Is the Federal Reserve done cutting interest rates?

- Go back to blog home

- Latest

The Federal Reserve cut interest rates by another 25 basis points on Wednesday although, as we had anticipated prior to the October meeting, suggested that it may be done easing monetary policy for the time being.

Powell’s comments were actually fairly upbeat. He reiterated that the move was merely an ‘insurance cut’ designed to protect the US economy from a potential blow up in trade tensions. Powell also stated that the US economy was continuing to grow at a ‘moderate’ pace, supported by a ‘strong’ labour market, with downside risks from abroad, notably Brexit, beginning to recede.

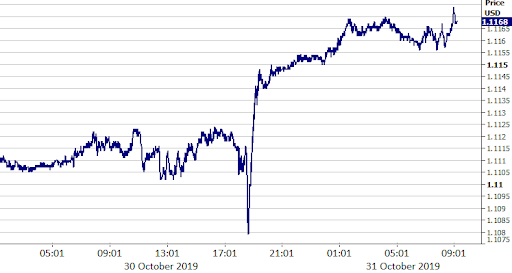

According to the Federal Reserve Chair, monetary policy is currently in a ‘good place’. Importantly, the bank’s ‘act as appropriate’ pledge, included in previous statements to indicate the bank’s willingness to lower rates, was removed. We think that the aforementioned ensures that we are not likely to see any more rate cuts from the Fed during the remainder of the year, with a pause in the easing cycle likely for a little while at least. The US dollar did, however, react in a somewhat surprising fashion, selling off by around half a percent against the euro, despite initially rallying (Figure 1).

Figure 1: EUR/USD (30/10 – 31/10)

We think that a couple of factors were behind the move. Firstly, Powell warned that the General Motors strike in September, the longest auto workers strike in 50 years, could shave a couple of tenths off US growth in the third quarter. He also talked down the possibility of raising rates anytime soon, stating there would need to be ‘a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns’.

Johnson’s Tory Party well set ahead of election

With almost all attention on the Federal Reserve yesterday, most other news went largely under the radar. We did see a bit of a rally in the pound, which rose back above the 1.29 mark versus the US dollar this morning. While much of the move can be attributed to dollar selling, there is a general sense of optimism surrounding Brexit that is provided investors with reason to be cheery.

Ahead of the 12th December election, Boris Johnson’s Tory Party are looking well placed and are currently well ahead in the latest polls. Bookmaker implied probabilities are now showing in excess of an 80% chance of a Tory victory and around a 55% chance of a majority. It is worth noting, however, that support for Labour has historically surprised to the upside on election day compared to the polls, so a comfortable victory for Johnson is far from guaranteed.

Investors eye Friday’s US labour report

Next up in the markets will be this morning’s Euro Area inflation and growth numbers. The GDP data runs on a lag, so we don’t expect any meaningful reaction in EUR/USD, although today’s inflation print could shift the common currency if it materially deviates from consensus.

Investors will now have one eye on tomorrow’s US payrolls report. With the Fed indicating that it may be done cutting rates, tomorrow’s labour data may take on slightly less importance than usual. That being said, we think that we may see a bit of a recovery in the dollar should the latest earnings numbers show that wage growth picked up to back above 3% this month.