Hopes of Brexit breakthrough sends Pound sharply higher

- Go back to blog home

- Latest

Sterling jumped by around three-quarters of a percent against the US Dollar on Tuesday evening, extending its gains this morning, after Theresa May stated that the UK government would seek another extension to the Brexit deadline.

Whether these talks yield any sort of common ground remains to be seen, but the market has treated it as a positive development. Traders briefly lifted Sterling to its highest level in a week this morning, although news that the UK’s services PMI had fallen into contractionary territory in March reversed much of these gains.

Upwardly revised PMI data allays EZ recession fears

A slightly better-than-expected set of PMI data out of the Eurozone this morning helped lift the Euro off its near two year lows on Wednesday.

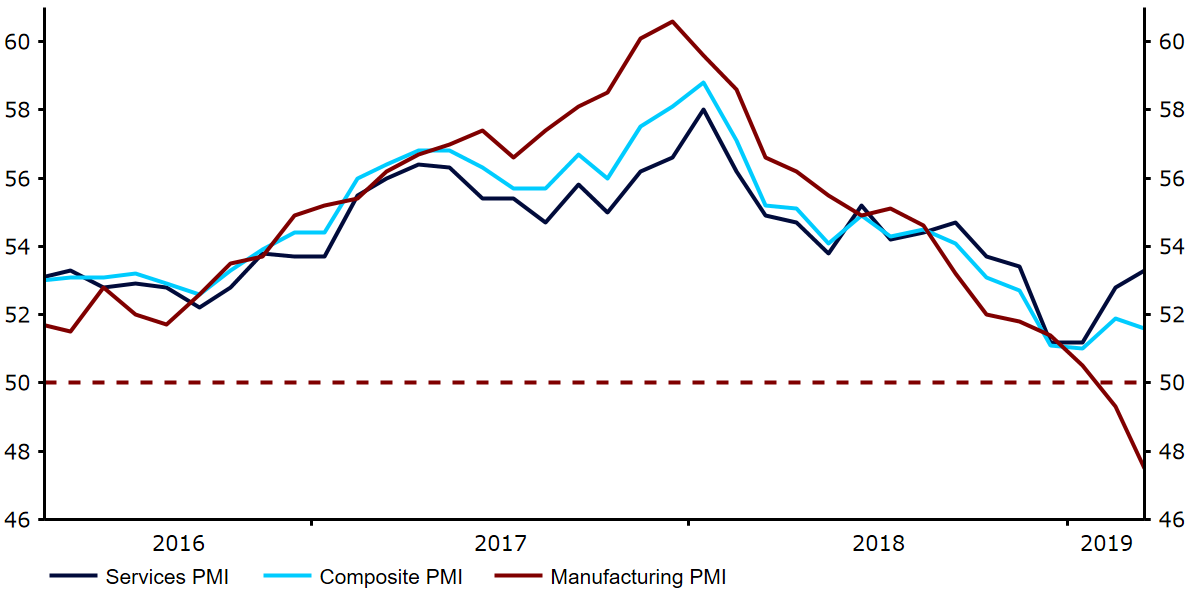

The common currency has been under heavy downward pressure in the past few weeks as a string of fairly dire macroeconomic data out of the bloc has raised genuine concerns over the possibility of an imminent recession. These concerns were allayed somewhat this morning after the March services PMI was revised upwards. The critical index was revised up to 53.3 after investors had eyed a 52.7 reading. This marks a fairly rare divergence with the manufacturing index, which fell to its lowest level in six years last month (Figure 1)

Figure 1: Eurozone Composite PMI (2016 – 2019)

Mixed economic data buffets US Dollar

A fairly mixed set of news out of the US has buffeted the Dollar in both directions so far this week. On Monday, some fairly encouraging news out of the manufacturing sector was offset by dismal retail sales figures. The latter, seen as one of the most important US data releases on the economic calendar, contracted for the second time in the past three months in February, reinforcing the view that the world’s largest economy likely slowed in the first quarter of 2019.

Next up will be this afternoon’s non-manufacturing PMI for March from ISM, although one eye will be on Friday’s all-important nonfarm payrolls report. We think that a strong report here could be enough for another bout of Euro weakness and send the critical EUR/USD cross back towards its mid-2017 lows.