Bercow dashes Brexit vote hopes, UK jobless rate falls

- Go back to blog home

- Latest

Sterling steadied itself on Tuesday morning, having fallen by almost one percent against the US Dollar at one stage yesterday. This ensured that the Pound was the worst performing major currency on Monday.

That being said, currency traders are far from panicking, with a long extension to Brexit still looking like the most likely option. The next opportunity for an extension to be approved by the EU is this Thursday’s EU Council meeting. Should May’s vote not be passed in a parliament vote before then, as is looking very likely, a longer delay that may even include the stipulation to hold a second referendum looks increasingly likely. This, we believe, would provide Sterling with further room to rally.

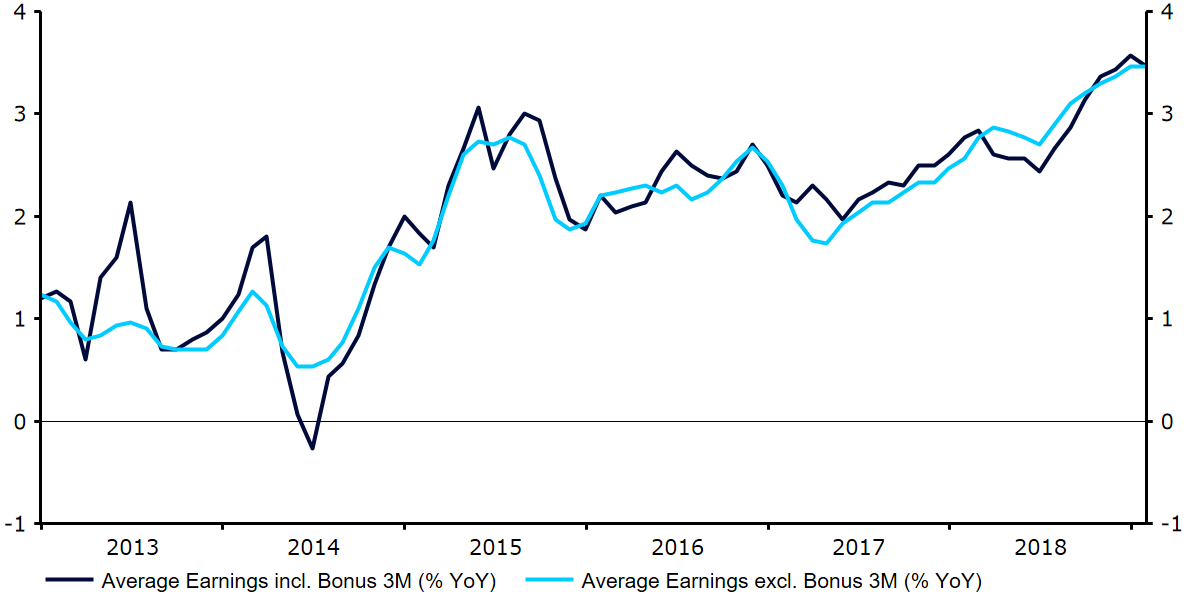

Away from Brexit, this morning’s UK labour data was impressive, although with all focus on politics, Sterling was little moved. Unemployment fell again, declining to a fresh four decade low 3.9%, while wage growth came in unchanged at 3.4% after investors had eyed a modest decline. This should provide at least some reason for optimism from the Bank of England when it begins its two-day monetary policy meeting tomorrow.

Figure 1: UK Average Hourly Earnings (2013 – 2019)

Euro continues to climb higher ahead of Fed meeting

With attention in the FX markets largely on Brexit, the EUR/USD rate traded within a fairly narrow range on Monday, albeit continued to edge higher towards the 1.135 mark.

Ever since the March ECB meeting, in which policymakers delivered a resoundingly dovish tone of communications, focus has shifted firmly to expectations for this week’s Fed meeting. With domestic inflation soft and risks from abroad growing, the market is now heavily anticipating a downward revision to the bank’s ‘dot plot’. As we mentioned in our FOMC preview report, we expect the median committee member to now signal zero hikes throughout the entirety of 2019. This, coupled with the news that the bank’s balance sheet runoff may be set for a pause could, we believe, help lift EUR/USD back towards the 1.15 mark in the next couple of weeks.

The Fed will be announcing its policy decision at 6pm UK time tomorrow, with Powell’s press conference to follow shortly after.