Sterling: The Volatility Awakens

- Go back to blog home

- Latest

We have said for a while that the pound has behaved more like an emerging market currency than a major one ever since the Brexit vote in 2016. Thursday was a prime example of this.

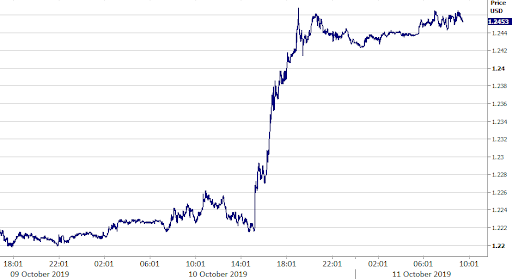

Figure 1: GBP/USD (10/10/19 – 11/10/19)

Unsurprisingly, the rationale behind the aggressive move was headlines on Brexit. We said yesterday that investors were placing next to no chance on a Brexit deal being forced through at some point before the end of the month deadline. This is certainly not the case now, with investors piling into the UK currency on renewed optimism that a compromise on the Northern Irish border may not be as far away as first believed.

A joint statement from PM Boris Johnson and Irish leader Leo Varadkar stated that they could ‘see a pathway to a possible deal’. While the magnitude of the move in sterling off the back of these comments is not all that surprising, we still think that the market is getting a little carried away. Our base case remains for no agreement to be reached at the 17-18th EU summit, with Johnson to then seek another three month extension on the 19th, as is required by law. It does, however, provide hope that a deal could be forced through at some point in early-2020, albeit this may still require a general election in the interim.

While attention was, of course, on Brexit yesterday, it would be a complete oversight to overlook yesterday’s GDP numbers for August. According to the data, the UK economy contracted by 0.1% month-on-month, albeit there was an upward revision to the July number to 0.4% from 0.3%. The NIESR estimate for September painted a much more rosy picture, suggesting that growth in the three months to last month was more around the 0.5% mark. That being said, it is clear that activity remains weak and that the Brexit mess is having at least some impact on UK activity.

Euro jumps above 1.10 on Trump’s trade remarks

Most other news in the FX market took a back seat to Brexit on Thursday, although we did witness a jump in EUR/USD back above the 1.10 level yesterday morning. The move can largely be attributed to renewed risk appetite after President Trump stated that the US had ‘very, very good negotiations with China’ regarding trade.

Elsewhere, yesterday’s US inflation numbers were pretty underwhelming, further suggesting that the Federal Reserve would be right to cut interest rates again at its next meeting in October. US headline inflation was particularly soft, with prices not growing at all month-on-month in September.

We also had the ECB’s meeting accounts out yesterday, which suggested that last month’s decision to restart the QE programme was not as one-sided as first thought. According to the minutes, there was a ‘clear majority’ in favour of the QE decision and a ‘very large majority’ in favour of the rate cut. We think that this lack of opposition to the status quo suggests more stimulus could be on the way at upcoming meetings.