Another delay? General election? What’s next for Brexit?

- Go back to blog home

- Latest

Last night saw another hectic few hours in the House of Commons, with investors frantically trying to gauge the implications of two crucial votes in Westminster.

According to Johnson, he will now seek a general election in order to try and break the deadlock. While the PM has long insisted that the UK will leave the EU come what may on 31st October, he did begrudgingly send a letter asking for an extension over the weekend. We now await official word as to firstly whether or not the EU will actually grant the extension and, more importantly, the length of said extension.

European Commission chief Donald Tusk tweeted that he recommends the EU offer an extension, so the first question looks almost certain to be a yes at this point. As far as the delay is concerned, the EU has typically offered two dates in the past – one a matter of a few weeks in the future in order to see if a deal can be forced through, and a second a few months down the line should no compromise be reached before the initial deadline. We should get the EU’s decision by Friday.

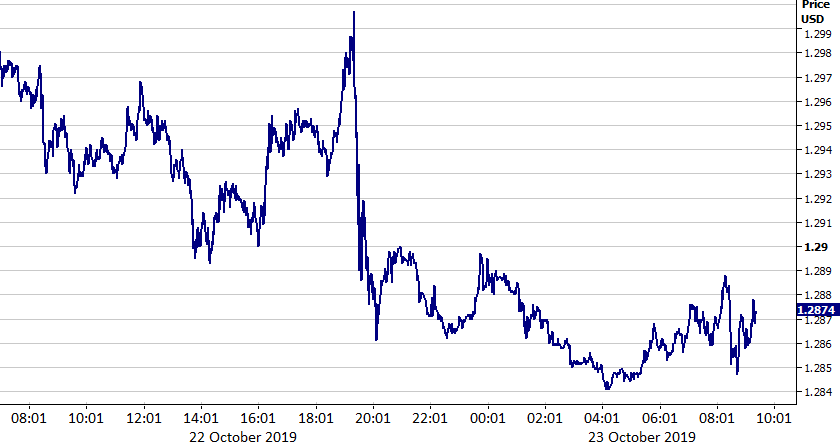

Sterling has actually taken the news largely in its stride in the past few days. We have seen a sell-off of almost one percent following Johnson’s defeat on the WAB timetable, although this is largely due to the fact that another delay is likely, rather than the odds of a ‘no deal’ rising. The general consensus in the market is that a ‘no deal’ Brexit has almost zero chance of happening at this juncture, particularly given the Prime Minister now effectively has a majority in favour of his revised deal. This is primarily why the pound has remained as resilient as it has done, with the UK currency currently holding steady around the 1.2860 level versus the dollar.

Figure 1: GBP/USD (22/10 – 23/10)

Investors await Draghi’s last ECB meeting

The FX market had another day yesterday where all other news got largely overshadowed by Brexit developments, with EUR/USD once again mostly mirroring movements in cable. It is worth remembering that the prospect of another Brexit delay and a prolonging of uncertainty does little in the way of improving global risk sentiment, particularly in the Eurozone. We may see signs that this uncertainty is feeding its way through to lower consumer sentiment in the common area today, with the October consumer confidence index for the Euro Area set for release this afternoon.

Aside from that, the economic calendar today looks surprisingly barron on Wednesday. Investors will have to wait until Thursday for the next major pieces of central bank and macroeconomic news. The main focal point during the rest of the week will be Mario Draghi’s last press conference as President of the ECB tomorrow. Given that a host of easing measures were announced at the last meeting, we actually think that this week’s one will be pretty low key.