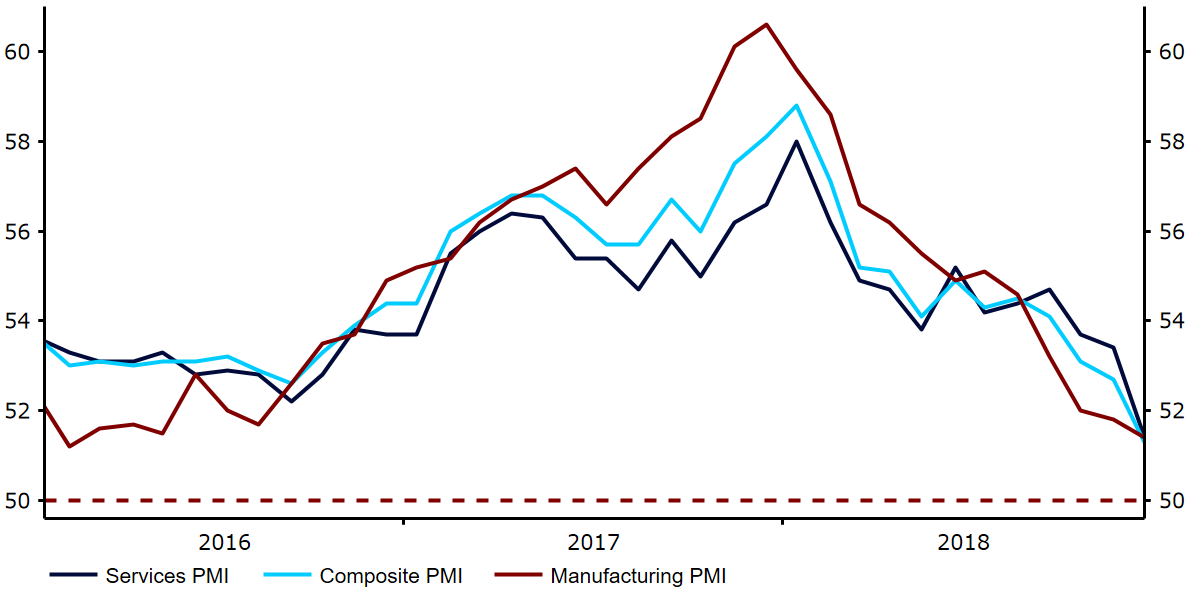

There were Euro-positive developments in Italy, where the Government proposed a new, revised target deficit of 2% of GDP, which we think is quite close to a level acceptable to the European Commission. This news was, however, overshadowed by the new fall in the flash PMI indicators of economic activity (Figure 1). A lot of the drop was due to the Yellow Vest disruption in France, which seems to be ebbing. Nonetheless, the numbers are concerning and warrant close attention in the coming weeks.

Figure 1: Eurozone PMIs (2016 – 2018)

The ECB appears to be getting concerned as well, stating in its December meeting that risks have moved to the downside. We see now no chance of a Q3 2019 hike from the ECB and are delaying our forecast until December 2019, though we maintain for now our Euro forecasts as we await the January PMI and inflation numbers.

USD

Strong inflation and retail sales data out of the US appear to confirm that a US recession is nowhere on the horizon, and probably sealed the case for a hike at this week’s FOMC meeting.

We are expecting the Fed’s forecast for its own policy decisions to be revised significantly down, in line with dovish statements from its members. The median forecast for 2019 should drop from three hikes to one. While interest rate markets have fully priced in such a move, we are not sure strategists and economists have, which opens the door for a potential US Dollar sell-off if our views turn out to be correct.