Is a US-China trade deal on the horizon?

- Go back to blog home

- Latest

The major currencies spent much of trading yesterday fairly range bound, with a public holiday in the US and a lack of major market moving news ensuring that activity was fairly limited.

Despite some very encouraging comments from President Trump that trade talks with China are going ‘very well’ and that it would be his ‘honour to remove [tariffs]’ should an agreement be reached, the market is not getting carried away with the notion that a deal will be done. Trump has suggested that the 1st March deadline for a deal to be agreed could be pushed, although time is running out and investors are unlikely to commit to sizable positions either way until we get some concrete news on this front.

Attention also tentatively turns to next month’s European Central Bank meeting, which could present another fairly significant downside risk to the Euro. Macroeconomic data out of the bloc has continued to undershoot expectations of late and there is now a very good chance that policymakers will downgrade their growth forecasts when they next convene on 7th March. Thursday’s preliminary PMI readings are likely to be key. Another downside surprise here could trigger a renewed bout of weakness in the common currency this week.

Sterling holds firm after UK labour data

The Pound has been stuck in a relatively narrow range around the 1.29 mark against the US Dollar so far this week, as investors await further developments on the Brexit front.

Theresa May remains on a mission to seek alternative solutions to the NI ‘backstop’ in time for a fresh parliament vote before the end of the month – likely late next week. With the clock ticking until the 29th March exit data and with Sterling holding up remarkably well, we continue to get the impression that the market is still confident that a ‘no deal’ will be avoided and that an extension to Article 50 is on the way.

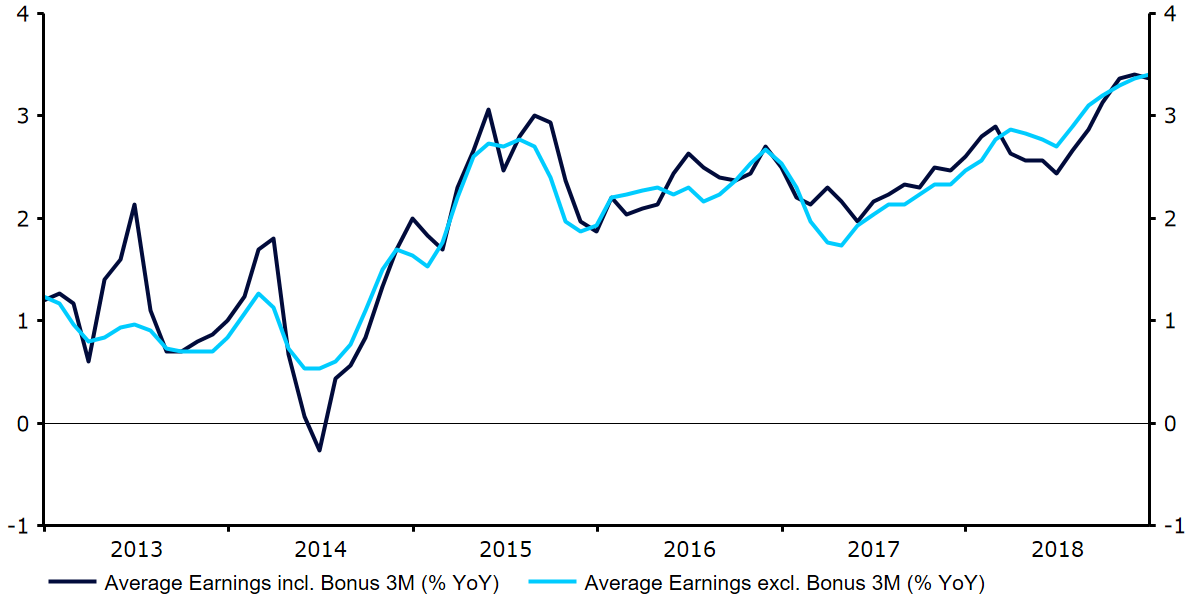

Meanwhile, this morning’s UK labour data came in mostly in line with expectations and did little to shift the currency. Unemployment remained at its four decade low 4%, although average earnings including bonus unexpectedly came in unchanged at 3.4% (Figure 1), after economists had eyed a modest uptick. This remains at a very healthy level that could encourage the Bank of England to raise interest rates before the year is out, provided we get a smooth and orderly Brexit in the interim.

Figure 1: UK Average Earnings Growth (2013 – 2018)

Macroeconomic news out of the UK is fairly light on the ground for the rest of the week and all attention will therefore be on Brexit.