Theresa May calls fresh Brexit vote as cross party talks continue

- Go back to blog home

- Latest

Financial markets began digesting last night’s news from Downing Street this morning that Theresa May was planning on holding another vote on her Brexit withdrawal agreement in the week beginning 3rd June.

Whether cross party talks between Labour and the Tories will have made adequate progress by then remains to be seen. Newsbites out of the discussions have not been all that positive, although talks will continue this week with May and Corbyn set to meet at 18:15 tonight.

Currency traders still remain pretty pessimistic over the prospects of an imminent deal, with Sterling continuing to languish around the 1.29 level against the US Dollar, its weakest position in almost three weeks. Yesterday’s soft UK labour report, which saw a relatively marked drop off in earnings growth, can also be attributed to much of the weakness in Sterling.

Euro falls as investors fret over US trade policy

The Euro sank briefly back below the 1.12 level against the US Dollar this morning following some mixed domestic data and concerns over trade policy.

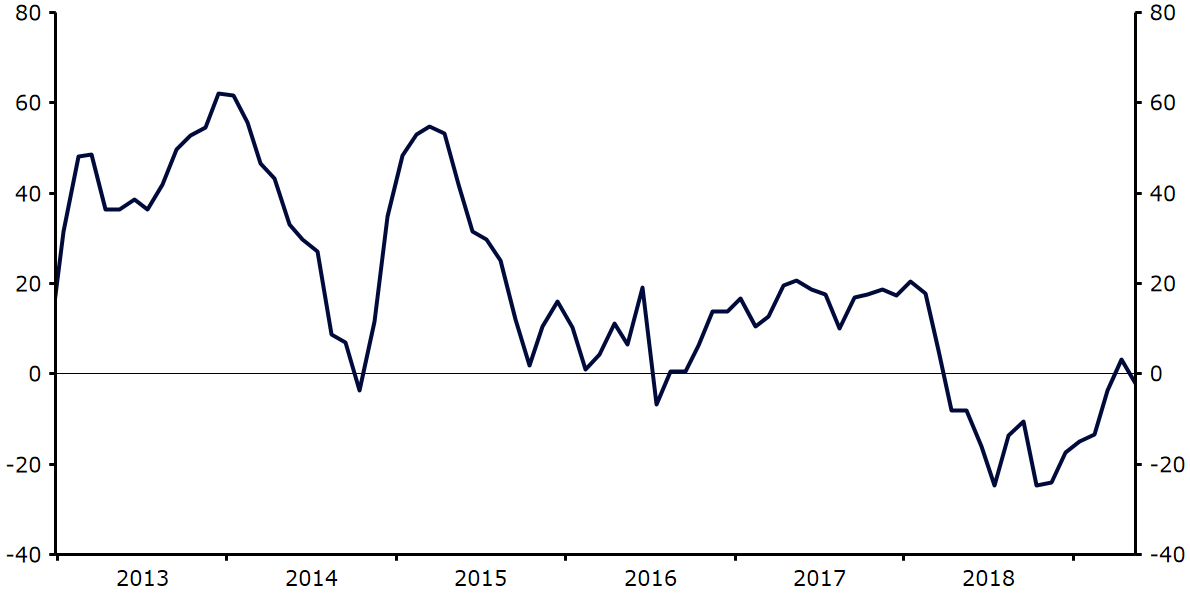

Donald Trump has stated that he will make a decision on European auto tariffs on 18th May. While we think that the actual implementation of taxes on Europe’s $50bn car industry this week is unlikely, the risk is high and investors are taking nothing for granted. Meanwhile, yesterday’s ZEW economic sentiment index for Germany far from helped the common currency, falling back into negative territory and in the process reigniting concerns over the health of Europe’s largest economy.

Figure 1: German ZEW Economic Sentiment Index (2013 – 2019)

The next big hurdle for EUR/USD will be this afternoon’s US retail sales report, one of the most important data releases on the economic calendar this week. We think that the bar is pretty low for an upside surprise, with the market currently only pencilling in a 0.2% month-on-month increase in the measure. Recent steady levels of jobs growth and high wages should be supportive of domestic demand in general and could lead to a stronger number than the market is currently pricing in.