Biden announces plans for mammoth US stimulus programme

- Go back to blog home

- Latest

The US dollar retreated against its major peers on Thursday afternoon following the announcement of both a massive fiscal stimulus plan from President-elect Biden and some dovish commentary from Federal Reserve Chair Jerome Powell.

The announcement of a large US stimulus programme is good news for risk assets, and a negative for the safe-haven dollar, albeit with much of the details already announced in the media it was comments from Fed chair Powell that proved the biggest market mover yesterday. Powell noted that the US was still a long way off reaching the central bank’s goals of full employment and 2% inflation, and that it was far too early to think about winding down the pace of asset purchases. There had been speculation that purchases could be wound down later this year, although Powell comments suggest that this is unlikely to be the case.

Sterling traders encouraged by UK’s rapid vaccine progress

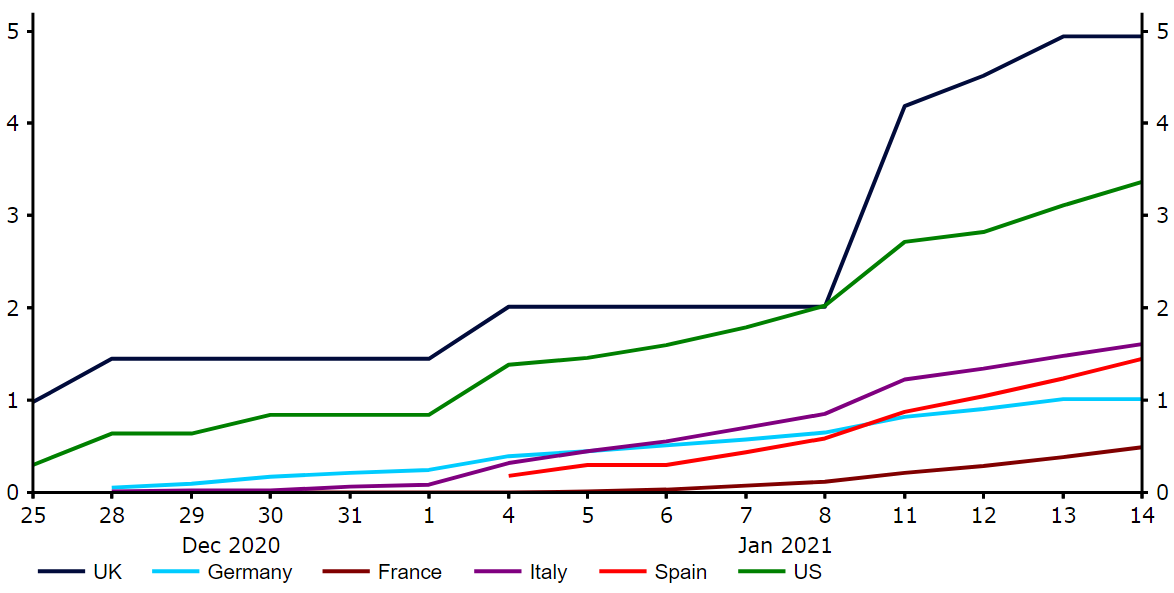

Investors continue to turn a blind eye to the recent worrisome COVID data out of the UK, instead focusing on the positives, namely the rapid progress being made towards mass vaccinations. As of data from Wednesday, the UK had administered at least one of either the Pfizer or AstraZeneca jab to approximately 5% of the population. The UK is currently leading the vaccination race among developed nations, with the likes of the US (3.4%), Italy (1.6%) and Spain (1.5%) still some way behind (Figure 1).

Figure 1: COVID-19 Vaccinations Administered (per 100 people)

Source: Refinitiv Datastream Date: 15/01/2021

Despite the encouraging vaccine progress, the prolonged lockdown measures mean that another technical recession in the UK is very much on the cards. Data this morning showed that Britain’s economy contracted by 2.6% in November during the country’s second national lockdown. While caseloads have shown early signs of levelling off in some areas, it will still be a number of weeks before measures are gradually eased, ensuring that the economic situation is likely to get worse before it gets better. This could provide a bit of a drag on sterling in the short-term, in our view.