Big hike coming, but uncertainties abound

( 3 min )

- Go back to blog home

- Latest

We believe that this week’s Bank of England meeting is one of the hardest to call for some time, and expect volatility in the pound to be elevated during either side of the decision.

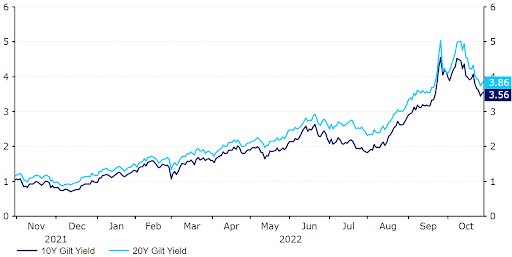

Figure 1: UK 10Y & 20Y Gilt Yields (2021 – 2022)

Source: Refinitv Datastream Date: 01/11/2022

Speaking in mid-October, Bank of England chief economist Pill warned that a ‘significant’ rate increase was on the way in November. These remarks were, however, before the dramatic budget U-turn, which will have significantly altered the bank’s view on UK inflation. One of the biggest issues of the budget was the perceived impact of the tax cuts on consumer price growth, which was expected to remain above the BoE’s target for longer than previously anticipated. But with most of these tax cuts now gone, and the government’s household energy bill freeze set to run for only six months, rather than two years, we see a significant easing in pressure on the MPC to tighten policy aggressively at upcoming meetings.

Heading into Thursday’s meeting, market expectations have eased materially, and swaps are now only pricing in a 75 basis point interest rate hike, though this would still be the largest in more than three decades, and a base rate of around 5% in mid-2023. As we have said since the mini-budget announcement, we believe that it may be difficult for the MPC to meet these lofty expectations in the coming months. We think that even in the event of a 75bp rate hike this week, sterling could sell-off should the bank signal a more gradual pace of tightening ahead. In our view, the reaction in the pound following Thursday’s meeting will be highly dependent on the below.

- Size of this Thursday’s rate hike

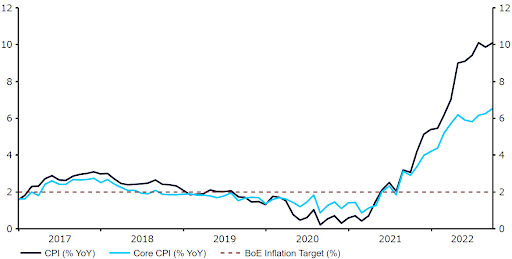

We believe that the decision on rates this week will be a very close call, as we see strong arguments on both sides. On the one hand, UK inflation continues to massively overshoot the MPC’s target (10.1% in September), and members may see a 75bp rate increase as necessary in order to anchor inflation expectations.

High consumer prices present the biggest downside risk to Britain’s economy, and there appears to be a general consensus among the world’s central bankers that front-loading does less harm to economies in the long-run than a slow and steady approach. A shock 100bp rate hike may not be out of the question either, particularly as there is a sense that the BoE has reacted too slowly to surging prices, and still has some catching up to do with many of its major peers.

Figure 2: UK Inflation Rate (2017 – 2022)

Source: Refinitv Datastream Date: 21/09/2022

On the other hand, there are a handful of arguments to suggest that the majority may again vote for a smaller, 50bp hike. For starters, UK macroeconomic activity data has shown clear signs of a deterioration, and a technical recession looks highly likely on the way. Gilt yields also remain elevated, while sterling has recovered in trade-weighted terms, which could both discourage a larger hike. Moreover, the recent tax U-turns ensure that we are effectively back to where we were before the budget announcement, when the MPC appeared largely comfortable moving in 50bp increments.

- Voting pattern among MPC members

In light of the above, we think that a split vote on the magnitude of the hike is almost a guarantee at Thursday’s meeting, just as it was in September. We expect members Ramsden, Mann and Haskel to once again vote for at least a 75bp hike, with the hawks likely to cite both the strong UK labour market and high inflation momentum. On balance, we believe that at least two of Bailey, Broadbent, Pill, Cunliffe and Tenreyro (who all voted for a 50bp hike in September) will side with the hawks, though it may be a close call. Swati Dhingra, who has only recently joined the MPC, is a bit of an unknown quantity, although we think that she will probably vote for a 50bp move (25bp in September).

Should the MPC indeed vote for a 75bp hike, market participants would likely perceive a close 5-4 or 6-3 vote as bearish for the pound, whereas a 7-2 or higher split would probably be bullish. Another three-way split vote cannot be ruled out, albeit this would add to market uncertainty and support the narrative that the bank doesn’t have a clear grasp on the situation.

- Signals on future monetary policy

The BoE will have a delicate balance act on Thursday, as it will in all likelihood attempt to talk down market expectations for hikes, while trying to convince investors that it is committed to anchoring inflation expectations. MPC member Broadbent warned in late-October that the bank could undershoot market expectations in the coming months, while fellow ratesetter Catherine Mann has said that markets are ‘too aggressively priced’.

We think that this may be a prelude to a dovish hike, whereby the MPC delivers another jumbo rate increase, but suggests a more gradual pace of tightening is on the way in the coming months. This presents a potential downside risk to sterling.

- Updated GDP and inflation projections

This week’s fresh GDP and inflation forecasts are among the most difficult to call in recent times. In light of the government’s energy price guarantee scheme, we suspect that the GDP projection for 2023 will be revised higher from August, when the MPC predicted a five quarter long recession. The impact of the government’s measures on inflation is less clear, but the cap on energy bills will probably limit near-term price growth. This could result in a downward revision to the bank’s inflation forecasts.

We think that risks to sterling are skewed to the downside heading into this week’s Bank of England meeting. The MPC has a recent track record of surprising to the dovish side, and we believe that market participants may well be disappointed once again. A 75bp rate hike is our base case scenario, though we expect a split vote, with a handful of members in favour of a smaller rate increase. Given current market pricing, another half a percentage point move would be unequivocally bearish for the pound, regardless of the bank’s accompanying communications. We believe that the BoE will attempt to talk down market expectations for rate hikes in 2023. Swap markets are currently pricing in a base rate of almost 5% next year, which we think is too high in light of the pending recession.

The Bank of England’s policy decision, monetary policy report and meeting minutes will be announced at 12pm BST (1pm CET) on Thursday.