BoE holds rates: the unreliable boyfriend strikes again

- Go back to blog home

- Latest

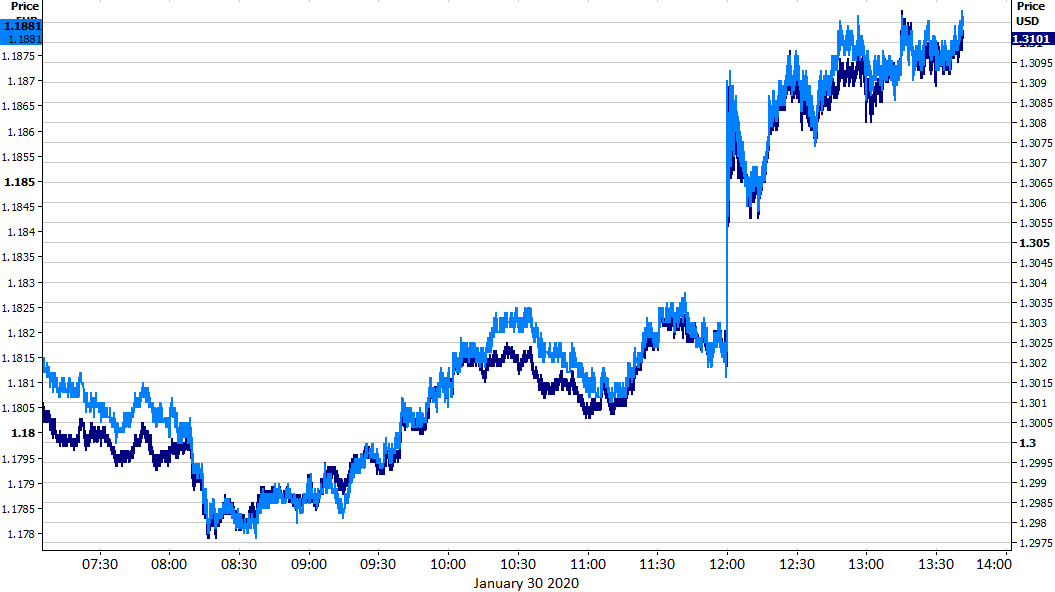

The pound leapt around half a percent higher against the US dollar on Thursday after the Bank of England voted to keep interest rates unchanged in Mark Carney’s final meeting as governor of the central bank.

Figure 1: GBP/USD & GBP/EUR (30/01/20)

, After a raft of fairly underwhelming macroeconomic data releases and some dovish comments from a handful of MPC members, including Carney himself, money markets had suggested that today’s rate decision was too close to call. In the end, the vote on rates remained split 7-2 in favour of no change, as it was at the previous meeting in December. Messrs Saunders and Haskel were once again the only two members of the committee that voted for an immediate cut, surprising the market that had expected at least one other rate-setter to follow suit.

