US Dollar holds gains ahead of nonfarm payrolls report

- Go back to blog home

- Latest

The US Dollar firmed around its strongest position in two weeks against the Euro on Wednesday, with investors in a non-committal mode ahead of tomorrow’s all-important nonfarm payrolls report.

Last month’s payrolls report was uncharacteristically poor, so the bar for a rebound this month is pretty low. Yesterday’s ADP employment number was, however, slightly weaker-than-expected, while weaker consumer confidence and a rise in the four-week moving average jobless claim number do not bode all that well. Investors are eyeing a headline job creation number around the 165k mark and earnings growth of 0.3%.

Ahead of Friday’s report, volatility in the EUR/USD pair could be relatively low today with investors in the US away from their desks due to Independence Day.

Dire PMIs point to soft second quarter UK growth

Sterling held its own against the US Dollar on Thursday morning, despite another clear sign that uncertainty surrounding Brexit was having an impact of UK business activity.

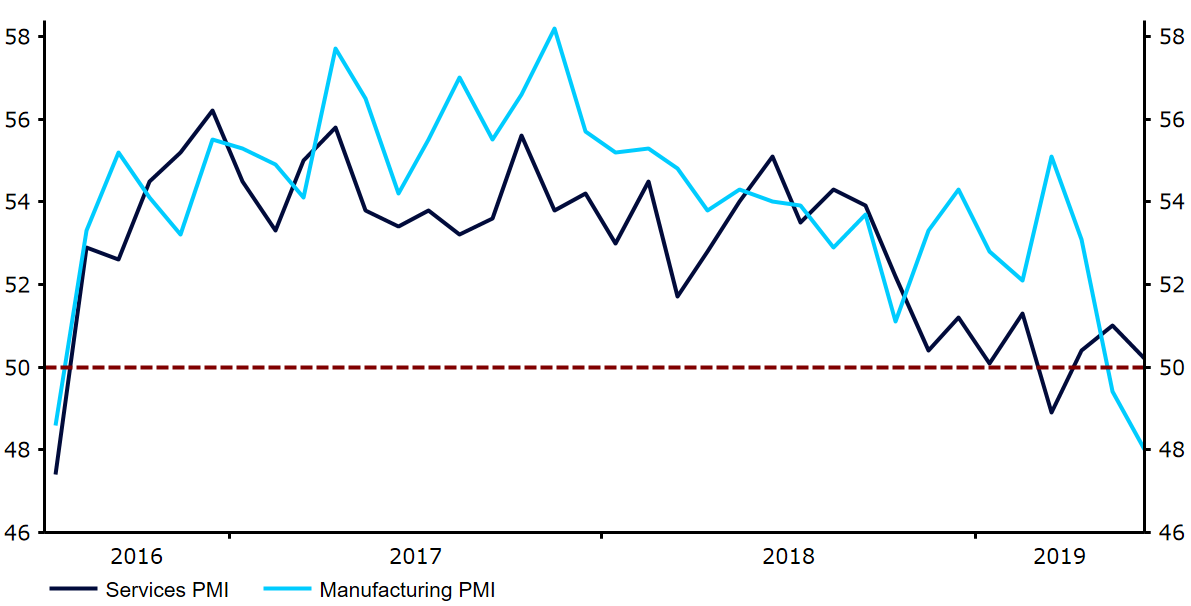

Following a dire set of manufacturing and construction activity data earlier in the week, yesterday’s services PMI also came in well short of expectations. The critical index is now hovering barely above the level of 50 that denotes expansion at 50.2 in June, its lowest level in three months and well below the 51.0 that investors had priced in. This would suggest that the UK economy recorded fairly negligible growth in the second quarter of 2019.

A combination of soft UK data and heightened expectations for a ‘no deal’ Brexit present a particularly unfavourable environment for the Pound, which is currently languishing around its weakest position in almost three weeks. The path of least resistance for now is lower and we’re unlikely to see Sterling post any meaningful gains until after the race for the next PM is decided in the third week of the month.

Figure 1: UK PMIs (2016 – 2019)

Elsewhere in the markets, updated PMIs out of the Eurozone this morning were somewhat better-than-expected, although remained pretty soft and had little impact on the currency market. Despite the rather aggressive pace of Fed rate cuts currently priced in by the market, EUR/USD has been pinned below the 1.13 mark in the past few sessions. The nomination of Christine Lagarde as the next President of the ECB is largely to blame, with the existing IMF Director perceived as a policy dove that could favour prolonged policy accommodation in the Eurozone.