US dollar firms on impressive retail sales numbers

- Go back to blog home

- Latest

A strong set of US retail sales data helped the dollar rally against its major peers yesterday afternoon, while calming concerns over the possibility of a prolonged slowdown in the world’s largest economy.

Despite the encouraging data, expectations for Federal Reserve easing at their next meeting in September remain sky-high, with the US-China trade dispute looking no closer to resolution. Both parties have made it clear that the recent tariff delay on some Chinese goods does not represent improved relations. Chinese authorities also claimed yesterday that retaliatory measures were being put in place against the US after Trump broke the tariff ceasefire earlier this month.

All in all, investors remain in a cautious mood as trade uncertainty rumbles on and are continuing to favour the safe-haven Japanese yen and Swiss franc over all else. With European markets closed on Thursday, activity in the bloc in the past few days has been light. That is likely to remain the case today, with EUR/USD likely to be driven largely by this afternoon’s US housing data.

Impressive macroeconomic news buoys Sterling

The pound had a very good London trading session yesterday, rallying by over half a percent against a broadly stronger dollar. The GBP/USD cross is now trading back above the 1.21 mark this morning, having spent much of the past week below it.

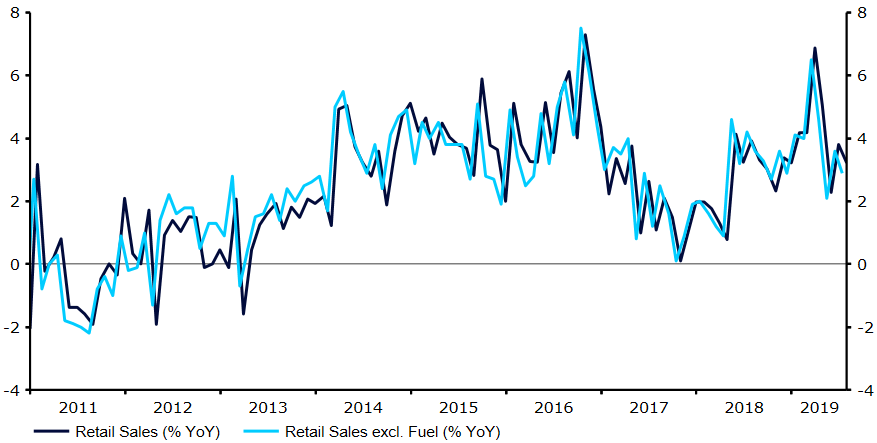

Much of the strength in Sterling yesterday was due to another encouraging set of macroeconomic data that suggests the UK economy may not be struggling as much as last week’s fairly dire second quarter GDP numbers would suggest. UK retail sales added to impressive earnings and inflation data from earlier in the week in beating expectations, coming in at 3.3% year-on-year in July (Figure 1). While a slight slowdown on a month previous, this remains at a very healthy level and above the 2.6% that investors had pencilled in.

Figure 1: UK Retail Sales (2011 – 2019)

The aforementioned data suggests that the UK economy is performing much better than almost anyone had expected in the face of a potential ‘no deal’ Brexit. Yet, with expectations for a ‘no deal’ seemingly on the rise day by day, the pound continues to underperform and is likely to continue to do so until we get more concrete positive news on the Brexit front.