Sterling falls sharply on breakdown of May-Corbyn Brexit talks, trade tensions buoy Dollar

- Go back to blog home

- Latest

The Pound was the worst performing G10 currency last week as Brexit concerns once again focused traders attention.

Elsewhere, emerging market currencies had a rough go of it as US-Iran tensions were added to the trade conflict. All the major EM currencies sold-off save the Ruble, buoyed by higher oil prices. The worst performer last week was the Brazilian real, hammered by poor domestic economic data.

This week data is scarce in terms of macroeconomic news out of the key currency areas. We expect politics to dominate, including trade conflict headlines, Brexit events, and European Parliament election results. The main macroeconomic report will be the flash PMIs of economic activity, set for release in the Eurozone on Thursday.

GBP

Reasonably good economic data out of the UK was completely overshadowed by the forceful return of Brexit politics to the top of the agenda. The labour market contributes to cruise ahead, generating nearly 100,000 jobs in the three months to March. None of this mattered to markets as the news that Prime Minister May plans to leave during the summer hit the wires.

The likelihood that May will be replaced by a hard Brexiteer, and the subsequent collapse of the May-Corbyn talks on Brexit, hammered Sterling, which ended the week down up to 2% against every other G10 currency.

EUR

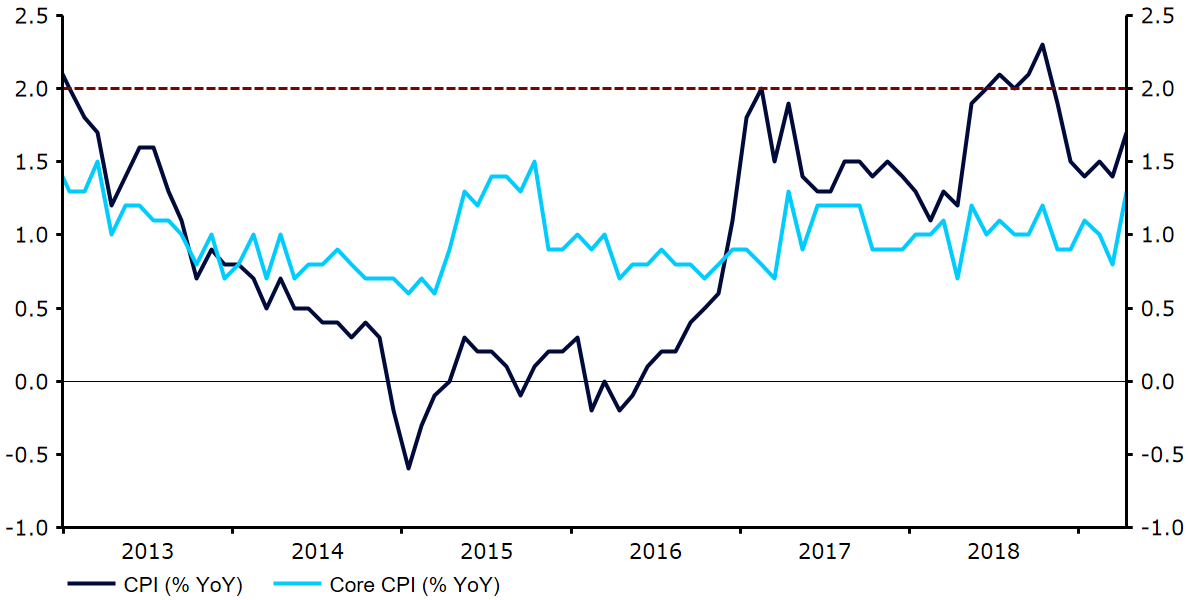

Economic news out of the Eurozone continued its tendency to surprise to the upside. This time it was core inflation that was revised up to 1.3%. While this is still below the ECB target, it is the highest reading since early-2017. This upward trend will be very welcome by the ECB council, and probably means that significant stimulus measures are far from guaranteed in the Eurozone. Despite being an unambiguously positive development for the common currency, the Euro traded very quietly in the middle of its recent tight range last week.

Figure 1: Eurozone Inflation Rate (2013 – 2019)

This week we look for the PMI surveys of business activity to confirm the rebound in European indicators and surprise to the upside. If so, we would not be surprised to see the Euro break higher towards 1.13

USD

Market moving data was scarce last week in the US, and the Dollar mostly reacted to headlines from the US-China trade conflict, as well as the increased tensions with Iran. The latter provided support for the greenback, which rose steadily all week against all major currencies, save the oil-dependent Russian Ruble.

This week is also short on key data, but the minutes from the last Federal Reserve meeting will be released on Wednesday. This should provide critical insight on whether market expectations that the next move in rates will be down are correct. We believe they are not.