Currency volatility explodes on pandemic fears

- Go back to blog home

- Latest

The sharp worsening of the coronavirus pandemic, which has led to nationwide lockdowns in Italy and Spain, has shaken world financial markets in the past week.

Figure 1: US Dollar Index (09/03/20 – 16/03/20)

The focus this week will be on the extraordinary measures taken by governments and central banks to mitigate the blow to the world economy. The Federal Reserve has already cut interest rates to zero, lowering its fed funds rate by 100 basis points during an emergency meeting on Sunday. This, we believe, should be followed by all G10 central banks that still have positive rates. We also should see aggressive measures to support demand, employment, SMEs and household finances, particularly in the Eurozone that is bearing the brunt of the crisis right now. Economic data out this week will be hopelessly out-of-date and markets will likely ignore it.

GBP

The Bank of England cut rates by 50 basis points to 0.25% during an unscheduled meeting last week, while launching a series of initiatives to ease the credit flow, particularly to SMEs.

Sterling took little notice, having a rough week against both the dollar and the euro amid the stampede away from risk assets (sterling fell over 6% against the dollar last week alone). We do, however, think that the significant fiscal easing announced in the Budget is a significant medium-term positive, and that the pound is currently severely undervalued after last week’s sharp falls. We attribute the move more to investors favouring the US dollar due to its safe-haven status and role as the world’s most liquid currency.

EUR

With Spain and Italy under lockdown, and France not far behind, a pall of uncertainty has descended over the Eurozone economy. The good news is that monetary and fiscal authorities are reacting quickly.

The ECB corrected Largade’s miscommunication during the bank’s Thursday’s meeting and has made it clear that it will ensure Eurozone sovereign bonds remain stable. European governments are preparing fiscal stimulus and various forms of support for households and businesses to ride out the lockdowns and consequent fall in demand. Germany’s €500 billion pledge is particularly welcome here.

A combination of bank forbearance, extremely low rates and fiscal stimulus is a powerful antidote to the economic and financial consequences of the pandemic. We are optimistic that the Eurozone economy can rebound quickly after the lockdowns end.

USD

The dollar turned around mid-week and became the preferred currency for investors fleeing risk. The perception that the US is not as affected as Europe by the pandemic likely played a role. However, the numbers there are also worsening rapidly, in spite of the very limited testing.

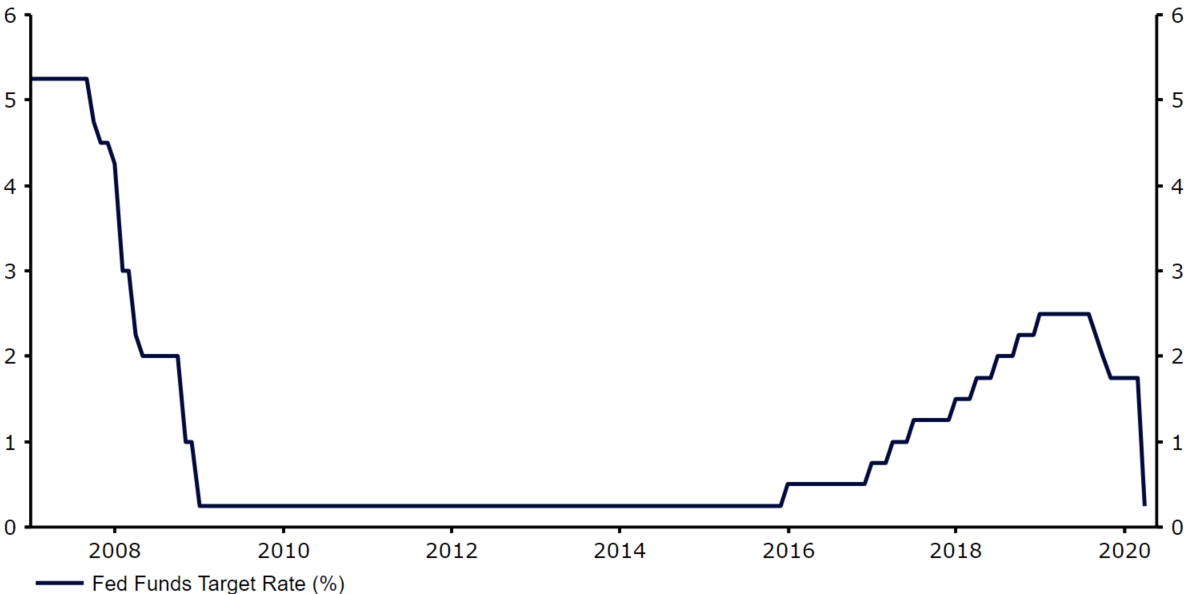

With the Fed taking aggressive measures, including emergency cuts in rates and additional QE, it will be critical to see if the dollar rally continues as and when the US takes stronger measures of the kind we are seeing in Europe. The issue for the Federal Reserve is that it now has very limited additional room for maneuver, particularly on interest rates that are now at the effective lower bound – where they were in the aftermath of the financial crisis in ‘08 (Figure 2).

Figure 2: Fed Funds Target Rate (2007 – 2020)