All eyes on central bankers as Fed, ECB meet

( 3 min read )

- Go back to blog home

- Latest

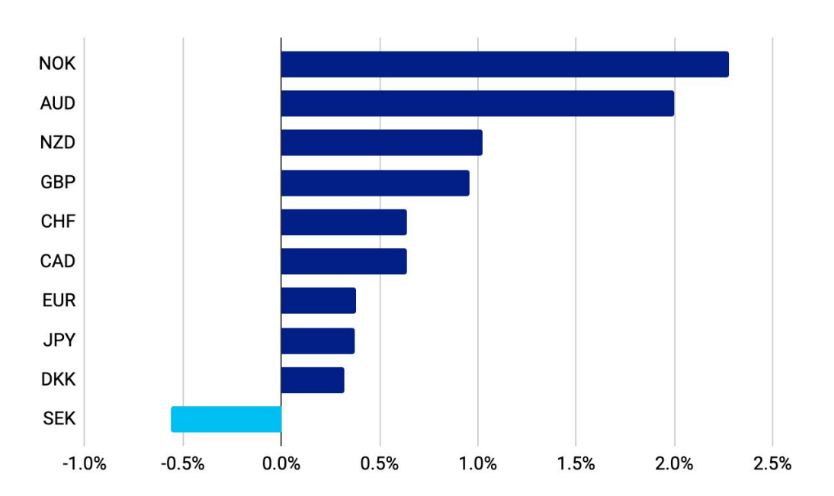

The dollar struggled in lackluster trading last week, as the rebound in commodity prices and improving investor sentiment meant the main 2023 trends continue to drive markets: a soft dollar, and a particularly strong showing by commodity currencies.

After a news-light week, markets are bracing for the Federal Reserve and European Central Bank meetings. Markets are pricing in a one-third chance of a hike from the Fed Wednesday. However, the release of the critical inflation report for May the day before means that some FOMC members likely will not decide their vote until the day of the meeting. The ECB decision is an easier call, with markets and strategists universally expecting a 25 bp hike; the key there will be the new staff forecasts and the hawkishness of the communications. Expect plenty of volatility.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Bloomberg Date: 12/06/2023

GBP

Sterling continues to drift higher against both the dollar and the euro, as markets expect the Bank of England to react to sticky inflation by hiking rates well above 5%. This week’s macroeconomic data could provide the next leg up for the pound.

Another strong labor market report is expected, with wages seen growing at a near 7% rate. April monthly GDP should meanwhile mark a return to growth. For now, therefore, the path of least resistance for the pound seems to be up.

EUR

The final GDP report for the first quarter of 2023 showed that the Eurozone did enter a recession, albeit only by the most technical definition of the term: two consecutive quarters of a tiny 0.1% contraction. This data point is lagged and backward-looking, but it did add marginally to the gloom about recent European economic performance.

We think, however, that the technical recession is mostly due to one-off factors and the Eurozone economy is well poised to perform in the coming quarters, as the lower energy prices and a tight labor market support household spending. If the widely expected interest rate hike by the ECB this week is accompanied by hawkish rhetoric, the euro should receive support from the meeting.

USD

The two big events in quick succession this week may finally cause the dollar to break out of the indecisive range where it has been stuck recently. On Tuesday we get the inflation report for May. It will be closely watched as an upward surprise there could be enough to tilt the next day´s decision to a hike.

We are going with the market consensus for unchanged rates in June, but possible dissents and hawkish communications could assure markets that the next move in rates is more likely to be up than down. However, we are a lot closer to the end of this hiking cycle in the US than in the Eurozone, and so we expect the dollar to underperform over the medium term.

JPY

Friday’s Bank of Japan meeting will be closely watched by investors, though we do not expect any change in policy, nor any groundbreaking tweaks to the bank’s communications. The new board has continued to strike a dovish tone in recent communications, and this is likely to remain the case again this week. There is, however, a possibility that the bank upgrades its view on inflation, which may be perceived by the market as a prelude to higher rates in the not too distant future. Swap markets are currently assigning around a one-in-four chance of a 10bp hike by September, so we see room for upside in the yen should the bank up its inflation projections.

It will also be interesting to see whether the BoJ touches on the recent resilience of consumer demand. Last week’s GDP figures were far stronger than expected by economists, with the Japanese economy posting solid growth of 2.7% annualised in Q1 (well above the 1.6% consensus). We continue to look for a hawkish pivot from the Bank of Japan, although whether this materialises on Friday’s meeting or at a later date remains to be seen.

CNY

The yuan continued its sell-off last week and was among the worst-performing currencies in Asia. A further decline against the US dollar can be seen as rather disappointing, particularly considering that last week was a tough one for the greenback, which fell against almost all G10 currencies. At the same time, the sell-off in the yuan appears stretched, and barring a strong negative surprise (such as a Fed hike this week) we believe the currency could start to gain ground.

Positive data could help in that regard, and there will be plenty of releases this week, particularly on Thursday, when key hard readings will be out. Last week’s Caixin PMI data provided a badly-needed break from the gloom, but proved insufficient to sustainably lift sentiment towards the yuan. Attention turned to trade data shortly thereafter, which showed a 7.5% YoY decline in exports in May, much larger than expected. CPI & PPI data weren’t as surprising, but nevertheless did not inspire optimism – the former confirmed that consumer prices rose by 0.2% YoY, while the latter showing that producer price deflation deepened again, to -4.6%. Weak economic activity and an absence of price pressures mean that attention is now turning to the PBOC, especially since major state banks recently cut deposit rates. It’s hard to say whether we’ll see an MLF rate cut on Thursday, but we can’t completely rule it out this time.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports