Strong UK retail sales data boosts Sterling

- Go back to blog home

- Latest

A bumper set of UK retail sales data helped propel the Pound back towards the 1.25 mark against the US Dollar on Thursday morning.

Sales jumped by 3.8% year-on-year in June and by 1% on a month previous, well above the 2.6% and -0.3% priced in. This much better-than-expected news suggests that the UK economy may have posted positive growth in the second quarter after all. At its latest meeting, the Bank of England stated that it expected the UK economy to post flat growth in the three months to June.

Euro edges higher after inflation beats expectations

The Euro edged modestly higher versus the US Dollar this morning, with a decline in US treasury yields largely to blame.

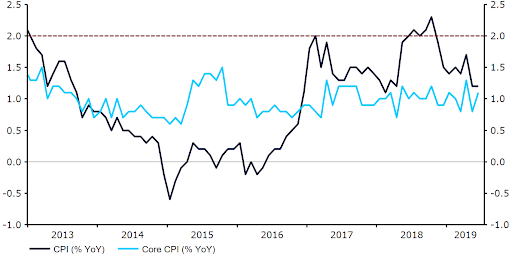

Investors also reacted in an optimistic fashion to Wednesday morning’s inflation numbers, which showed that consumer price growth increased by 1.3% in June, better than economists had anticipated. That being said, this still remains well short of target and is unlikely to give the European Central Bank any incentive to change its downbeat tone over inflation in upcoming communications.

Figure 1: Eurozone Inflation Rate (2013 – 2019)

With no Eurozone data out today, the common currency is likely to be driven by events elsewhere.

Dire US housing data weighs on Dollar

The recent rally in the Dollar against its major peers eased on Wednesday, with some weak US housing data weighing on the greenback and dragging bond yields lower. US housing permits were particularly worrisome, sliding by a massive 6.1% to their lowest level in two years. The US housing market remains one of the weak spots in the world’s largest economy, having had a negative contribution to overall growth in five straight quarters.

With no data other than jobless claims set for release today, investors will likely focus on a couple of speeches from central bank members Bostic and Williams this afternoon. The market will be looking for whether either member comments on the need for multiple interest rate cuts from the central bank during the course of the rest of the year.