Currencies choppy after hotter-than-expected US inflation data

( 3 min )

- Go back to blog home

- Latest

The main focal point of trading in financial markets this week was undoubtedly yesterday’s US inflation report, which led to some rather choppy trading in FX.

Summary:

- USD ends London trading higher after stronger-than-expected US inflation report for January.

- Strong UK labour report supports GBP, but easing UK inflation data takes pressure off BoE.

- Investors turn their attention to Wednesday’s US retails print, and speech from ECB’s Lagarde.

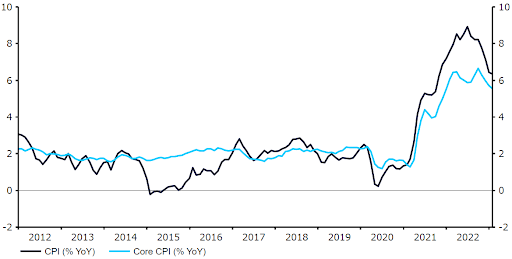

The January CPI data beat expectations, with both the headline and core prints coming in above the consensus of economists. The headline print eased slightly last month, although the 6.4% number was higher than the 6.2% priced in, while core inflation continues to remain sticky, coming in at 5.6% versus the 5.5% estimate. Somewhat counterintuitively, the initial reaction was to send the US dollar lower, with the greenback at one stage falling to its lowest level in over a week against the euro. We can only assume that the market was perhaps preparing for a slightly higher number than pencilled in by economists, or that investors were perhaps weighing up the growth implications of the data. The move lower in the dollar was, nonetheless, rather stange.

Source: Refinitiv Datastream Date: 14/02/2023

Normal services resumed later in the afternoon, as the dollar quickly reversed its losses, and ended London trading higher against both the euro and sterling. Both the January NFP and inflation reports suggest the US economy continues to run hot, and that the Federal Reserve would be justified in continuing to raise rates on multiple occasions during at least the next couple of FOMC meetings. Following yesterday’s data, futures are now fully pricing in a 25bp hike in March, while assigning around a 93% implied probability of another in May. A third and final move beyond then is not our base case scenario just yet, but markets are now pricing in a terminal rate of almost 5.3% in July, i.e. around an 80% probability of an additional hike after the May meeting.

This week is a very hectic one for sterling, with a host of UK data releases creating a volatile trading environment. Tuesday’s UK labour report was on the strong side. Earnings growth excluding bonuses jumped by 6.7% in the three months to December, unemployment remained near multi-decade lows, while the claimant count number, which measures the number of jobless benefit claims, dropped by 12.9k – the most since July. Data released last week showed that the UK economy avoided tipping into recession in the final quarter of last year, and the strength of the labour market could help to prevent one in 2023.

The key to the above will, however, likely be the persistence of UK inflationary pressures. This morning’s January inflation data eased more than expected, which is positive for the growth outlook, but not so for sterling. Headline prices fell by 0.6% on the month, the largest drop since January 2019, with the annual rate easing to 10.1%, versus the 10.3% priced in. The sharp decline in core inflation will also be a welcome one – this fell to 5.8%, its lowest level since June. Sterling has come off around half a percent on the dollar on the news. While this should lessen the risk of a deep and prolonged recession, it may also take pressure off the Bank of England to continue raising rates aggressively. Markets now see just two more 25bp hikes from the MPC this year, with a 50/50 chance of a first rate cut by year end.

The next few days are jam-packed with a host of macroeconomic data releases. Investors will be paying close attention to this morning’s Euro Area industrial production print, and this afternoon’s US retail sales report. ECB President Christine Lagarde will also be speaking at around 2pm GMT (3pm CET). At its February meeting, Lagarde hinting that the bank remained committed to delivering at least one more 50bp rate hike, before potentially moderating the pace of tightening. We see no change in this stance until after the next Governing Council meeting on 16th March.