Pound tanks towards post-Brexit lows on ‘no deal’ concerns

- Go back to blog home

- Latest

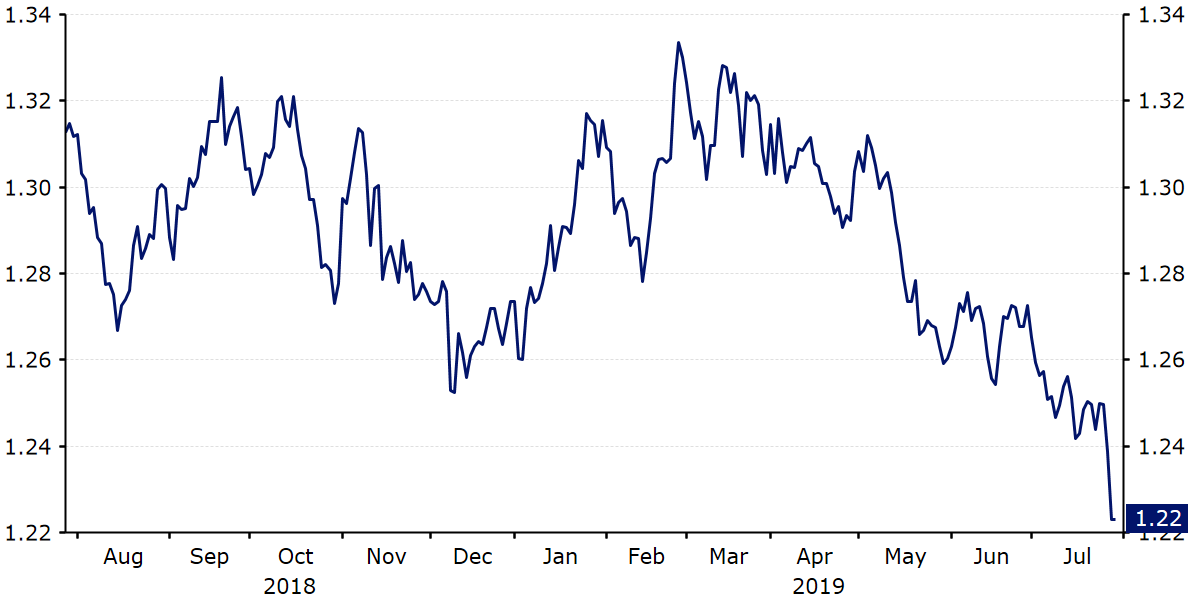

The Pound nosedived to its lowest level against the US Dollar in over two years this morning, while free-falling below the 1.09 level versus the Euro, amid increased concerns that a Boris Johnson-led Tory party could be sending the UK towards a ‘no deal’ Brexit come the end of October.

Sterling was sent crashing around 1.25% lower on the greenback on Monday and another half a percent this morning, with political uncertainty causing investors to steer well clear of the UK currency.

Figure 1: GBP/USD (2018 – 2019)

, Since taking office, Johnson has reiterated his staunch stance that the UK will leave the European Union come what may on 31st October, stating that a ‘no deal’ is ‘now a very real prospect’. This follows comments on Sunday from fellow Tory member Michael Gove who stated that the UK government were now working on the assumption that the UK would leave without a deal in place. Gove will be chairing the first ‘no deal’ cabinet meeting later today.

We reiterate that the path of least resistance for Sterling is undoubtedly lower in the coming weeks. With Brexit uncertainty showing no signs of abating, the possibility of a general election growing and with recent economic data ramping up expectations for Bank of England policy easing, there appears to be little standing in the way of Sterling breaching its post-Brexit lows just above the 1.20 mark.

Federal Reserve set for first rate cut in a decade

One potential saving grace for the Pound could be tomorrow’s Federal Reserve meeting. Amid increased US-China trade tensions and underwhelming macroeconomic data globally, the Fed is overwhelmingly expected to lower rates by 25 basis points when they meet on Wednesday.

With a cut fully priced in by the markets, the key to the reaction in the US Dollar will be the tone of communications regarding future cuts and the FOMC’s update ‘dot plot’, which shows where each member of the committee expects rates to be at the end of each year. Our base case is for the Fed to cut rates, but state that future rate reductions are dependent on upcoming economic data, rather than a foregone conclusion. This could provide some room for a modest rally in the dollar against its major peers.

While we think there is a very small chance of a 50 basis point rate cut tomorrow, we acknowledge there is a risk that the Fed strikes a more-dovish-than-expected tone that paves the way for additional easing during the remainder of 2019. Confirmation of such a dovish turn would likely weigh on the US currency, even given the already sky-high market expectations. Financial markets are currently pricing in a total of three rate cuts in the second half of this year, a slight overreaction in our view.