Sterling climbs on easing ‘no deal’ Brexit concerns

- Go back to blog home

- Latest

The Pound looked set to notch its largest weekly gain versus the Euro in over a year this morning, buoyed by optimism that the UK would avoid the disastrous ‘no deal’ Brexit scenario.

Attention in the UK now turns firmly to Monday, with Theresa May set to address the House of Commons on how she intends to proceed with Brexit. Hopes that this could include an extension to Article 50 were, however, dealt a blow yesterday after a spokeswoman to May claimed that Britain would decline an offer from the EU to extend the Brexit deadline.

On the macro front, this morning’s UK retail sales figures confirmed that British retailers suffered from a difficult Christmas period. UK retail sales declined by 0.9% year-on-year in December and by an even greater 1.3% when discounting fuel, a much larger drop than expected. This provides further evidence that uncertainty over Brexit may be feeding its way through to a softer domestic economic performance. This comes off the back of recent disappointing PMI data that suggested the UK’s services sector also barely grew in the final month of 2018.

Low Eurozone inflation keeps ECB hikes some way off

Meanwhile, the Euro was fairly range bound against the US Dollar again on Thursday, putting the greenback on course for its first weekly rise in five weeks.

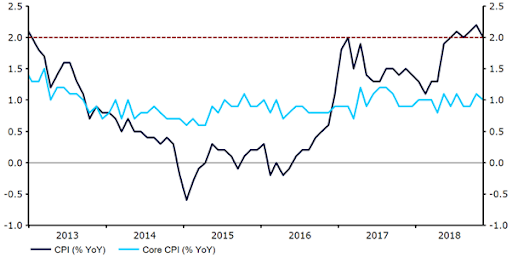

Economic news was fairly light on the ground yesterday, with Eurozone inflation numbers the only major piece of data for investors to chew on. The critical core inflation number, the key metric the European Central Bank looks at when deciding on monetary policy, came in unrevised at a lowly 1.0% (Figure 1). Recent stubbornly low readings in this crucial measure have caused investors to continue dialling back expectations for the timing of ECB hikes, now pricing in less than a 50% chance of a move before the end of the year.

Figure 1: Eurozone Inflation Rate (2013 – 2018)

With data releases light on the ground in the US due, in part, to the government shutdown, the greenback has been driven largely by external developments and a changing appetite for risk in recent sessions. We expect much of the same today, with industrial production numbers and a speech from Federal Reserve member John Williams not expected to materially shift the US currency this afternoon.