Markets take a breath after frantic few days of news

- Go back to blog home

- Latest

Following a frantic past week or so littered with major political, central bank and macroeconomic news, activity in the foreign exchange markets was much more serene on Monday.

The common currency itself received no support whatsoever from yesterday morning’s Euro Area PMI data that showed a welcome surprise to the upside. Manufacturing activity according to Markit’s monthly index remained below the level of 50 denoting contraction in October, although was revised upwards to 45.9. It is clear that markets are not going to change their view on the Eurozone economy until we see a much more sustained upward move in these PMI indicators.

Probably the main news came out of China, with the People’s Bank of China conducting its first interest rate cut since 2016. Amid uncertainty over trade relations with the US, the PBoC slashed its one-year medium term facility rate (MLF) by 5 basis points. This was, however, a disappointment to the market that had been pencilling in a larger move and the Chinese yuan actually rallied to its strongest position in three months.

All quiet on the Brexit front, for now

Investors and analysts alike at last have chance to catch their breath from the Brexit saga, with no significant developments on that front likely until the election results on 12th December. As a nice change of pace, attention this week will be back on Bank of England monetary policy.

Policymakers at the BoE have maintained a fairly united front in the past few months in favour of holding policy unchanged while it awaits more concrete indications as to how Brexit will play out. It will therefore be interesting to see whether the bank’s communications strike a slightly more upbeat note on Thursday, given that risks of an imminent ‘no deal’ Brexit have undoubtedly receded.

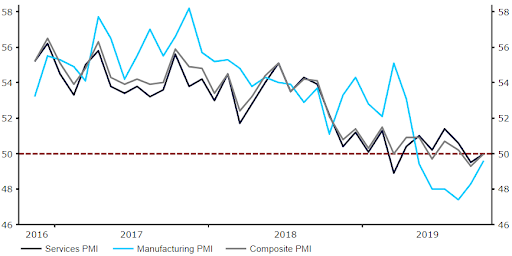

The bank’s quarterly Inflation Report and Governor Carney’s press conference could both note optimism regarding the above. Yet, with election uncertainty still looming large the most likely scenario would be for the BoE to maintain a neutral stance. Data out of the UK also continues to be mixed. While this morning’s services PMI surprised to the upside, it came at the level of 50 in October (Figure 1), suggesting flat growth in the sector. This will no doubt be of at least some concern to Carney and co.

Figure 1: UK PMIs (2016 – 2019)