Why did Sterling rally after May’s crushing Brexit vote defeat?

- Go back to blog home

- Latest

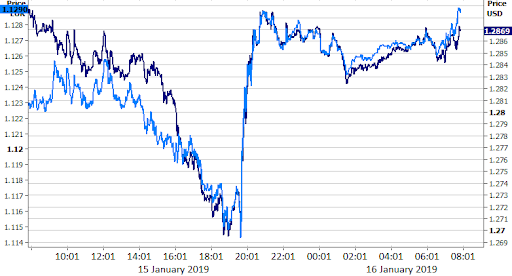

Sterling rallied by over one percent against the US Dollar on Tuesday evening, despite Theresa May’s EU withdrawal agreement being overwhelmingly shot down in last night’s Brexit vote.

Figure 1: GBP/USD & GBP/EUR (15/01/2019 – 16/01/2019)

This downward move was, however, extraordinarily brief, with the GBP/USD cross quickly reversing its losses and breaking back through the 1.28 level. Paradoxically, we think that investors have taken on the view that the size of the defeat is actually good news for the Pound in the short term. A narrower defeat for Theresa May would have very likely ensured another fruitless bout of toing and froing between the UK and EU that may have culminated in another rushed and ultimately futile second vote in a matter of weeks.

As it stands, we see very little chance that a deal could be forced through parliament in time for the 29th March EU exit date. With the Tory leadership, EU leaders and indeed the Labour Party all resoundingly against a ‘no deal’ scenario, we think that at least a three-month extension to Article 50 is now highly likely. This would allow for more time to negotiate and opens up the possibility of a second referendum.

What’s next for Theresa May?

Unsurprisingly, the leader of the opposition, Jeremy Corbyn, tabled a motion of no confidence in the government. This will now be debated on Wednesday, with MPs expected to vote on whether to back a no confidence motion at 7:00 pm UK time. This opens up the possibility of a general election in a matter of week. Theresa May now has 3 working days to return to parliament with a plan of action and we see it as very likely that this will entail an extension of Article 50. An extension of Article 50 would be positive news for the Pound, in our view, given it increases the chances of an amicable deal being struck and leaves the door ajar to another referendum. We therefore maintain our bullish forecasts for GBP in the short term.

Euro sinks on German growth fears

The Euro was dealt a double blow yesterday, sinking by almost one percent for the day against the US Dollar amid concerns over German growth and the crushing defeat for Theresa May.

Germany’s latest growth figures confirmed our suspicions that the European Central Bank would likely delayed its first interest rate hike since 2011 until very deep into 2019 or, more likely, early-2020. Hit by weaker exports, the German economy expanded by just 1.5% in 2018, its weakest year of growth in five years. While the actual GDP numbers for the fourth quarter of the year will not be released until February, it is expected that Europe’s largest economy expanded in the final three months of the year, therefore avoiding a technical recession as many had feared.

Regardless, these numbers are damning and helped drag the common currency to its weakest position in ten days yesterday. Next up for the Euro will be tomorrow’s crucial inflation numbers. A confirmation that the core rate remained stuck at 1% in December makes us growingly confident of no hikes from the ECB throughout the remainder of this year.