50 basis point hike likely, but a very close call

( 3 min )

- Go back to blog home

- Latest

The Bank of England is certain to raise interest rates again at its delayed September meeting on Thursday, although the magnitude of the hike (50 vs. 75 basis points) is more of an open question.

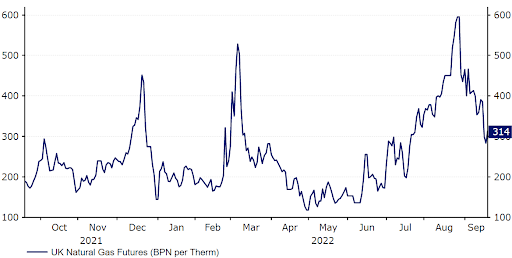

Figure 1: UK Natural Gas Prices (2021 – 2022)

Source: Refinitv Datastream Date: 21/09/2022

Arguably the most significant development has, however, been the announcement from new Prime Minister Liz Truss that the UK government will be freezing energy bills at £2,500 for the average household from 1st October. We contest that the impact of the £100 billion fiscal package on interest rates is not necessarily as clear cut as one would expect. In the near-term, the energy bill freeze will limit upside pressure on prices, and there is even an argument that inflation may have already peaked. At the very least, it is likely that prices will not rise at anywhere near the rate that had been previously feared, which in itself would warrant a less aggressive pace of policy tightening. The MPC had as recently as last month indicated that it thought UK inflation could rise above 13% in October.

The issue for the Bank of England is that larger fiscal spending means higher disposable incomes, greater consumer spending and the lower risk of a prolonged recession. Ultimately, the latter is clearly a desirable outcome, though MPC members have recently voiced their opinion that a period of economic contraction is likely to be needed in order to bring down prices in a sustainable manner. Speaking during the House of Commons Treasury select committee earlier this month, Bank of England policymakers, including governor Bailey, reiterated the need for additional rate increases. According to chief economist Pill, the freezing of energy bills would ‘probably lead to slightly stronger inflation’ and that the short term implication on inflation ‘may not be the most important thing’ for monetary policy.

We think that the decision on interest rates this week is, therefore, likely to be a closer call than perhaps some investors are anticipating. On the one hand, the government’s fiscal package means that near-term inflation will be lower. In our view, this lessens the chance of a 75bp hike at this Thursday’s meeting.

That said, higher fiscal spending means that medium-term price pressures may be higher, and the risk of recession lower. This may well trigger at least one or two of the more hawkish members (Mann, Haskel and Ramsden being the likely candidates) to vote in favour of an immediate 75bp move. As always, the nature of the voting pattern will be key to the market reaction, with a more even split between a 50bp and 75bp hike to be perceived as bullish for sterling. There will be no economic projections or press conference this week, so the vote split will likely take on added importance.

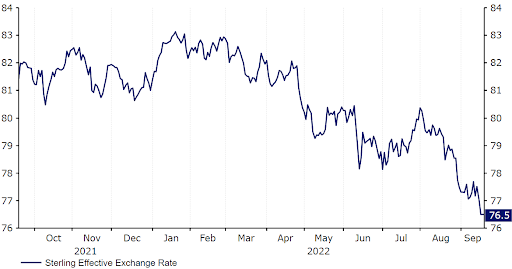

With regards to future policy moves, we once again believe that the MPC will opt against providing any clear forward guidance, instead taking a data dependent, meeting-by-meeting approach, in line with both the Fed and ECB. That said, we expect the BoE’s communications to remain hawkish. We think that the line in the statement that the bank intends to ‘act forcefully’ to stem inflation will be kept in the communications, thus leaving the door open to additional 50 basis point hikes at the November and December meetings. The hawks within the committee may also voice concerns about the recent sell-off in sterling (down approximately 5% in trade-weighted terms since 1st August). In itself, this is inflationary, though we think that it is likely to have little material impact on prices in reality.

On balance, we think that the Bank of England will raise interest rates by 50 basis points on Thursday, partly given both weaker near-term inflationary pressures and the MPC’s recent track record of surprising to the dovish side. At the time of writing, financial markets are pricing in around 68 basis points of hikes, so a 50bp move would be seen as dovish. In the event of such a move, we think that the reaction in the pound may, however, be guided by the voting pattern among MPC members. A close vote, with a handful of dissenters in favour of a 75bp hike, could be enough to support the pound towards the end of the week.

Figure 2: Sterling Trade-Weighted Index (2021 – 2022)

Source: Refinitv Datastream Date: 21/09/2022

Should the MPC also indicate a lower risk of recession since its last meeting in August, then GBP could rally. Even prior to the energy bill freeze, we thought that the bank’s August GDP projections were overly pessimistic. In our view, the doom and gloom scenario of a larger than 2% contraction in activity through year-end 2023 is now likely to be avoided, which should be a sterling positive. We also don’t rule out the possibility of a surprise 75 basis point hike this week. This would send a clear message to the market that the bank remains committed to preventing a prolonged overshoot in UK inflation, and would trigger an immediate knee-jerk rally in sterling.

The Bank of England’s policy decision, monetary policy summary and meeting minutes will be announced at 12pm BST (1pm CET) on Thursday.