RBNZ shocks market with 50 basis point interest rate cut

- Go back to blog home

- Latest

Financial markets were rattled again on Wednesday after the Reserve Bank of New Zealand shocked investors with a much greater-than-expected interest rate reduction.

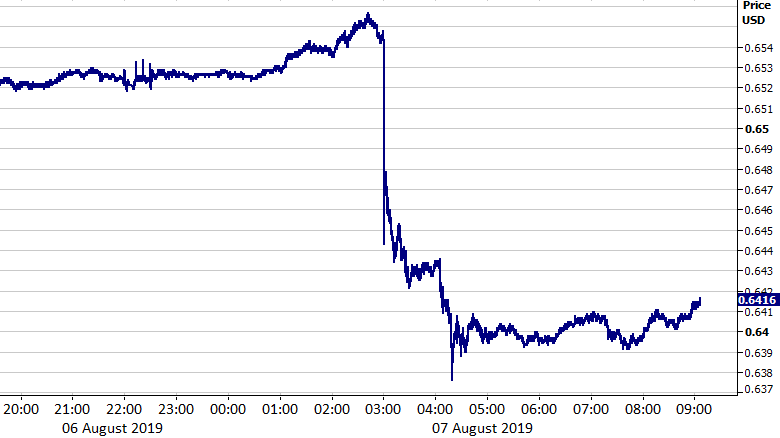

The aforementioned actions from the RBNZ are the most drastic measures we’ve seen thus far from a major G10 central bank, almost all of which have becoming increasingly dovish following the escalation of the US-China trade conflict. Unsurprisingly, the New Zealand dollar sank hard on the news, falling by around 2% in the immediate aftermath of the decision, its biggest one-day drop in two years.

Figure 1: NZD/USD (06/08/19 – 07/08/19)

It is becoming overwhelmingly evident that central banks in the G10 are genuinely concerned about the potential negative impact global trade tensions could have on their respective economies. The move to a more accommodative policy from these banks provides further weight to our call that emerging market currencies are due a rebound during the remainder of 2019. The RBA, RBNZ and Federal Reserve have all already cut rates this year, with the ECB now firmly expected to follow suit in September.

EUR/USD steady, US labour data beats expectations

Despite the surprise news out of New Zealand, and the flock to the safe-haven Japanese yen that followed, EUR/USD was actually little moved and has spent much of the past 24 hours in a holding pattern. The past few days have been typical August trading as far as the main pair is concerned, with little macroeconomic data to report whatsoever out of the Eurozone.

In the US, yesterday’s JOLTs job openings data was pretty encouraging, further supporting our call that the strong state of the US labour market does not warrant an aggressive pace of Fed easing. A stronger-than-expected 7.35 million positions were waiting to be filled in the US in June, with quit rates holding steady around a decade high 2.3%.

Investors ramp up GBP/EUR parity bets

Sterling was similarly range bound against the US dollar yesterday, with no economic or Brexit news for investors to digest.

It is perhaps worth noting that some bookmakers are, as of this week, now placing a 50% chance of GBP/EUR hitting parity before the end of the year, an eventuality we think is only remotely plausible under a ‘no deal’ scenario. Talk has shifted to the possibility of a general election in order to force Brexit over the line. Yet, with time running out, it has been reported that the earliest a general election can now be held is 31st October, better known as Brexit date, baring the formation of a temporary government.