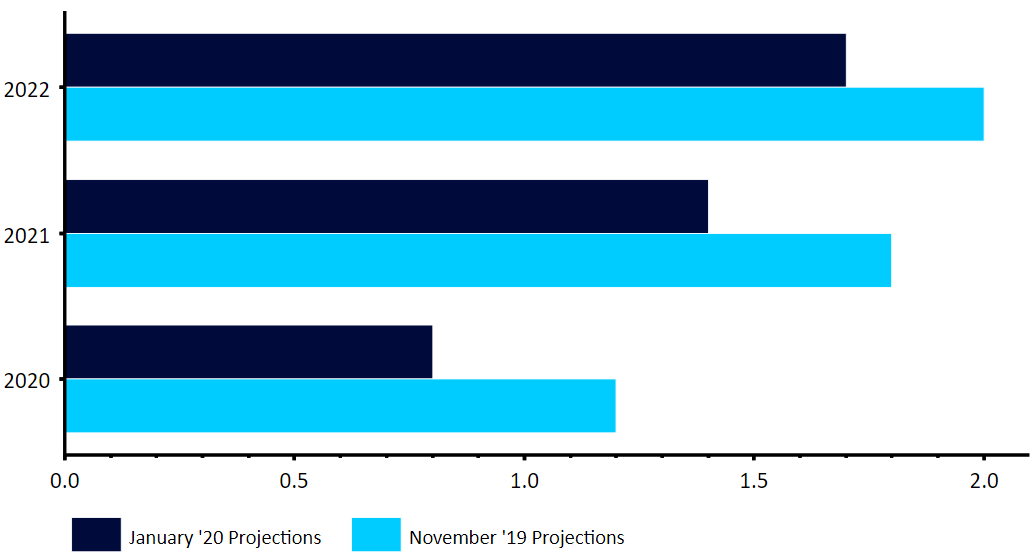

Carney, who has been perhaps slightly unfairly labelled as the ‘unreliable boyfriend’ during his time at the central bank due to his sometimes dubious forward guidance, struck a mostly upbeat tone during his press conference. UK economic activity data had picked up ‘sharply’ according to the governor, and that recoveries in both growth and inflation data had been ‘encouraging’. He did strike a note of caution regarding the recent stabilisation in global growth, explicitly mentioning the potential downside risk posed by the recent coronavirus outbreak. Growth forecasts for the next three years were also lowered, with expansion in 2020 projected to come in at 0.8% versus November’s 1.2% projection (Figure 2). That being said, Carney did state that ‘some modest tightening may be needed’ should the economy recover as forecast.

Figure 2: BoE GDP Growth Forecasts [January 2020]

, Sterling reacted in a fashion that one would expect, rising approximately 0.5% against both the dollar and the euro in the immediate aftermath of the rate decision. In our view, the main rationale behind the fairly limited nature of the upward move is that investors had already begun dialling back expectations for a cut in the last few days, with market pricing for a cut down to below 50% prior to the meeting from closer to 70%.

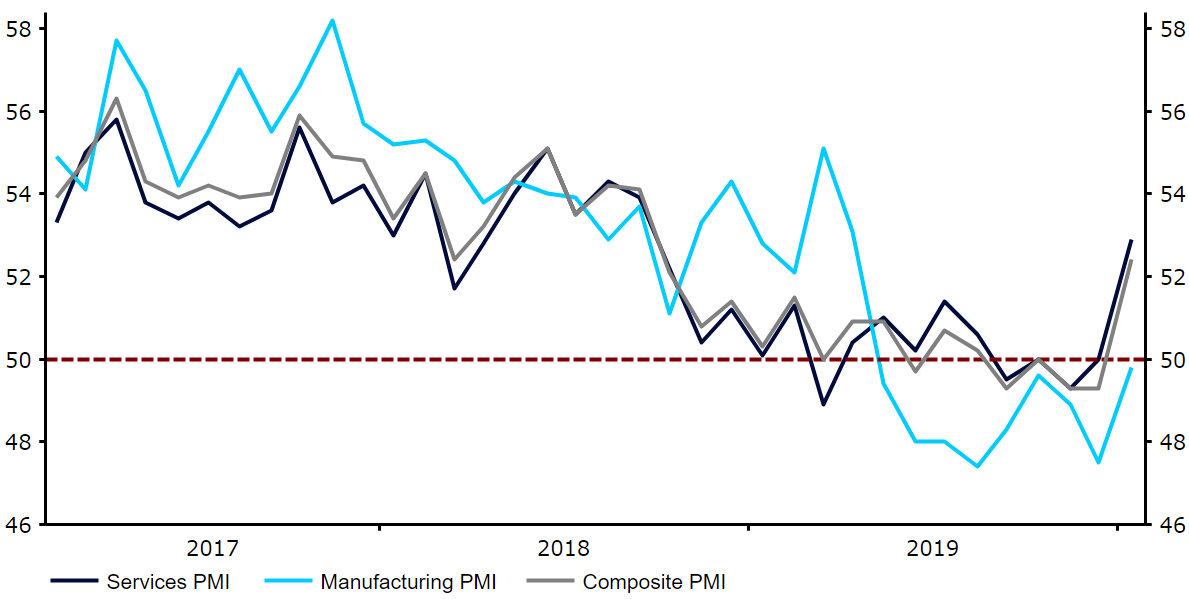

We had said prior to today’s meeting that we thought the bank would hold off from cutting interest rates this time around. Our main rationale was the sharp move higher witnessed in the January PMI data (Figure 3), which reflected the first full month of data since the removal of the short-term ‘no deal’ Brexit uncertainty.

Figure 3: UK PMIs (2017 – 2020)

, As we mentioned in our Bank of England preview report, we think that the ship may now have sailed for the bank to deliver a Federal Reserve-like ‘insurance cut’ to protect the UK economy. Now that the uncertainty surrounding Brexit is out of the way, there is a general consensus among economists that domestic economic data is more likely than not to improve in the coming months – we have already seen signs of said rebound in the key business activity PMIs. Should this uptrend in data continue, we believe that the macroeconomic fundamentals would simply not warrant lower rates. Futures markets seem to be in agreement and are now, in fact, pricing very little chance of a rate cut at the bank’s March meeting, Andrew Bailey’s first as the new governor.