ECB June Meeting Preview

- Go back to blog home

- Latest

ECB to maintain cautious stance amid growing external risks.

At the ECB’s April press conference, Draghi reiterated the dovish message from the March meeting, in which policymakers revised lower both growth and inflation forecasts, while announcing a new round of TLTRO. The TLTRO, known as Targeted Long Term Refinancing Operations, involves the ECB issuing long-term loans to banks and will run from September to March 2021. While the technical details of the programme have not yet been announced, we may hear more at the June meeting. The recent focus on the negative impact of ECB stimulus measures on European bank’s profitability suggest that the terms of the programme will be quite favourable.

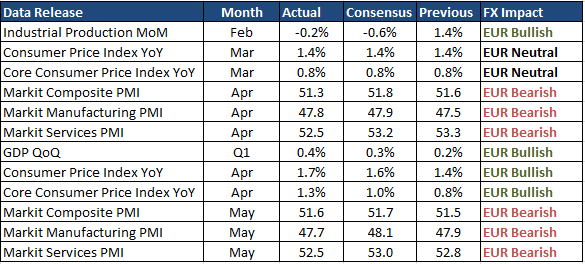

In April, President Draghi kept the door ajar to additional policy easing, should macroeconomic conditions take a turn for the worse. Economic data out of the Eurozone has been muddled since then (Figure 1). Inflation, which was described in the ECB’s April meeting accounts as ‘uncomfortably low’, has shown some encouraging signs of moving towards the bank’s ‘close to, but below’ 2% target. The vitally important core inflation measure finally broke out of its recent tight range in April, jumping back up to 1.3% from 0.8%, its joint highest level since late-2015. The May inflation numbers, set for release just two days before next week’s ECB meeting, will now be key and could have a significant bearing on the tone of the bank’s message.

Figure 1: Eurozone Key Macroeconomic Releases (since 10/04/2019)

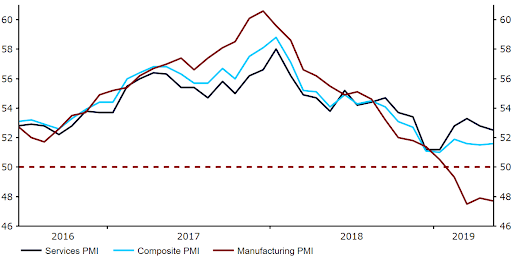

By contrast, the indicators of business activity have remained soft and well below the levels that the ECB would deem desirable. The composite PMI came in at a slightly worse-than-expected 51.6 in May (Figure 2), with manufacturing activity in contractionary territory in each of the past four months. That being said, we are beginning to see a dichotomy between the soft PMI data and the hard indicators of GDP and industrial production. It is worth noting that first quarter growth surprised to the upside, while the three-month moving average of MoM industrial output is currently at its highest level since December 2017. We certainly do not believe that the Eurozone is in any way heading for a recession.

Figure 2: Eurozone PMIs (2016 – 2019)

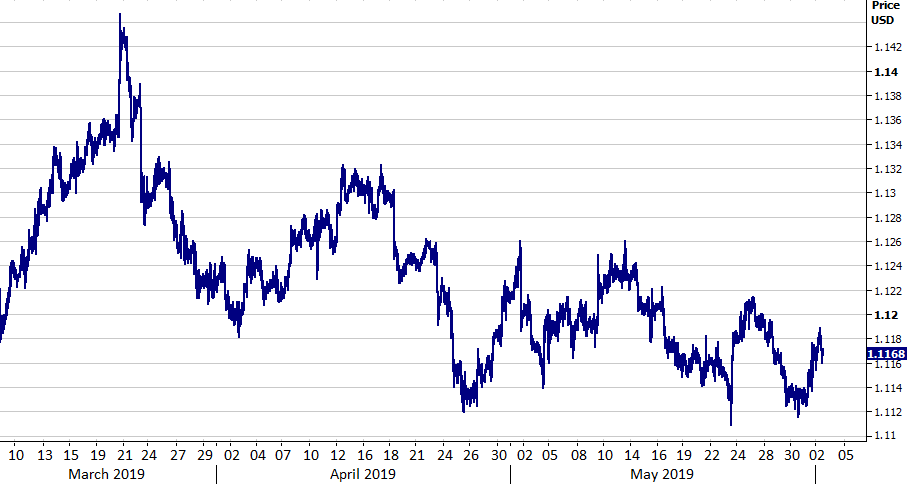

, External risks to the outlook for the Euro Area have intensified in recent weeks, which we think will keep pressure on the ECB to maintain its dovish stance. The US-China trade war has taken a turn for the worse in the past month and is already being reflected in weaker German sentiment indicators, unsurprising given the country’s heavy dependence on demand from China. There also appears to be no end to the Brexit saga in sight, with the heightened risk of a ‘no deal’ a potentially significant downside risk. The subsequent flight from risk can be attributed to much of the recent softness in EUR/USD (Figure 3), which is currently trading around its weakest position since mid-2017. The postponing of car tariffs from the US does, at least, provide some positive news.

Figure 3: EUR/USD (March ‘19 – June ’19)

, While the improvement in core inflation will be a source for optimism, uncertainty from abroad, namely concerns over how US-China trade relations could impact Germany’s fragile manufacturing sector, are likely to dominate the Governing Council’s discussions. We therefore expect Draghi to mostly stick to the script during his press conference, maintain a cautious tone and continue to reiterate that no rate hikes are on the cards during the remainder of 2019. We do not think there will be any change in forward guidance at this stage although, as we mentioned earlier, we are likely to get more details on the TLTRO programme. We think that additional policy tweaks, including the recently speculated tiering system on the bank’s deposit rate, is unlikely. There has been very little talk of tiered rates among ECB members since the April meeting.

Given the aforementioned, the Euro could be driven largely by the ECB’s updated growth and inflation forecasts. Any changes to the projections are likely to be very minor, although a more aggressive than expected upward revision to the inflation projections in light of recent data could help spark a recovery rally in the common currency.