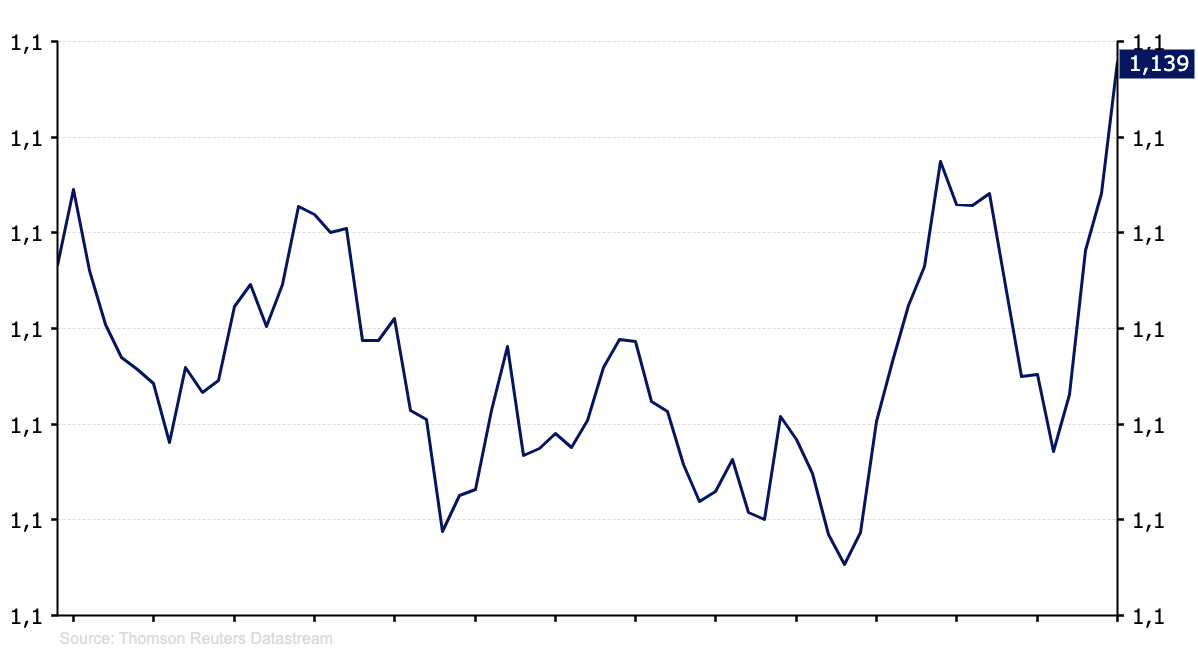

EUR/USD crosses 1.14 for the first time in three months

- Go back to blog home

- Latest

Following last week’s monetary policy revelations, the main pair continues crawling upwards.

Figure 1: EUR/USD (22/03/19 – 25/06/19)

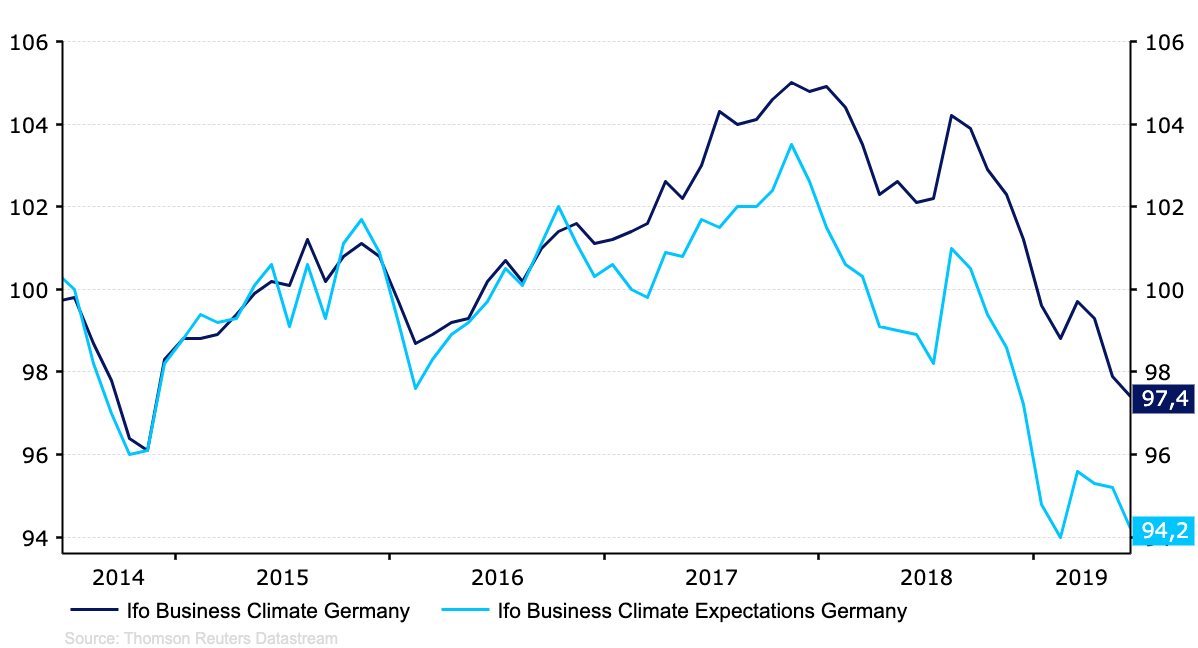

The recent strength of the common currency is not related to any improvements in the common bloc. On the contrary, yesterday’s Ifo data showed that the business sentiment in the Eurozone’s largest economy recently fell to the lowest level since November 2014 (Figure 2). However, because the decline in the main indicator was expected, it did not stop EUR/USD from advancing during the day.

Figure 2: Germany Ifo Business Climate Indicators (2014 – 2019)

,

Markets await Powell’s speech

Today will be quite light in terms of macroeconomic news. The calendar, however, is stuffed with speeches from Fed officials. The key would be the address from the central bank’s president, Jerome Powell, taking place near the end of today (5 pm GMT). His dovish rhetorics could strengthen the market’s view that the Fed is set to cut interest rates in July. It seems hard to imagine that the market could be more dovish towards the Dollar than it is now, fully pricing in the 25 bp cut during the central bank’s meeting in July, nonetheless, in terms of market expectations, there never is a set ceiling.

Considering that historically, on a few occasions, the Fed has started the easing cycle by cutting rates by 50 bp, it is possible (although not necessarily expect by us at this point) that it would deliver similar action now. Fed fund futures show that markets already think this scenario is reasonable, placing in nearly a 40% implied probability of a 50 bp cut in July.