Why did the dollar rally after the Fed cut interest rates?

- Go back to blog home

- Latest

The Federal Reserve cut interest rates in the US for the second time in consecutive meetings on Wednesday, although struck an unexpectedly hawkish tone that suggests it may be done with easing policy, for now.

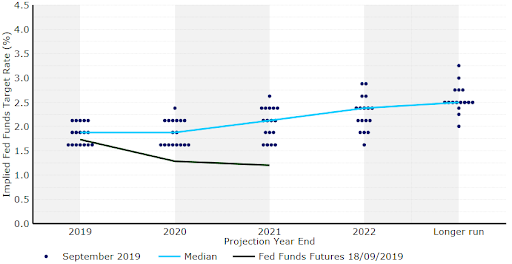

The Fed’s ‘dot plot’ showed that the FOMC is divided regarding the need for additional action. While the median dot for 2019 signalled no additional rate cuts this year, seven of the seventeen members on the FOMC’s board indicated their view that another rate reduction was needed in 2019. Five members indicated that a higher Fed funds rate would be appropriate this year, although we think this merely represents the degree of opposition to Wednesday’s rate cut rather than support for hikes.

Figure 1: FOMC September 2019 ‘Dot Plot’

During Powell’s press conference, he stated that the Fed was not on a preset course and would be highly data-dependent, deciding on the need for action on a meeting-by-meeting basis. He did state that ‘more extensive cuts may be needed’ down the road, although this would only be warranted if the economy takes a turn for the worse. We see this as an indication that the Fed is done with cutting interest rates, for now, absent a crisis or US recession. Given that we see little chance of this materialising any time soon, we think that the Fed is now more likely than not to keep interest rates unchanged during the remainder of 2019.

The lack of commitment to additional rate cuts from the Fed was reflected in a small way in the US dollar, which rallied by a modest one-third of a percent against the euro before given up its gains on Thursday morning. The lack of a more meaningful and sustained rally in the currency can be attributed to the divided nature of the FOMC’s rate projections.

Bank of England set to keep rates unchanged

The major central bank announcements continue to come thick and fast this week, with the Bank of England set to announce its latest policy decision this afternoon.

As it has done at every meeting in the past few months, we think that the BoE will once again reiterate it is keeping policy unchanged until it gets a clearer indication as to the outcome of Brexit. During his most recent press conference, Carney warned that the chances of a ‘no deal’ Brexit had increased and uncertainty from abroad could have a larger-than-expected impact on the UK economy. While Carney will not be delivering a press conference at this month’s meeting, investors will still be paying close attention to the bank’s meeting minutes for any indication that policymakers view these risks as growing.

In all likelihood, today’s BoE announcement could be largely a non-event for sterling, which has remained buoyed just shy of the 1.25 mark amid growing bets against a ‘no deal’. The UK currency largely brushed aside yesterday’s soft inflation numbers, which showed that consumer prices grew by just 1.7% in August versus July’s 2.1%.