Bank of England set to hike rates, what about the ECB?

( 3 min )

- Go back to blog home

- Latest

Thursday will be a particularly eventful day in financial markets, with both the Bank of England and European Central Bank set to announce their latest policy decisions.

With that in mind, the bank’s official communications, Bailey’s press conference and quarterly economic projections may be key to the sterling reaction. A large upward revision to the inflation forecasts, and rhetoric that flags heightened concerns over rising prices in the bank’s statement, would be a clear signal for a move higher in the pound. Any comments that leave the door open to an aggressive pace of hikes during the remainder of the year would also be seen as bullish. While we don’t think that Bailey will explicitly commit to one hike a quarter, we don’t think he’ll push back against market pricing either, and that could provide decent support for GBP this afternoon.

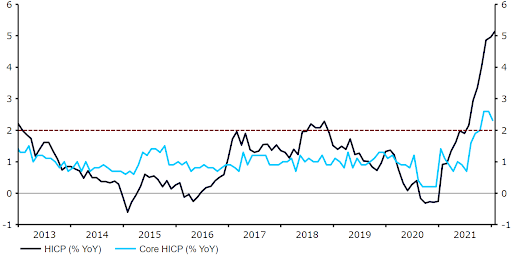

Almost immediately after the Bank of England’s announcement, the European Central Bank will be unveiling its latest policy decision. Wednesday’s surprise to the upside in Euro Area inflation (to a fresh record high 5.1% versus the 4.4% expected) has made today’s Governing Council meeting even more important. So far, ECB President Lagarde has continued to insist that the spike in prices is of a ‘transitory’ nature – a description that the Federal Reserve ditched a number of weeks ago. This insistence that price pressures will ease and that higher interest rates won’t be required any time soon will be tested to the max today, particularly given the growing signs of hawkish dissent among council members. Should the latter become increasingly evident this afternoon then the euro rally, which has seen the EUR/USD pair edge back above the 1.13 level, could have further to run this week.

Figure 1: Euro Area Inflation Rate (2013 – 2022)

Source: Refintiv Datastream Date: 02/02/2022

Ahead of tomorrow’s US payrolls report, Wednesday’s ADP employment change number, which represents job creation in the private sector, was a big disappointment. 301,000 net jobs were shed last month after the market had priced in a number around the +200k mark – the first contraction in employment since April 2020. While clearly a massive downside surprise, investors didn’t appear overly concerned given that the drag on jobs was almost entirely due to omicron and will therefore likely prove temporary. We would expect a similar muted reaction in currencies to such a downside surprise from Friday’s NFP report.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports