BoE meeting preview: MPC more divided than ever

- Go back to blog home

- Latest

We see a great deal of uncertainty surrounding this Thursday’s highly-anticipated Bank of England meeting, which is likely to lead to heightened volatility in the pound either side of the decision.

We view the ‘jumbo’ interest rate hike in November as a one-off, and a move largely in reaction to the market turmoil caused by Liz Truss’ fateful mini-budget announcement. We’ve continued to see a range of views among MPC members as to the pace of tightening, and we cannot rule out another three-, or even four-way, voting split among the committee at this month’s meeting. The BoE has a very delicate balancing act to contend with. On the one hand, UK inflation has continued to break to fresh four decade highs above 11%. On the other, there remains an acute degree of uncertainty surrounding the economic outlook, with the MPC warning in November that the longest UK recession on record was on the way.

While we believe that a 50bp hike is highly likely on Thursday, we acknowledge that this is not necessarily guaranteed. Swap markets are fully pricing in a half a percentage point move with a non-negligible possibility of a 75bp hike (almost one-in-three). We even think that some of the doves will vote in favour of a ‘standard’ 25bp move, with a possibility that one or two could side in support of no change. We have outlined below the arguments in favour of both a smaller and larger increment rate hike this week, and our view of how each MPC member could vote.

Arguments in favour of a larger base rate change

Unlike in some of the other major nations, notably the US, we are yet to see any signs of an easing in rates of UK inflation. The November CPI report will be released on Wednesday, with the headline measure of consumer price growth expected to break to fresh highs (11.5% consensus). Even in the event of a downside surprise here, inflation remains far too high for comfort and the BoE has made it clear that bringing down price growth continues to be the main priority. The IMF has warned that UK inflation will end 2023 above 7%, which they see as by far the highest in the G10.

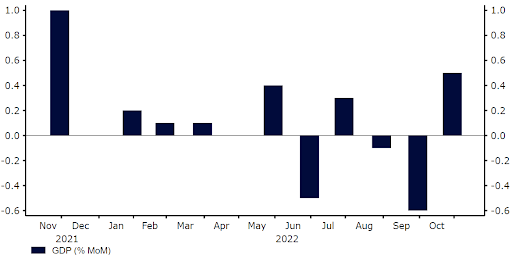

Since the November meeting, UK macroeconomic data has also held up rather well. The business activity PMIs have exceeded expectations and are only printing in modest contractionary territory, while the October GDP print showed solid growth. Tuesday’s labour report is also set to confirm that the jobs market remains healthy, characterised by low unemployment, high wage growth and a sizable mismatch between job vacancies and unemployed individuals.

Figure 1: UK GDP Growth Rate (% MoM) (2021 – 2022)

Source: Refinitv Datastream Date: 12/12/2022

…and arguments in favour of a smaller one

Like it or not, a UK recession is probably on the way in the coming months – not the archetypal timing for tighter monetary policy. The Bank of England has been warning that a downturn was on the way, and that this could slow the pace at which it raises interest rates, since as far back as its March meeting. The IMF expects the UK economy to grow by just 0.3% in 2023, and higher rates should act to exacerbate the downturn in the near-term. The MPC warned in November that Britain’s GDP would experience a peak-to-trough collapse of 2.9% based on market pricing for rates.

Moreover, there remains nothing that Bank of England policy can do to influence energy prices or supply-chain disruptions, which have largely contributed to the spike in UK inflation. The impact of policy normalisation also won’t feed its way through to the real economy for some time, and a handful of the doves may argue that a pause in the cycle is required to assess the impact on economic conditions.

How will the MPC members vote?

As mentioned, we think there is a good chance that we see at least a three-way split vote among the committee this week. Once again, the hawks Haskel, Ramsden and Mann may vote for a 75bp hike, as they did in November – the latter warned last month that inflation was becoming ‘increasingly embedded’ and that this necessitated a strong policy response. Meanwhile, we fancy that members Pill, Broadbent, Cunliffe and governor Bailey will probably constitute the faction that sides in favour of a half a percentage point rate increase.

On the other end of the scale, members Dhingra and Tenreyro, who voted for 50bp and 25bp moves respectively in November, have both struck dovish tones in recent communications. Dhingra has warned that additional tightening could lead to a deeper and longer recession, while Tenreyro has explicitly noted her view that UK rates should remain on hold, with cuts to follow in 2023. We think that either one, or both, of Tenreyro and Dhingra could stand pat on Thursday. This may lead to an unprecedented 3-4-1-1, or similar, voting split among committee members (which admittedly sounds more like a formation one would see at this year’s World Cup).

How could GBP react to Thursday’s announcement?

There will be no fresh macroeconomic projections released from the Bank of England this week, with the next Monetary Policy Report not out until February. Assuming we see no surprise on rates, the reaction in sterling will, therefore, likely be determined by both the voting pattern among committee members and the bank’s communications in its statement and meeting minutes. At the November meeting, the BoE pushed back against market pricing for interest rate hikes, noting that the peak in rates would be ‘lower than priced into financial markets’. We suspect that it may do so once again this week, which could present some downside to GBP.

In the event of a 50bp rate hike, and an increasingly divided committee, we think that sterling could sell-off, particularly should the statement or meeting minutes once again push back against current market pricing for UK interest rates. That said, another 75bp hike cannot be ruled out entirely. This would be bullish for GBP, given current market pricing.

The Bank of England’s policy decision and meeting minutes will be announced at 12pm GMT (1pm CET) on Thursday.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports