D-Day for May as UK parliament votes on Brexit deal

- Go back to blog home

- Latest

Today is shaping up to be one of the most significant and meaningful days in UK politics in a number of years, with MPs this evening finally voting on whether to accept or reject Theresa May’s 585-page Brexit withdrawal text.

But how will the vote work and how could the Pound react?

When will MPs be voting?

Voting will commence at 7:00pm UK time this evening, with MPs to first cast their vote on proposed amendments to the motion. A maximum of six amendments to the motion can be made, each taking approximately 15 minutes to vote on, ensuring that the main vote itself will take place any time between 7:00-8:30pm. The result will likely be known very soon after.

What are Theresa May’s chances?

In a last ditch attempt to win over her doubters and rebels within the Tory Party, Theresa May launched a final defense of her agreement on Monday. The contentious NI backstop, a failsafe that ensures no hard border in the event that an agreement can’t be reached, would be a necessity to any deal according to May. Letters released from the EU yesterday, May’s so-called ‘legal assurances’, also stated that the EU did not want to enforce the backstop and if it was enforced, would only apply temporarily.

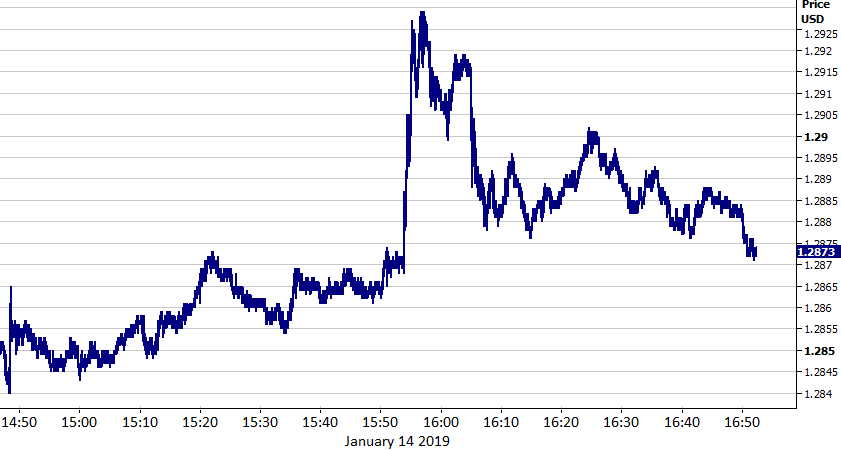

Even following the release of the aforementioned assurances, May’s chances of passing the bill today look slim. A report from the ITV on Monday that the European Research Group (ERG), a group of pro-Brexiters within the Tory Party, may back the deal briefly raised hopes of an agreement and caused a sharp upward move in the Pound. Sterling soared to a 2-month high after Robert Peston tweeted that the ERG could back May, unless an amendment that would rule out no-deal is withdrawn.

Figure 1: GBP/USD (14/01/2019)

, The claim was, however, almost immediately denied by MP Steve Baker and Sterling quickly reversed much of its gains.

How will the Pound react to tonight’s vote?

ITV’s report aside, around 100 Tory and DUP MPs are said to be voting against the Prime Minister this evening. The key to the GBP reaction will likely be the margin to defeat. We outline three very broad scenarios to the vote:

- Theresa May wins. The UK would leave the EU as planned on 29th March. We would expect a sharp GBP rally in event of vote unexpectedly passing. GBP/USD to 1.33-1.34.

- Theresa May loses by narrow margin (<50 votes). Narrow vote may pave the way for minor renegotiation on the backstop and another vote in a matter of weeks. Could be GBP positive if very small defeat.

- Theresa May loses by sizable margin (>100 votes). A big margin of defeat could see GBP/USD hit the 1.24-1.25 mark, dependent on May’s comments on how to proceed.

What happens if MPs do not back the deal?

As for what will actually happen should the vote fail to pass, we think five scenarios are realistically possible:

- Article 50 is delayed – This looks like the most likely scenario. Would allow extra time to negotiate with EU on backstop.

- Snap general election called, acting as a de facto public vote on May’s Brexit deal. Two-thirds of MPs would need to support it (i.e incl. a large number of Tory MPs).

- UK leaves EU on 29/03 with no deal in place. May and Corbyn have both voiced a desire to avoid a ‘no deal’. ECJ ruling ensures Article 50 can be revoked.

- Theresa May resigns. (This could pave the way for 5).

- A second EU referendum (a ‘people’s vote’) is called. Good for GBP given 50/50 chance of no Brexit.

Regardless of the outcome of the vote, today will be a particularly volatile day in the currency markets. Sterling will be susceptible to wild swings in either direction both leading up to the vote and following the actual vote itself.