How did Powell’s testimony impact the FX market?

- Go back to blog home

- Latest

The US dollar rallied against its major peers on Tuesday, although quickly gave up all of its gains, following some upbeat comments on the US economy from FOMC Chair Jerome Powell.

One of the key questions on investors’ minds going into the testimony was Powell’s view on the impact of coronavirus on both the global and US economy. While he did note the risks posed by the virus, saying that the Fed would be ‘closely monitoring’ its impact on China, he seemed mostly unconcerned, seemingly suggesting that it would have little impact on US monetary policy.

We think that Powell’s comments reinforce our view that rates in the US are unlikely to be changed at all in 2020. Powell implied as much by stated ‘as long as incoming information about the economy remains broadly consistent with this outlook, the current stance of monetary policy will likely remain appropriate’.

Pound rallies on UK growth optimism

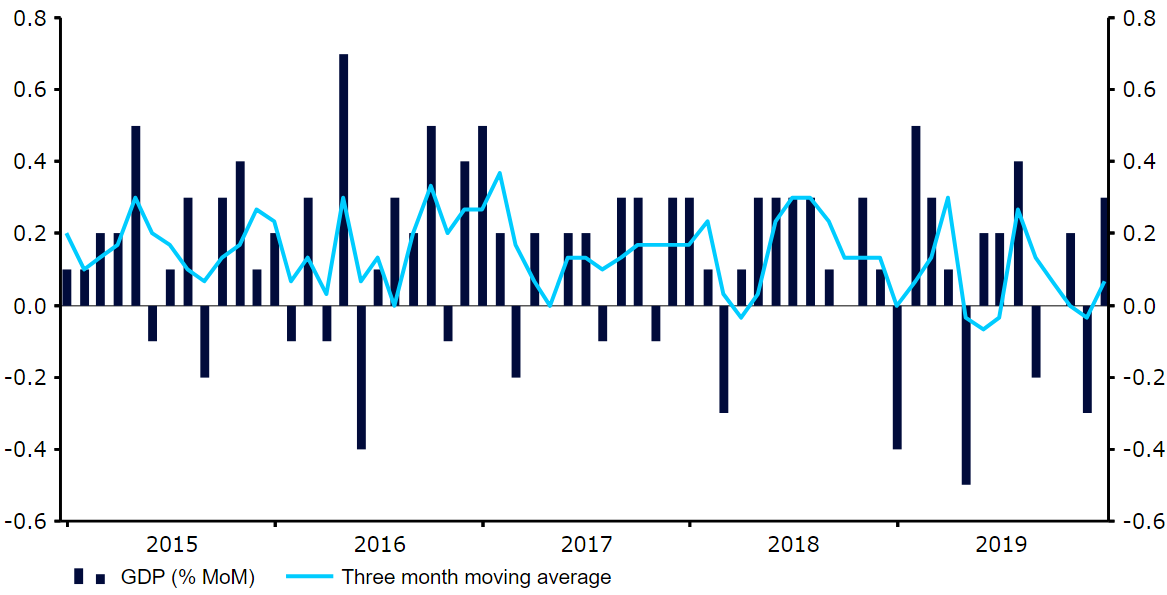

Sterling appeared unfazed by Powell’s optimism, rising by around half a percent versus the dollar during London trading yesterday. Investors took an optimistic view of the fourth quarter growth data. While growth came in flat quarter-on-quarter, traders were hopeful that the solid December number (Figure 1) can be viewed as a precursor to a post-election bounce in UK economic activity.

Figure 1: UK GDP Growth Rate (MoM) (2015 – 2019)

We now don’t have too long to wait before the January retail sales numbers (20th February), which could go a long way to either proving or disproving the hypothesis that the removal of the short-term ‘no deal’ uncertainty will filter its way through to an improvement in domestic growth data.

Risk assets rally as coronavirus said to be over by April

Risk assets such as the pound, and indeed the euro, have also continued to be well supported by easing fears surrounding the coronavirus outbreak in China. While the total death toll has now topped 1,000 (1,115 at the time of writing to be exact), there is a general sense of relief that the deadly virus has not spread aggressively across the globe.

As you can now read in our special report on how the coronavirus has impacted the FX market, the number of new cases in China, particularly in the Hubei provide, appears to be easing. The recovery rate is also rising fast and at a pace that far outstrips the death toll. The ratio of those fully recovered to deceased now stands at approximately 4.33:1, having been less than 1:1 at a matter of a couple of weeks ago. According to experts in China, the outbreak may be over by April, which is a highly encouraging sign.