Bleak Eurozone data sinks euro

- Go back to blog home

- Latest

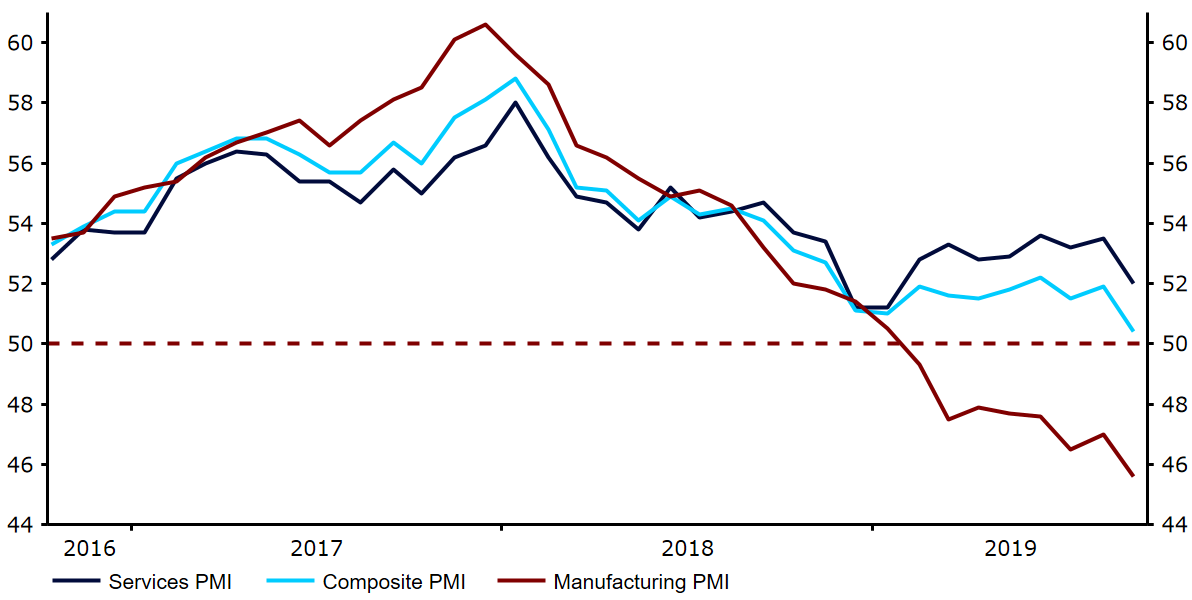

Last week started on a bad note for the euro, as the flash PMIs of business activity out on Monday came in worse-than-expected and provided further evidence that Germany may be entering recession.

The spotlight in the foreign exchange market this week is back on data releases. The key ones will be flash inflation data for the Eurozone on Tuesday and the US payrolls report on Friday. We will, however, also be paying close attention to political developments around possible German fiscal stimulus and, as always, the EU/UK Brexit talks.

GBP

Sterling reacted badly last week to further signs that British politics is becoming chaotic ahead of the 31st October Brexit deadline. The Supreme Court dealt Prime Minister Johnson a serious blow, ruling that his suspension of Parliament was illegal.

While the immediate prospect for a no-deal Brexit have receded further, there are increasing signs that the uncertainty is starting to take its toll on the British economy. This week’s business activity PMIs should confirm this trend.

EUR

Last week’s key Eurozone PMIs for the month of September painted a bleak picture. The manufacturing recession intensified, and while services are still expanding, the numbers are overall consistent with a stalling economy.

Figure 1: Eurozone PMIs (2014 – 2019)

With the economy growing modestly at best and inflation nowhere near the upward trend that the ECB wishes to see, the stimulus measures announced this month appear to be fully justified. Calls for fiscal stimulus in the core countries, particularly Germany, are going to get louder.

USD

As Congress moves toward a Trump impeachment, financial markets appeared to completely ignore political developments. Instead, the focus is on the decent newsflow coming from the US economy.

Buoyed by low rates, massive deficit spending and a solid job market, expectations for a downturn have come to nothing. We expect to see further confirmation of this optimistic view in Friday’s payrolls report, where we expect to see yet another upward surprise in wages.