BoE Governor Carney boosts Sterling off its lowest level since the ‘flash crash’

- Go back to blog home

- Latest

The Pound declined sharply to its weakest position against the US Dollar since the 7 October ‘flash crash’ on Tuesday, slumping by more than 1% against a broadly stronger US Dollar at one stage yesterday afternoon.

However, Sterling received some much needed respite late in the London session after Carney’s appearance in front of a committee of lawmakers from the House of Commons. Carney claimed that the bank’s monetary policy committee would take into account the ‘fairly substantial’ fall in the Pound when deciding on policy, possibly suggesting that a weak Sterling could cause the central bank to refrain from slashing interest rates again at next Thursday’s BoE meeting.

Meanwhile, the US Dollar briefly rose to a fresh nine month high against its basket of currencies on Tuesday, while rallying to its strongest position against the Euro since early March. Investors continued to ramp up expectations for an interest rate hike by the Federal Reserve before the end of the year, with Fed fund futures now pricing close to an 80% chance of a December rate increase.

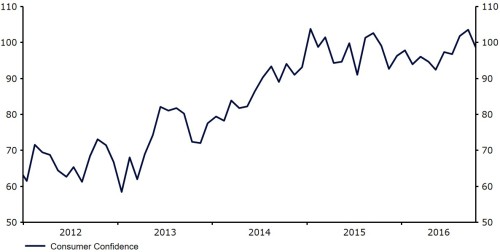

A broadly stronger Dollar came despite a relatively mixed day of economic data that saw consumer confidence buck its recent uptrend and slump to its lowest level since July (Figure 1).

Figure 1: US Consumer Confidence (2012 – 2016)

In a particularly hectic day of currency trading, President of the European Central Bank Mario Draghi also spoke at an event in Berlin. Draghi added little new information, although stated he was aware of the impact on European banks from the ECB’s negative interest rate policy.

Major currencies in detail:

GBP

The Pound recovered strongly yesterday afternoon having at one stage been the worst performing currency in the world. Sterling ended the day 0.3% lower versus the Dollar.

Sterling’s recent depreciation was a hot topic during Carney’s appearance on Tuesday, with the central bank Governor claiming that a weak Pound could push inflation to 1.5-1.8% by the spring. Carney warned that the risks in the global environment were ‘elevated’, although the BoE had a ‘range of measures’ other than additional QE in order to protect the UK economy, if needed.

We are in line with market consensus and expect the Bank of England to hold rates steady throughout the remainder of the year as it awaits further evidence of the health of the UK economy.

Economic releases will be limited today with third quarter UK growth figures on Thursday the main announcement this week.

EUR

A mixed day for the single currency ended with the Euro 0.15% higher against the Dollar, despite touching its weakest position since March.

Earlier in the session, the latest business sentiment surveys from the IFO all increased more than expected in Germany. The business climate index rose to 110.5 from 109.5 in September, continuing its recent upwards trend and, in the process, reaching its highest level since April 2014. Companies in Europe’s largest economy expressed optimism for the months ahead, boding well for final quarter growth in the Eurozone following yesterday’s impressive PMI data.

Consumer confidence data in Germany this morning will be the main economic release today in an otherwise relatively quiet session in the Euro-area.

USD

The Dollar faded late on Tuesday afternoon to end 0.1% lower against its major peers, having earlier touched a fresh nine month high on growing expectations for a December rate hike by the Federal Reserve.

Consumer confidence fell more than expected in October with the monthly index from the Conference Board declining to 98.6 from a revised 103.5. There was slightly better news on the housing front, with the housing price index rising above forecasts by 0.7% in August compared to the 0.5% market consensus.

A number of mostly second-tier economic releases in the US could lead to a relatively busy session. Services sector growth at 14:45 UK time this afternoon will be the main focal point.

Receive these market updates via email