Dollar gains on better-than-expected US retail sales

- Go back to blog home

- Latest

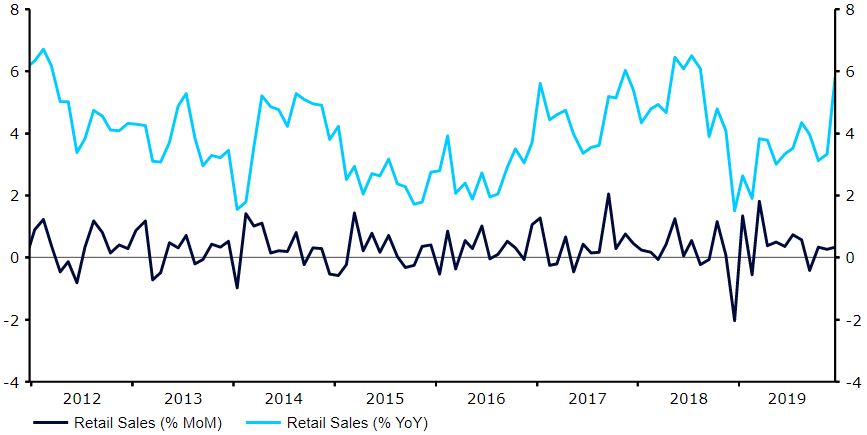

US equity markets rose, while the dollar rallied to its strongest position against the safe-haven Japanese yen in eight months after yesterday afternoon’s strong US retail sales report.

Figure 1: US Retail Sales (2012 – 2019)

Estimates now point to overall growth of around 2.5% annualised in Q4 – a pretty healthy level by all accounts. The positive headlines we received out of the US-China trade war in the past few months will no doubt continue to support US growth as we enter into 2020. A number of Federal Reserve members seemed to be in agreement during various public appearances yesterday, with members Kaplan, Kashkari and Bowman all noting a positive outlook over the US economy, particularly the labour market.

Friday is actually a pretty busy one across the pond, with a number of economic releases on the docket. We will be paying close attention to the latest industrial production numbers for December. JOLTs job openings and housing data could also shift the greenback.

Sterling on course for fourth straight session of gains

Sterling has proved very resilient in the past few days to the growing bets in favour of Bank of England easing. The UK currency is on course for its fourth straight day of gains against the dollar, having risen by around 1% since Tuesday. There has been no real catalyst for the move, other than investors perhaps taking the view that the market implied probability for a January BoE cut is currently too high, at present a little over 50%.

We think that this morning’s retail sales figures will take on added importance given recent Bank of England comments. The consensus among economists’ is for a pretty strong reading for December, so there is some room for a downside surprise. Should the data come in less-than-expected, we may see a bit of a sell-off in sterling as investors begin to ramp up expectations for an imminent rate cut from the Bank of England.

ECB strikes upbeat tone in December accounts

The euro fell against a broadly stronger dollar on Thursday, with investors paying more attention to the data out of the US than yesterday’s ECB meeting accounts.

The accounts struck an upbeat tone, in line with comments from President Lagarde at the December meeting. Policymakers noted that political risk was receding and that inflationary pressures may be building. The minutes also stated that ‘incoming data since the last monetary policy meeting pointed to continued weak but stabilising euro area growth dynamics’. All in all, this reinforces our view that policy is more likely than not to remain unchanged in the Euro Area in 2020.

Next up will be this morning’s revised inflation numbers for December.