BRICS FX report – Spotlight on CNY: Yuan internationalisation paves the way for additional currency strength

( 3 min )

- Go back to blog home

- Latest

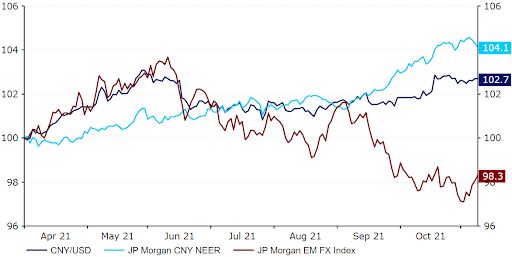

Our view that the Chinese yuan is set to becoming increasingly favoured among market participants has been vindicated by the recent outperformance of the currency relative to its emerging market peers.

Figure 1: CNY NEER vs. JP Morgan EM FX Index (April ‘21 – November ‘21)

Source: Refinitiv Datastream Date: 10/11/2021

We think that we are seeing a significant shift among investors whereby the yuan is now perceived as closer to a major currency than an emerging market one, particularly as it becomes progressively more internationalised. CNY continues to account for a growing share of foreign exchange reserve assets, a trend that we expect to continue in 2022. 311.9 billion dollars worth of Chinese renminbi were held in reserve by the world’s central banks in the second quarter of this year, up more than 33% on a year previous. Only the US dollar, euro, Japanese yen and pound sterling were higher on the list.

The yuan is also being used increasingly for invoicing and payments, accounting for 2.2% of the global share of the latter in September, up 6.7% on a month previous. This reaffirms the yuan’s status as one of the top five most widely used currencies globally. We note that this is also considerably less than China’s weight in global trade (13% of the world’s exports), suggesting room for growth and scope for additional demand for the currency.

The growing use of the yuan in international transactions, and the continued resilience of the currency to US dollar strength, makes us increasingly confident in our bullish yuan call. The country’s macroeconomic fundamentals are also solid, and concerns regarding the recent economic slowdown and situation in the real estate sector are overblown, in our view. We expect the fallout from Evergrande’s pending collapse to be contained – authorities have already indicated that they are willing to intervene in order to protect consumers and the banking system.

Moreover, we think that the PBoC is becoming increasingly more comfortable with a moderately stronger yuan as the country moves away from a model that is heavily export-oriented. The PBoC’s CFETS index, a closely monitored indicator measuring CNY against a weighted basket of currencies, has risen by around 10% since August last year. At the same time, FX reserves held at the central bank have been stable, with little large-scale intervention designed to rein in currency appreciation. We expect this hands-off approach to continue for the foreseeable future, paving the way for additional gains in the yuan versus the US dollar.

👉 For more information, download our latest BRICS report, which includes a more detailed report on the Chinese Yuan, plus the analysis of Brazilian Real, Russian Ruble, South African Rand, and Indian Rupee.