Sterling volatility hits June 2017 highs ahead of crucial EU summit

- Go back to blog home

- Latest

UK Prime Minister Boris Johnson will be heading to the two-day EU summit in Brussels today in the hope of ratifying a deal before the end of the month Brexit deadline.

We have mentioned in the past few days, however, that the market may be getting a little carried away with itself. The key aspect to the whole Brexit process is not whether the PM can successfully negotiate alterations to the withdrawal agreement, but whether these changes are sufficient enough to garner enough support within the House of Commons.

This, we think, is something that the market seems to be overlooking. It is far from guaranteed that a revised deal will pass, particularly given that the Tories do not hold a majority in parliament. Comments from the Tory’s coalition partner, the DUP, were also less than encouraging yesterday, with the party reportedly unhappy at elements of the deal.

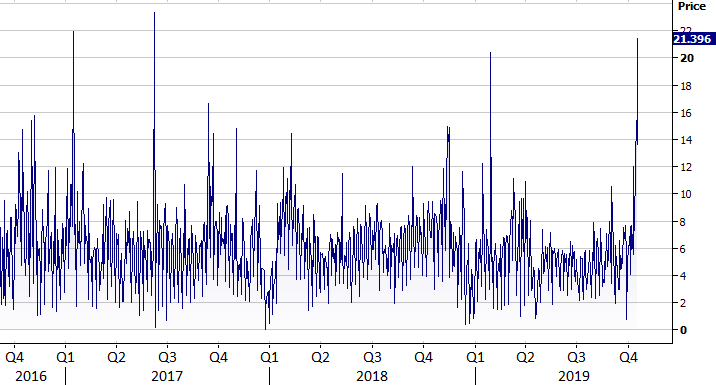

Regardless of what happens at the EU summit, volatility in the pound is likely to remain sky high during the remainder of the week. A good indicator of this is the overnight volatility measure in GBP, which is, at the time of writing, at its highest level since June 2017 and its third highest level since the immediate aftermath of the EU referendum (Figure 1).

Figure 1: GBP ONO Volatility (2016 – 2019)

UK retail sales data out this morning, much like the labour report and inflation numbers from earlier in the week, will go almost unnoticed this morning in favour of Brexit headlines.

Fed’s Evans talks down need for more US rate cuts

Brexit news has continued to dominate headlines in financial markets. The euro’s upward move yesterday, which saw it rally by almost half a percent versus the dollar to its highest position in around a month, can largely be attributed to the optimism surrounding the UK’s EU exit.

Data out of the Eurozone yesterday was actually pretty weak, indicating that the market’s focus is currently largely on developments elsewhere. Euro Area inflation fell even further below the ECB’s target, coming in at just 0.8% year-on-year in September. This heaps even more pressure on the European Central Bank to ease policy further in the coming months.

FX traders also largely overlooked comments from Federal Reserve member Evans on Wednesday. Evans stated that he thought no more rate cuts were needed in the US through 2020, given that the world’s largest economy was in a ‘good place’. Given that Evans is seen as one of the more dovish members on the FOMC, we think his comments are pretty meaningful. It does, at the very least, suggest to us that two more rates cuts from the Fed this year is highly unlikely.