Sterling slides to more than 2 year low on Brexit fears

- Go back to blog home

- Latest

Uncertainty surrounding the Brexit process has continued to dominate trading in the UK so far this week.

With that in mind, investors are growing increasingly fearful that the only end to the impasse could be via a ‘no deal’ Brexit. While many analysts have raised their expected probability of a ‘no deal’ in the past few days (Deutsche Bank now put the odds at 50%), betting markets are holding firm and continue to show around a one in three implied probability of such an outcome.

Governor of the Bank of England Mark Carney is due to speak at midday today. Yet, with attention firmly on Brexit, investors will be awaiting the announcement of the new PM, expected next week. Johnson remains the clear front runner and it would now take something fairly extraordinary for him to not be named the next Tory leader.

Common currency falls on ECB easing bets

The Euro continued to lose ground throughout London trading on Tuesday, briefly sliding below the 1.12 level against the US Dollar this morning.

The main rationale behind the weakness in the common currency so far this week has been continued bets that the European Central Bank would ease policy at an upcoming meeting in order to support the Eurozone economy. Data out of the bloc has continued to disappoint in recent weeks, with ECB President Draghi suggesting last month that this could encourage the bank to lower rates or restart its QE programme. This is bringing next week’s Governing Council meeting into sharp focus. While we think that it is too early for the ECB to begin altering its policy, we think that there is a decent chance they could at the very least hint that looser policy is possible later in the year should economic conditions worsen.

Solid US retail sales data buoy the greenback

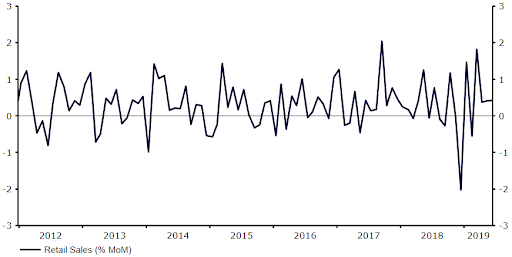

Meanwhile, the US Dollar continues to be well supported by some strong domestic data. Retail sales data out yesterday continued to point to robust levels of consumer activity in the world’s largest economy. Sales increased by a better-than-expected 0.4% in June after investors had eyed a slowdown to 0.1% (Figure 1).

Figure 1: US Retail Sales (2012 – 2019)

Macroeconomic news is relatively light in the US today, although second-tier housing data may receive some attention when released just after midday UK time.