BoE February Meeting Preview: Will the MPC raise rates again this week?

( 5 min )

- Go back to blog home

- Latest

The Bank of England looks on course to raise interest rates for the second time in as many months on Thursday, as it continues its battle to rein in four decade high UK inflation.

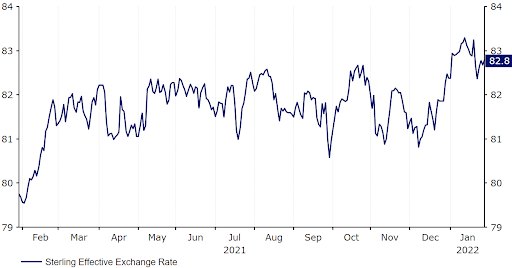

Figure 1: Sterling Effective Exchange Rate Index (2021 – 2022)

Figure 1: Sterling Effective Exchange Rate Index (2021 - 2022)

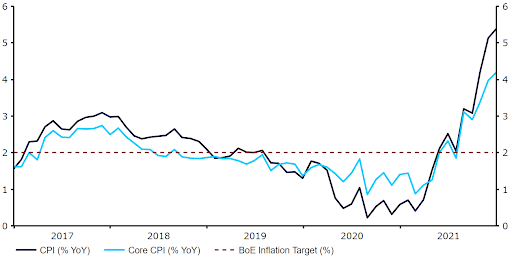

Since the last MPC meeting, UK inflation has continued to surprise to the upside, driven largely by higher energy prices and ongoing supply-chain disruptions. Headline inflation rose to 5.4% in December, above the 5.1% expected and its highest level since March 1992 (Figure 2). The BoE will be releasing updated macroeconomic projections as part of its Monetary Policy Report this week, with an upward revision to the 2022 inflation forecast now likely, in our view. Concerns surrounding omicron have also eased in recent weeks, which should support the case for policy tightening. The December PMIs and retail sales data suggest that the impact of omicron on the UK economy has clearly been a non-negligible one, although the limited restrictions that were re-imposed over the New Year period have now been removed.

Figure 2: UK Inflation Rate (2017 – 2021)

Source: Refinitv Datastream Date: 31/01/2022

We think that the near unanimous decision to raise rates in December tells us two things. Firstly, the MPC is growing increasingly concerned with rising inflationary pressures and the impact of higher prices on the UK economy. A major concern for policymakers will be the continued surge higher in energy prices, which are expected to rise further should the government’s energy price cap increase as planned in April.

While there is little the bank can do to stabilise energy costs or remedy supply constraints in the immediate-term, an aggressive pace of hikes would, at least, act to anchor inflation expectations and stave off a wage-price spiral. The second thing that the 8-1 vote tells us, is that policymakers do not appear unduly worried about the impact of omicron on the UK economy, nor do we believe that they should be. We would expect any slowdown in activity in December and January to prove limited and temporary in nature, and think that the growth outlook for this year remains a rather encouraging one.

What can we expect from the MPC on Thursday?

We are pencilling in a 25 basis point move in rates to 0.5% this week, which would be the first back-to-back rate increase from the Bank of England since 2004. Economists and investors are in broad agreement, with financial markets now more-or-less fully pricing in a hike this week. The bar for a hawkish surprise is, therefore, rather high, and a strong majority (either a unanimous or 8-1 vote) in favour of a hike may not be enough in itself to trigger any immediate gains in sterling. A split decision in favour of higher rates would likely be seen as a GBP negative, as it would perhaps indicate a slower pace of policy normalisation is ahead, while a surprise hold would trigger a sharp sell-off in the pound, in our view. There have been unusually few communications from MPC members since the December meeting, so the nature of the voting pattern is a difficult one to predict.

Aside from the rate decision itself, we will be paying close attention to the bank’s updated macroeconomic projections and communications on future policy moves.

Regarding the former, we expect an upward revision to this year’s inflation projection to be accompanied by a modest downward shift in the near-term GDP forecasts. We also expect to see a downward revision to the bank’s 2022 unemployment projection, particularly given the November Monetary Policy Report pointed to an increase in the jobless rate in Q4 2021, which has so far not materialised in the data.

We also think that the MPC will follow the Federal Reserve’s lead in turning increasingly hawkish in its communications this week, and hint that an aggressive pace of policy normalisation may be needed in 2022. At present, markets are pricing in a total of 120 basis points of hikes from the BoE this year (almost five full rate increases). We think that at least one hike a quarter is on the cards, and expect the bank’s communications to leave the door open to such a possibility by not pushing back against market expectations. A rate increase to 0.5% would also breach the Bank of England’s own threshold to begin normalising its balance sheet in a process known as quantitative tightening. We think there is a good chance this process will begin immediately, although in governor Andrew Bailey’s own words, this is not expected to have a big impact.

In summary, we expect a 25 basis point hike from the Bank of England this week in another near-unanimous vote (possibly 8-1). We expect its communications to leave open the possibility of an aggressive tightening cycle in 2022, without explicitly committing to one, which could provide some upside in sterling towards the end of the week.

The Bank of England’s policy decision will be announced at 12pm GMT (1pm CET) on Thursday.